Investors are beginning to catch on that energy stocks are the place to be. We got a big headline from MarketWatch yesterday:

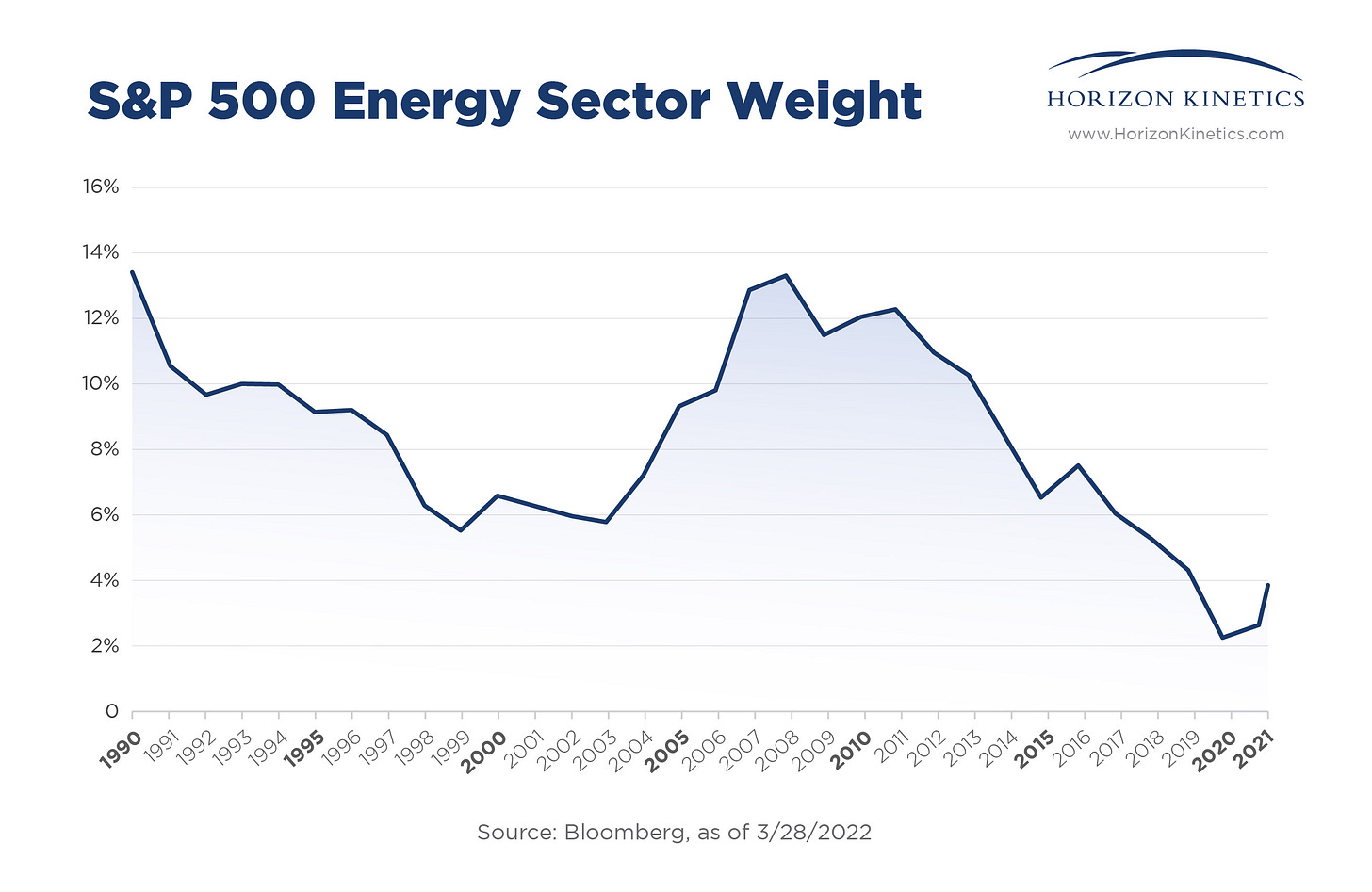

The herd is coming around. MarketWatch put this graph in front of it’s readers and it made it very plain:

The major indices are tech heavy, so are the hedge funds, private equity firms, and 401ks. We got a peek at this at the beginning of the month when Jefferies Equity Research team released their hedge fund report. Investors are searching for a place to earn a return and energy has performed well on the year. It should be no surprise that investors are beginning to embrace energy stocks.

Oil was down 3.9% at one point today. Many blamed the big drop on Biden’s new announcement that he will drain yet more oil from the SPR (strategic mid-term reserve). Yet energy stocks were bid.

Investors are beginning to realize that these companies are providing important services and are reaping big profits. I believe we are going to begin to see a disconnect between energy stocks and the oil price. The foundation for the pricing of these energy stocks was a faulty assumption. That is, that oil had peaked and would soon come back down to the $45-$65/bbl range. Now that a higher for longer approach is beginning to be priced-in, expect to see a movement into these stocks.

This should lead the S&P500 energy sector to increase in weight.

In addition, we’ve seen two important acquisitions announced yesterday.

The big one for former Wenzel readers was that Continental Resources (CLR) will be purchased by the Hamm Family for $74.28/share. CLR was a big winner that Wenzel had picked. It has had a terrific run. It is no surprise why Harold Hamm wants to take it private. It is generating a lot of income. At Harold’s offered price, he is getting CLR at under 6x free cash flow and a P/E of around 10. Now that’s a good deal… for Harold.

The second big sale was Archaea Energy, which is being sold to BP for $26/share. Archaea was not on my radar. They are one of the largest renewable natural gas suppliers. This gave them an edge in the market but they were not profitable. I feel BP spent a lot to obtain them but BP must see something I don’t. What I do see is the beginning of a pattern.

Smaller energy companies that are trading at large discounts or have a competitive edge in the market are going to look very attractive to buyers that want to take them private. Many of these companies are trading at big discounts to the free cash flow that they are producing.

Finally, I want to point you all to an article that Dr Michael Burry posted about. It is an interview with Russell Napier. Russell believes that a big Cap-Ex boom is coming. A boom which could last 10-15 years. While I don’t believe everything Russell says in this interview (I think he is missing the Fed’s game here), I think he nails it on the capex spending. Inflation is coming from the supply side and to remedy that, we need to develop more resources and become more efficient with the ones we have. In addition, there is going to be a “huge homeschoring and friendshoring boom”. Manufacturing is coming back. We had a big shift in manufacturing overseas but the weaknesses of these ideas was laid bare for all during the Covid hysteria.

“Just imagine what will happen when we decide to break free from our one-sided addiction of having pretty much everything we consume produced in China. This will mean a huge homeshoring or friendshoring boom, capital investment on a massive scale into the reindustrialisation of our own economies. Well, maybe not so much in Switzerland, but a lot of production could move back to Europe, to Mexico, to the US, even to the UK. We have not had a capex boom since 1994, when China devalued its currency.”

He also tackles the stagflation theories.

“So the endgame will be a 1970s style stagflation, but we’re not there yet?

No, not by a long shot. First comes the seemingly benign part, which is driven by a boom in capital investment and high growth in nominal GDP. Many people will like that. Only much later, when we get high inflation and high unemployment, when the scale of misallocated capital manifests itself in a high misery index, will people vote to change the system again.”

I believe for CLR to go private and be bought by Harold Hamm, it must pass a shareholder vote. How does that typically take?

Can we just sit on it while waiting to see what happens? Is it correct to assume if the vote passes, our shares will automatically get sold at the offered price?

You are so right about CLR. I let it go yesterday for just shy of 300% of what I paid. Now to find where the money goes next.

Still holding FCX (red) and DBC/GSP (big green) off the Wenzel portfolio.