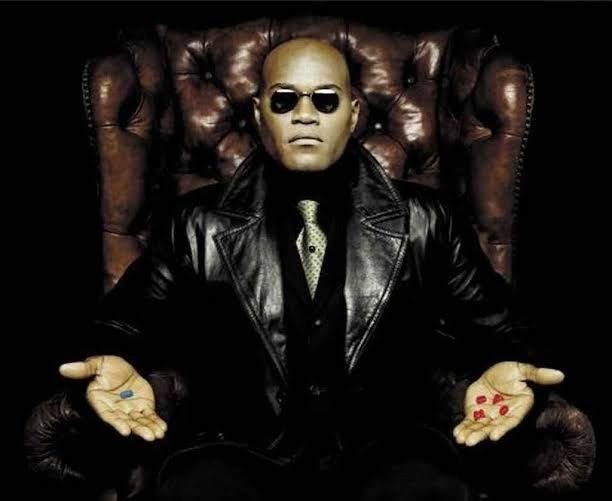

I will be splitting my website into two factions. The first faction will remain free. It’ll be filled with the regular analysis of the market, the factors that influence it, and memes. It’ll also continue to include the M2 13-week money stock report, the iconic investor highlights, and everything else you’ve come to enjoy from the Baerlocher Bearing.

The second faction will include my stock analysis, my portfolio, my current allocation, and what is on my watchlist. This will be behind a paywall which will be set at $10/mo or $100/yr.

However.

For those that have supported me monetarily, I am giving away year-long subscriptions.

Anyone that has followed me for a length of time will receive a 6-month sub.

Everyone else will get 1-month.

These changes will take effect before the end of the week.

Now with that business out of the way, lets get to the good stuff.

My portfolio will be highly influenced by three factors.

Austrian economics

Value investing principles

Capital expenditure cycles

I am breaking up my portfolio into 5 main categories.

Shipping

Energy

Industrial Metals

Agriculture

Precious Metals

Now if someone wanted to, it would be really easy to find ETFs that could emulate the gist of this idea. An example would be:

Shipping ETFs = BDRY, BOAT, SEA

Energy ETFs = XES, XLE, XOP

Industrial Metal ETFs = XME, DBB, GNR

Agriculture ETFs = DBA, TILL, JJA, TAGS

Precious Metal ETFs = GDX, GDXJ, SILJ

If one wanted the absolute easiest route. They could invest in Goehring & Rozencwajg’s mutual fund GRHAX.

I am not paid by Goehring & Rozencwajg nor is this an advertisement for their services. I just believe their product would be an easy one to invest in if one wanted to capture the general theme of the commodity supercycle.

This is just a sampling of the offerings that are available to those that don’t wish to dive deeply into each industry to find the companies that might outperform the competition. There are many more ETFs and mutual funds out there that could achieve similar exposure.

It is important for every investor to determine their own level of risk and the fees and holdings associated with the different products listed above. Everyone should be doing their own due diligence. Investing can be highly personal and each person could have different goals and different methods to achieving those goals. None of the information I am providing here should be construed as investment advice. It is up to the individual to determine their own level of risk and a level of investment that they are comfortable with.

The allocation that I’ll be targeting is:

15% Shipping

15% Industrial Metals

15% Agriculture

15% Precious Metals

30% Energy

10% Other

For me, there are certain criteria that I am going to be using to sift through the companies that fit the different sectors that I’ll be targeting. Several of these sectors have been neglected capital and investment dollars for extended periods of time. This can make many of these companies prone to bankruptcy risk. Some of the factors that I’ll be analyzing will be:

Debt load, bond values, and credit rating

Price to book & price to earnings ratios

Intrinsic Value (which is described in Security Analysis by Graham & Dodd)

Insider and Institutional ownership

Market cap

Recent stock performance

In the weeks ahead, I’ll be outlining the reasoning I have for each targeted sector and also provide some companies that I’m sifting through. With the recent strength of the dollar (and weakness in the money supply), I believe we are looking at a window of opportunity for investment in this commodity supercycle.

Finally, I want to acknowledge that as long as the sector thesis stays intact, I believe that many of these companies could be held for 3-5+ years before a breakout happens. Maybe longer. While I hope this isn’t true, I don’t want to discount that possibility.

Tomorrow we’ll get a look at the latest CPI data. Today’s data release showed that consumers believe inflation is going to continue to run higher (6.8%).

I'll be a paid subscriber. $100/year is a steal.

So excited for this!