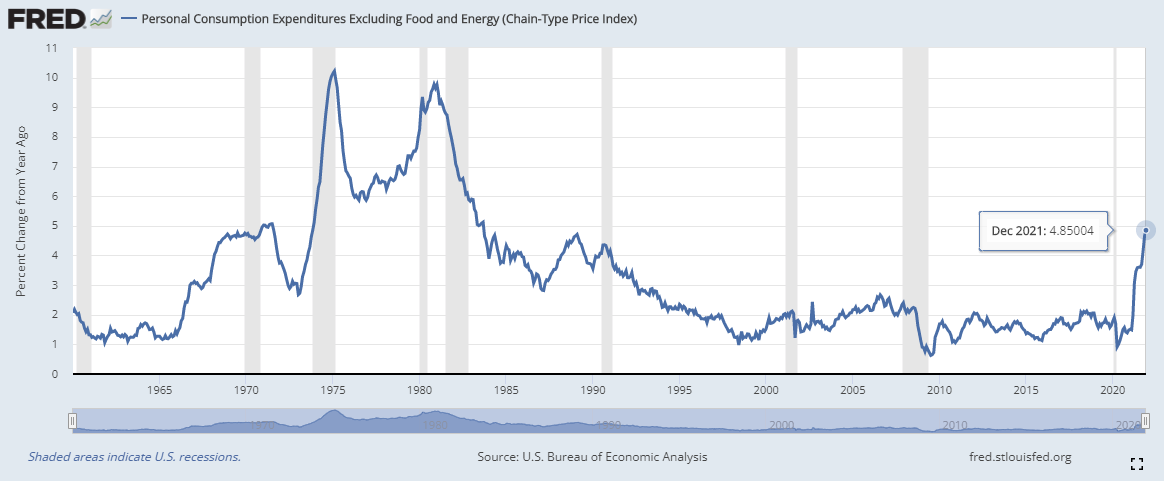

Another hot inflation print as the Fed stays patient

and another former Fed official tells the truth

Another month, another hot inflation print. Will this be the one that lights a fire under the Fed and gold? I’m not holding my breath.

The “core” came in at 4.9%. This is the PCE without those things that everyone buys like food and energy. When you add those back in, the index hit 5.8% which is the highest since the spring of 1982.

This actually came in below the estimate of 5.9%. I believe this is what led to gold, silver, and oil all having muted days. This looks like a very steep curve to me. I know that the Fed has dropped the “transitory” adjective but I still see many pundits out there that believe inflation is going to magically drop without the Fed needing to raise interest rates more than a few times. I find this to be very dangerous advice. We have a Fed that looks like they are losing control. Meanwhile they claim that there is nothing to worry about here.

I believe traders are going to realize soon that things aren’t going as well as advertised. A quick look at the 10 year treasury minus the 2 year shows an increasingly flattening yield curve.

It is currently at 63 basis points. It has come down dramatically this week. The trend here is not our friend. As a reminder, we generally don’t see a recession until this chart goes negative so there is still time for the Fed to turn this around but I’m not holding out a lot of hope.

In addition to the PCE index, we also got a look at the personal savings rate.

It got a small bounce from November and ended December at 7.9%. This is firmly in line with the pre-government-shutdown-and-handout range. I believe the consumer has exhausted their pent-up demand, this is why the recent reports from the Markit PMI report appeared so weak. Demand is falling back into line with where it was before the pandemic. The big boom is over. Now the real test begins. Can the economy continue to plug along while the Fed removes liquidity and talks about raising rates or will a recession emerge and change this game from checkers to chicken?

On that front, the former president of the Dallas Fed, Richard Fisher was on CNBC and gave quite a rant against the Fed’s current actions. This is yet another example of a former Fed official being able to tell the truth once outside of the Eccles Building. Mr Fisher lambasted how the Fed had allowed the market to become dependent on the Fed’s “largess”. He urged them to “wean the market off its dependency on a Fed put”. The former Dallas Fed president is of the belief that the Fed can stand firm in the face of a market meltdown to do the right thing and extinguish the flames of inflation. If he is right, and the Fed is able to persevere, this would mean bad news for the market. We could see a long drawn-out bear market similar to ‘00-’02. I still have my doubts if they will be able to persist in the face of a market meltdown. Only time will tell.