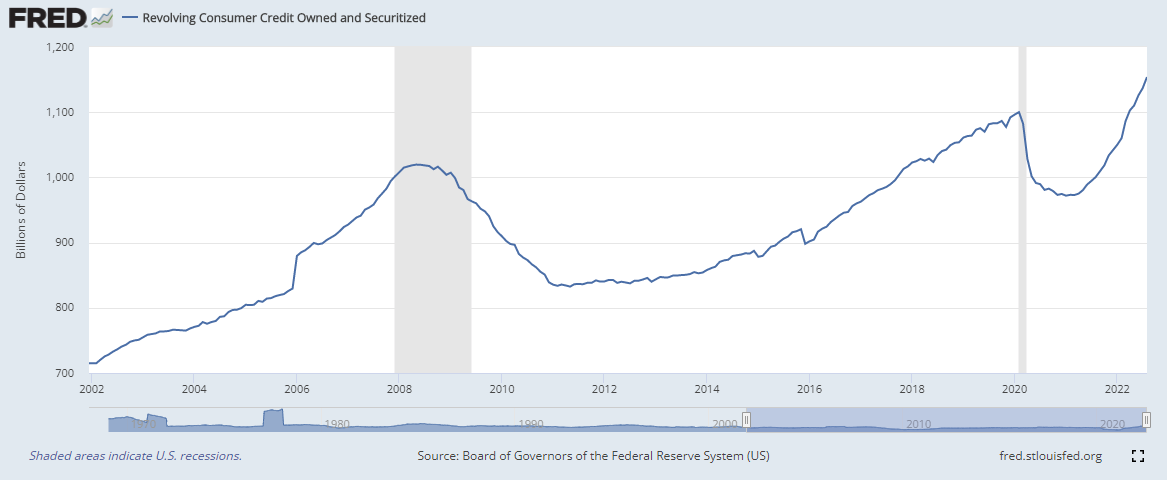

During the pandemic, stimulus checks were sent out to the masses. At one point, I thought all Americans might have tuned into Dave Ramsey as revolving credit lines were paid down, en masse. Now we are seeing consumer credit come roaring back.

Credit card use is up 15.3% year-over-year. This is a dramatic rise. I think there are two factors in play here; inflation and lifestyle drift. When the stimmies came out, many upgraded their lifestyle. Now that the stimmies have stopped, consumers are using their credit cards to maintain that new lifestyle. Inflation feeds this doom-loop. Higher prices for food, fuel, and fun have eroded the purchasing power of consumers.

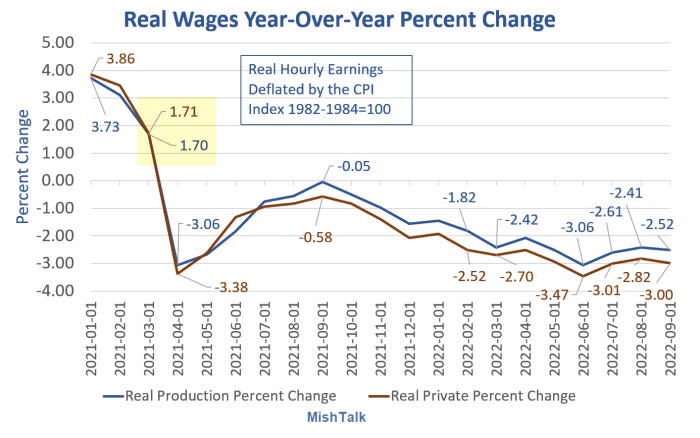

Mish has been all over the topic of real wage decline since the beginning. His latest post on it is here:“Real Year-Over-Year Wages Decline for 18 Consecutive Months”. He included this very nice graph:

Consumers are losing ground in their wages and their lifestyle costs. At some point, something has to give. I believe that holiday sales are going to be lower due to less disposable income. This means that consumer discretionary/cyclical companies could be in for a difficult 4Q and 1Q23. XLY is the SPDR consumer discretionary ETF.

In addition, I feel that less disposable income will lead to less travel spending. Companies like AirBNB, airlines, and booking companies (like Expedia) could really suffer from fewer sales. This lull in travel spending may take a little more time to develop as many travel during the holiday season.

Unfortunately for consumers, oil is going to continue to stay tight. President Biden, during a rally on Sunday for Kathy Hochul, announced to the crowd that “there is no more drilling”.

The SPR releases are soon to be finished. Oil is already drifting higher. No new drilling and no new refineries insures that we will have much higher oil and gas prices. Biden’s energy strategy is turning out to be worse that Carter’s (and anyone old enough to remember the Carter presidency knows that is really saying something).

The under-investment in fossil fuels over the last 5-10 years is the main reason we have an energy crisis today. Now governments have gone crazy. Why would any company invest in energy today with the rhetoric we are hearing? No more drilling, where will new supply come from? “Excess/windfall” taxes, what incentives are there for new players in the industry? Tax it and you’ll get less of it, subsidize it and you’ll get more. This is a time tested formula. This woke/ESG cult continues to eliminate the market mechanisms that would bring additional supply online. By hampering the market, high inflation will continue to be the norm.