I’ve spent entirely too much time reading bad takes on the recent bank failures. We’ve gotten a lot of how it happened but not a lot of why and who this action might benefit. Here’s the background…

Silicon Valley Bank (SIVB) was heavily involved in tech startups. These tech startups had taken in a lot of money through the PPP program during Covid. They deposited this money at SVB. The bank then purchased long dated treasuries to earn a return on these deposits. This was their first mistake. They were reaching for yield when they should have been cautious. When these companies began needing that money, the bank had to sell these treasuries. Normally this won’t be a problem but between the time that SVB bought these treasuries to the present, interest rates have steadily climbed. This makes the price on those bonds go down. Interest rates up, bond price down. That’s how that works. This would not have been a problem had the bank been able to hold the bonds to maturity.

The second mistake the bank made was not hedging their interest rate risk. Hedging risk is what banks are suppose to do. The Federal Government requires banks to hold treasuries on their balance sheet. The banks have to protect themselves from rising interest rates, especially if they are holding long dated paper and there are many tools at their disposal to do this. Unfortunately, Silicon Valley Bank went without a chief risk officer (CRO) from April ‘22 to January ‘23. It seems they weren’t concerned with their risk profile. They were much more concerned with diversity, equity, and inclusion (DEI).

As SVB's CRO office stood vacant in Santa Clara, Jay Ersapah -- a self-described "queer person of color from a working-class background" -- was splitting her time between risk management and an assortment of woke programs, as she co-chaired SVB's "European LGBTQIA+ Employee Resource Group."

Now we’ve seen three US banks fail in a week (Silicon Valley Bank, Silvergate Bank, and Signature Bank). There is a common theme that runs through all three and it’s their investments and partnerships with crypto, specifically so called “stablecoins”. I am no crypto expert but what I do understand are Wall Street mantras and one of the biggest is “don’t fight the Fed”.

Powell has said that he has no problem with Bitcoin but he isn’t a fan of stablecoins.

This leads me to believe that the Fed would welcome these kinds of developments. In fact, I believe their so-called “bailout plan” is a big nothing-burger. In the post-1930 history of banking in the US, large account holders have always been made whole. No one under or over the FDIC limit has lost money in a bank failure in this time period. During 2008, JPMorgan famously offered to buy Bear Stearns for $2/share. Big banks will swoop in and purchase these failed banks.

So we get back to the original question, who benefits from the failure of these banks? First off, I think the Fed benefits. These so-called stablecoins are the crypto version of eurodollars. Eurodollars are dollars that are offshore that the Fed has no control over. The Fed is actively attempting to rein in these offshore dollars markets. By taking the financing leg out from under the stablecoins, they will lose their peg to the dollar and crash. In addition, other banks will now be much more cautious about lending to these kinds of schemes.

Who else benefits? Those big NY banks. Just like in ‘08 when JPM picked up Bear for pennies on the dollar, the big banks who are appropriately positioned and hedged will be able to pick up these regional banks in the same fashion. I think there are some high quality regional banks that have been unduly punished by the recent market reaction. I’m searching for deals and when I find them, I’ll be sure to post about them.

So what does this mean for the upcoming FOMC meeting?

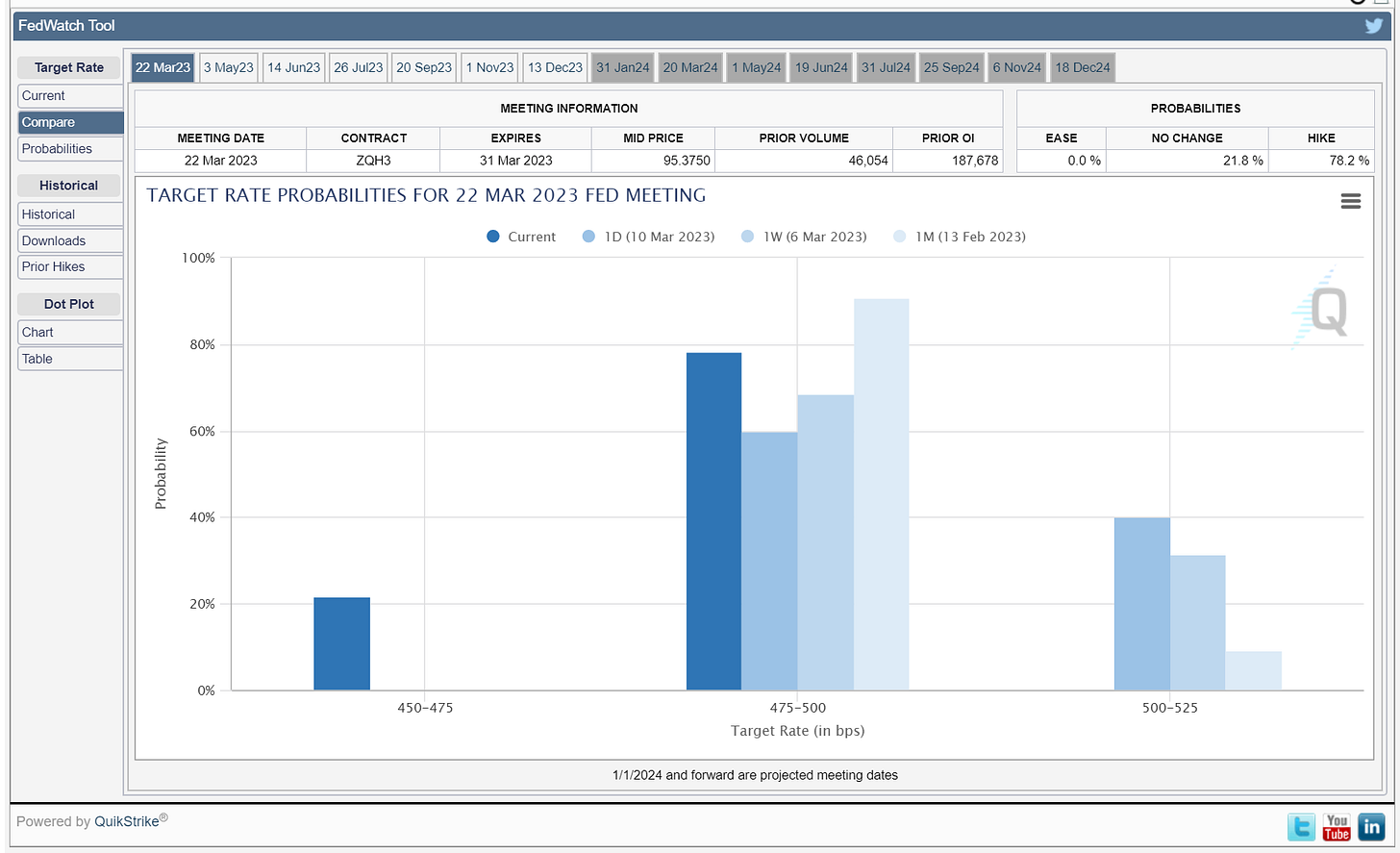

After the last meeting, I believe Powell wants to bait the market into doing his job for him. What I mean by this is that he knows that the current rates are beginning to shock the system. He has warned that this transition will be bumpy. A correction is ok, a crash is not. What the CME’s Fed Watch tool shows is most likely what the FOMC will go with as that will be the “safe” choice.

We are still firmly in the 25 basis point camp. If the market begins to price in less, expect traders to begin to position for rate cuts. At that point, a full blown second wave of inflation will be inevitable.

Thanks for this, Alan. There is so much noise around this that your cool take on it is much appreciated!