The market was all over the place today. The open saw a big selloff. This was directly related to the payroll report that came out. It beat expectations. Since the Fed has become hyper-focused on the employment side of their dual-mandate, traders have also been hyper-focused on the job reports. We have entered that realm where good labor reports equals bad days on the market. The market sees good job reports as a basis for the Fed to continue on their rate hike path. With blinders on, the Fed will not see the recession coming and may even doubt it’s existence. Say it with me now, “this recession is transitory”. It’ll be their mantra, I guarantee it.

The turn around came on comments from Minnesota Fed President and Arthur Burns impersonator, Neel Kashkari. His speech about the Fed’s interest rate goals was delusional, even for him. He stated that 2.0% is the Fed’s end goal and the “neutral” rate. Once traders realized that this came from Neel, expectations dimmed and the nasdaq slowly dragged lower.

Yesterday I highlighted a question from a reader. There was one point that he had asked that I had not answered.

Will 6+ 50 basis point raises gain traction against inflation?

This would equate to a 300+ basis point gain in the Fed Funds Rate (FFR). Since this was asked prior to the Wednesday’s rate announcement, I’ll take 50 basis points off and say 250+ basis point gain from the current rate of .75-1.0%. This would take the FFR to approximately 3.25-3.5%. Would it slow inflation? It is tough to have a straight up and down answer. As interest rates rise, the pool of buyers for consumer goods and assets shrinks. This tempers demand. However, what we are experiencing is supply side inflation. The Fed can’t print oil. It doesn’t print grain either. The Fed is only able to create more dollars into existence and they have excelled at this since the 2008 crash. Coupled with peak globalization, we are facing a terrible headwind. I’m of the mind that the FFR is going to need to be higher than the CPI inflation rate to actually stop inflation in it’s tracks.

Why take advice from me though when you have someone like Jim Cramer to tell you what he sees…

Cramer is the ultimate contrarian indicator. If you had done the inverse of everything Jim Cramer recommends, you would be beating the S&P by over 30% for the year. So when he says that inflation is peaking, I would take the opposite side of that bet. The next CPI release is this Wednesday. It will be very closely watched and if it shows any signs of stalling, expect the market to resume it’s epic meltdown. Traders would see good employment reports and a tempering of inflation as a sign that what the Fed is doing is working. They would believe that the Fed will stay on the path to higher interest rates and continue to crush forward earning discount models.

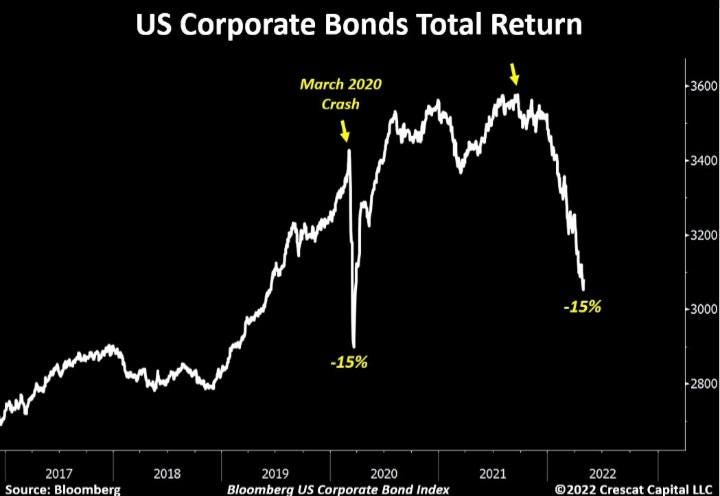

It is going to be vital to keep an eye on the bond market. It has become disconnected from the stock market. This is very strange. The stock market is a derivative of the bond market. When there is turmoil in the bond market, the stock market gets crushed. Right now, we’ve seen a serious correction in the S&P500 but the Treasury and MBS market has held steady. What hasn’t is the corporate credit bond market.

This could be due to investors who were seeking a safe return on investment and got pushed out on the risk curve. They are now realizing their error and searching for the exits. In time, if this spreads to MBS and Treasury rates, we’ll know that this is “the big one”.

In the meantime, I sold some of my puts today. I was looking at gains that were too good to pass up. I sold all of my MDB puts and half of both CVNA and TWLO. By selling half I covered my original contract costs and am now playing with “house money”. By no means do I believe this correction is over. I just couldn’t resist such a juicy return.

Great analysis. Like you said in a previous post, it may not be over but you have to watch your six in case the Fed abruptly changes course. This is gonna be a crazy month.