A bear market is when a market experiences a prolonged decline of 20% or more. While it isn’t official yet, I believe it is only a matter of time until a bear market is declared. Here is how close the S&P500 is to being in a bear market.

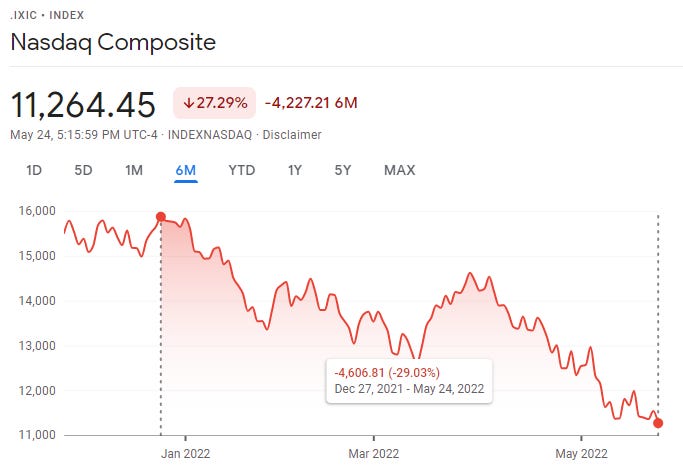

The NASDAQ has already crossed the Rubicon.

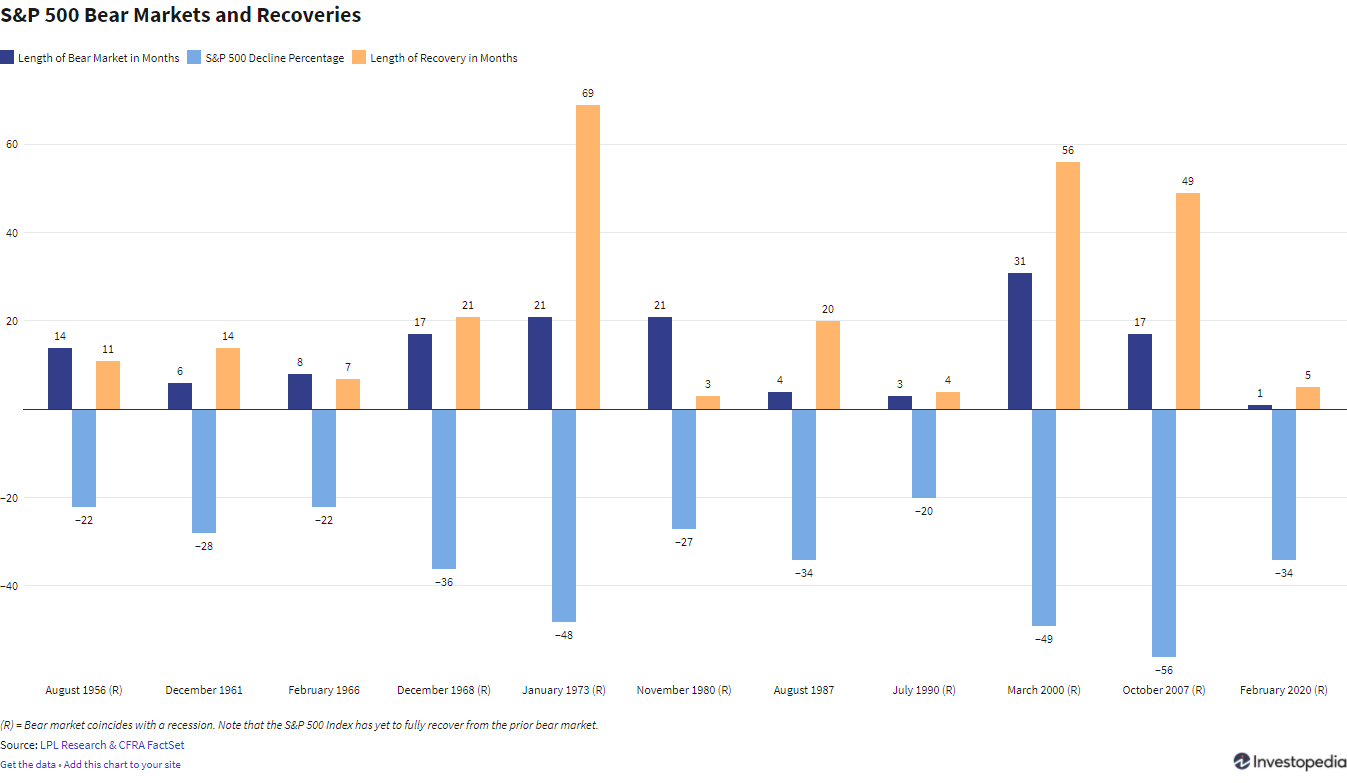

20% is a haphazard way of defining a bear market, but its what we’ve got to work with. Generally in a bear market, you’ll see a slowing of the economy. This leads to higher unemployment, less disposable income, and a drop in business profits. A bear market doesn’t necessarily have to be during a recession. In recent history (1956 to present), there have been 7 bear markets that occurred without triggering a recession. Here’s a great chart by LPL financial detailed the history of bear markets from April 1947 to September 2021.

There is a big difference between those bear markets with a recession and without. On average, the length of the bear market was 11 more months when it was coupled with a recession. In addition, the S&P500 declined 13% more. However, we are in somewhat rare territory. This bear market could officially get underway before a recession is declared.

While this chart points out which bear markets were accompanied by a recession, I believe that there are three instances of bear markets preceding a recession. Those instances are:

2000 to 2002

1968 to 1970

1973 to 1974

In these three instances a bear market started before the recession was officially declared. When you tease this data out, the average bear market length was 23 months and resulted in a 44% decline in the S&P500. While each bear market is different, don’t let anyone convince you that “this time is different”.

The FOMC minutes come out later today. Typically this is a market moving event. This is because it gives traders additional insight into the Fed’s thinking and future expectations. I expect a similar statement from the last meeting’s minutes. I believe Powell will continue to stress low unemployment and have a determination to bring inflation to heel. This will be tough for the market to swallow.