The hardest lesson to learn regarding long-term value investing is watching your portfolio become a sea of red and not panic. It is during these times that capital should be deployed, not clawed back.

“The best chance to deploy capital is when things are going down.” - Warren Buffett

Admittedly, I am still learning this lesson.

I grew fearful when I should have had patience.

I know once you have a thesis and are able to stick with it, good things will happen, as long as that thesis stays intact. I don’t believe anything significant has changed. My investment strategy is not wrong, I just lost patience. Also, I know that this works. I’ve seen it.

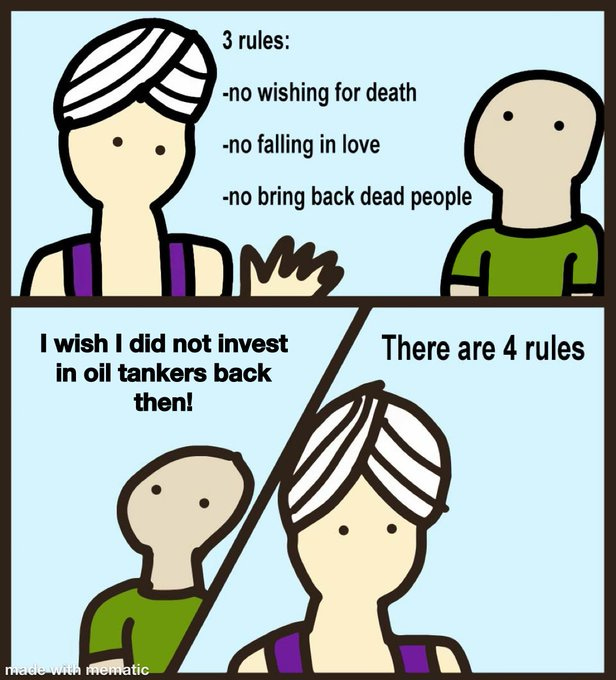

This guy started with $215k in April of 2020. He had found a thesis about oil tankers and went all-in. Within two months, he was down $50k. His portfolio bottomed in Oct 2020 down $70k. That is nearly a 33% draw-down. He began drowning his sorrows in making memes.

By March of 2021, he got back to break-even only to see another draw-down of $50k by January of ‘22. After that, things for tankers have turned around. He is now up over $400k. His estimated annual return is 13.5%. He hasn’t sold and I believe his thesis has more room to run, so his final annual return could be higher.

“Investing is where you find a few great companies and then sit on your ass.” – Charlie Munger

Unfortunately, I wasn’t able to just sit on my ass…