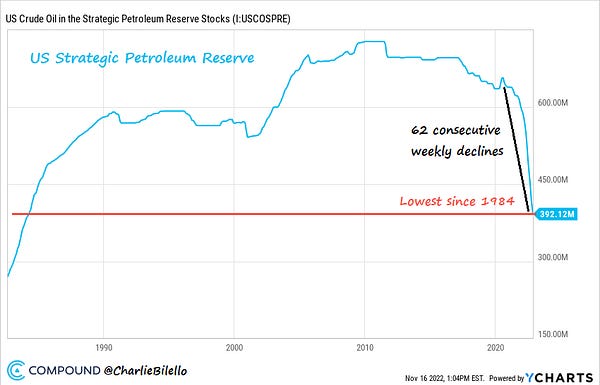

A major theme in the oil world has been the Biden administration’s attempts to hold down the price through massive oil releases from the Strategic Petroleum Reserve. It was an attempt to suppress the price of oil to keep voters happy, keep the dems in power, and control Russia. The results have been rather lackluster. At some point, these SPR releases will have to come to an end. That end maybe further into the future than some expect.

The SPR drain was a big seller in the oil market. There is going to be a fight over the SPR. Here are the details according to Yahoo.

“The Energy Department is seeking to cancel or delay sales mandated by Congress in fiscal years 2024 through 2027 so that it can move forward with a White House plan to refill the oil reserve when crude prices reach around $70 a barrel, an agency official told a Senate committee Thursday. Congress has mandated the sale of 147 million barrels of oil to pay for unrelated legislative initiatives during that time frame, including 35 million barrels in fiscal 2024, according to data compiled by research firm ClearView Energy Partners.”

It seems that the Biden administration isn’t going to be filling the SPR as fast as they drained it. In fact there’s a catch to filling it.

“Such a plan, which would require congressional approval, could be attached to a must-pass government funding bill that could come together this month.”

With the what transpired in the House over McCarthy’s bid to be speaker, convincing Congress to replenish the reserve could cost more political capital than the Biden administration has to spend. In addition, the Energy Department’s quest to withhold the mandatory sale could come under fire too. The fight to make McCarthy speaker is going to have consequences moving forward. It would not surprise me if the NY banks played a hand in that fight. It will be important to watch closely if legislation gets passed regarding the SPR.

At the same time, we are beginning to see China’s grand re-opening.