The inflation story is continuing to develop. Today saw the release of the CPI and it continues to be hot.

The news surrounding today’s CPI print is geared in two directions. The first is that today’s number was less than anticipated. While this is true, it feels awfully disingenuous. The forecast for the “core” CPI was 6.7% and it came in at 6.5%. What is not touted is that the inflation rate exceeded expectations when food and energy were added back in. Estimates were 8.3% and the actual was a blistering 8.5%. This was a 1.2% month-over-month increase.

Americans haven’t experienced this kind of inflation in over 40 years. That is a whole career for most guys on Wall Street. So it is no surprise that there is wishful thinking that this is the top. This was covered well by David at LiveBetterNow. Stocks blew higher to start the day but early optimism has faded and so have the major indices.

The second way this inflation is being portray is that there is no way it can go higher from here. One financial news outlet, LPL Financial, looked at “What categories could help release inflation pressures?” After such a high CPI reading, LPL wanted to know how this will ever start to come back down. While their conclusion is laughable,

“Inflation is possibly at the top but the cool down period could be painfully slow.”

their Chief Economist, Jeffrey Roach, had a powerful insight.

“The cool-down period for consumer prices may take a long time. Supply chains are still clogged, consumers have pent up demand for services, and the pool of available workers is small.”

None of those factors are being alleviated. In fact, China’s recent continued lockdown of Shanghai is going to continue to cause supply chain disruption. Many investors are beginning to shed shares of shipping companies. Both ZIM and Star Bulk Carriers look like buys here. I’ve gone over ZIM’s record before, but both of these shippers pay outsized dividends, which makes it easier to hold them over long periods of time. I currently own SBLK and am watching ZIM for a potential entry point.

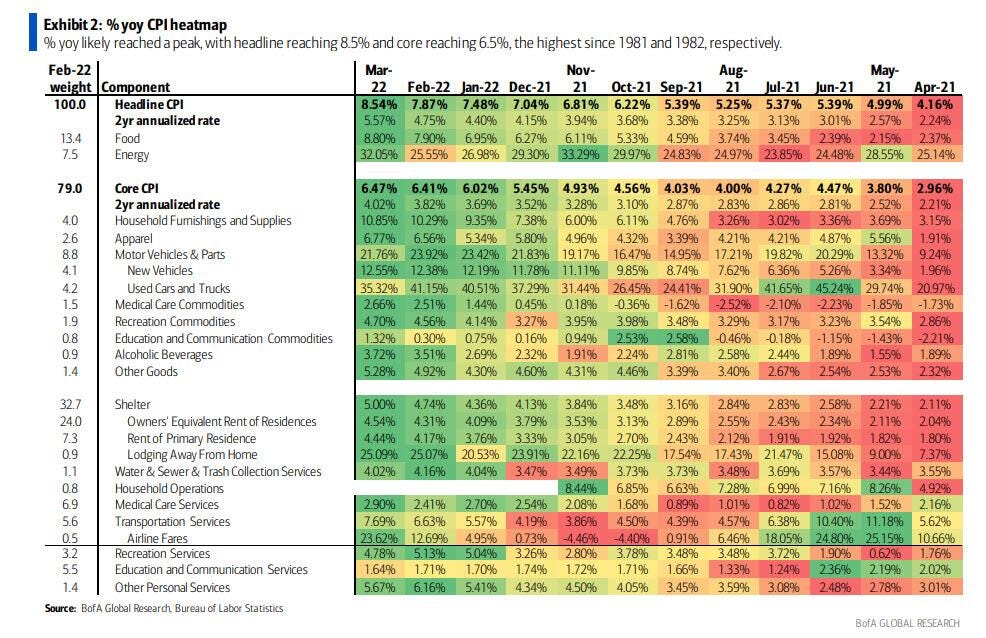

Finally, here’s the heatmap, showing in green where the hottest inflation has been found year-over-year.

On a month-over-month basis there are several components that have recently pulled back.

Used vehicles, though up over 35% in a year, are showing signs of cooling down. This is no surprise. Inflation propels forward throughout different components over time. When one is cooling off, other pick up the pace and carry inflation higher. We see this now in energy, food, and shelter costs, which are becoming a powerful force that will continue to propel the CPI higher.