Coking coal, also known as metallurgical coal, is an important ingredient in the steel making process. Coking coal is transformed into coke by heating the coking coal to 600+ degrees celsius. Coke, iron ore, and limestone are then fed into a blast furnace to create steel.

Today I’m going to dive into SunCoke Energy (SXC) a coking coal company and explore their fundamentals. This is what FinViz shows for SXC:

SXC is a small company. They have a market cap under $600M. To give a comparison, Ford Motor Company has a market cap of $64B and they are on the smaller side for a large company.

SunCoke has done a good job keeping their earnings positive during a tumultuous time for coal companies. Over the last 12 months they’ve made nearly $1/share. This equals a little over $83M in net income on $1.67B in sales. This makes their profit margin 5%, which is small. They will need to show improved efficiency and pricing to get that increased.

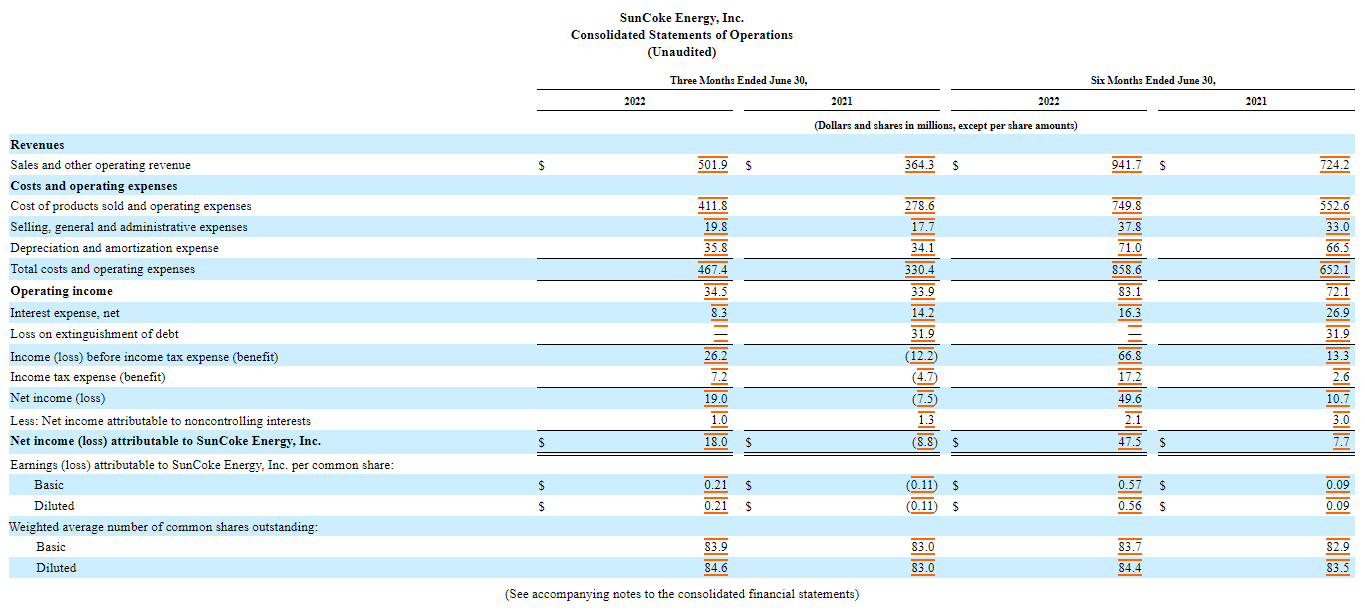

Looking through SXC’s latest financial statement, they show a marked improvement over last year’s figures (page 1).

The most recent six months ending June 30th compared to last year’s figure shows a $0.48/share improvement. Part of this is due to increased sales but part is also due to a more efficient cost structure. Last year, the costs of products sold was 31.1% of the sales revenue. This year, costs sold was down to 25.6%. This shows that SunCoke is getting to be a more efficient organization while seeing increased pricing for their product.

Moving on to the balance sheet (page 3), current assets total $371.2M. These are assets that are cash or easily converted into cash. Their total assets (of which a big chunk is properties, plants, and equipment) equal $1,677.4M. On the liabilities side, SXC has some accounts payable, accrued liabilities, and long-term debt, as well as benefit liabilities for their employees (this includes retirement benefits and “black lung” benefits). Black Lung benefits come from the Black Lung Benefits Act of 1972. They are paid to coal mine employees and survivors whose deaths are attributable to pneumoconiosis. This is a common liability to see on coal mining company balance sheets. When you subtract the total assets from the total liabilities, you get the owner equity of the business. You can think of this as what you would get if the company went out of business and sold everything. This is also called Liquidation Value or Book/share. For SXC this is equal to $6.84/share when I calculate it manually. FinViz has it at $6.43/share. This makes SunCoke a great value since their current price is $7.05. You are almost able to buy this business at their liquidation value.

Digging down into SunCoke Energy’s long-term debt shows the following:

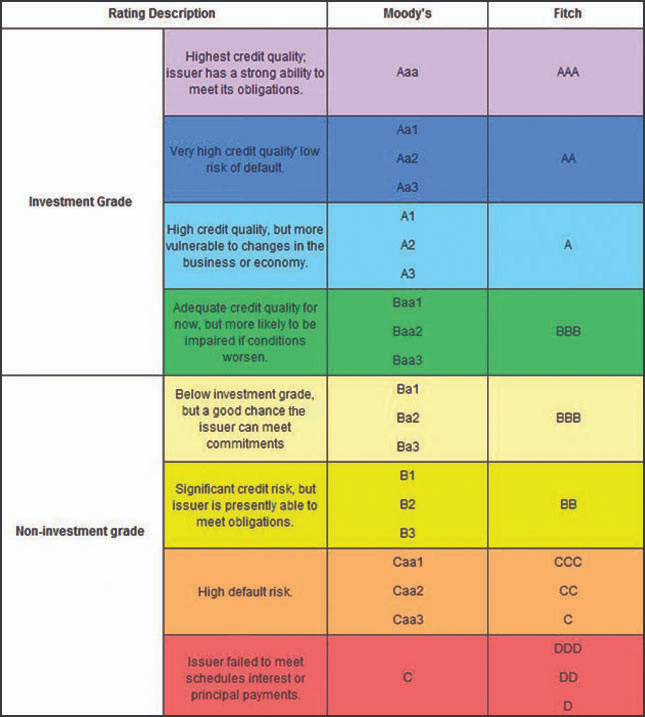

Their most current rating is BB. This means that they are a credit risk. Here’s a handy guide on bond ratings:

Three of their four bonds are near par (par = 100), this means bond investors believe the company’s bonds are being fairly valued and they are being fairly compensated for their risk. It is only the bond furthest from maturity that is priced around $88.

OpenInsider doesn’t show any activity but on SXC’s SEC page, they have several recent insider trading reports on file (all buys). I’m wondering if OpenInsider might not be very efficient when analyzing smaller companies.

To sum this one up, SXC looks like a very promising company. This is especially true when you add in the Energy Thesis angle. They are priced very favorably on a price/book (1.1), price/earnings (7.13), and price/sales (0.34!) basis. There are concerns about the company’s debt load, however I believe that with their improving efficiency and book/share value, they should have no problems servicing their debt and staying solvent.