We got a lot of news out of the Fed this past week. There were 6 separate speeches posted this week to the Fed’s website. Most importantly, 3 of those were made by Gov Chris Waller. Two at the Third Conference on the International Roles of the U.S. Dollar, hosted by the Federal Reserve Board in Washington, D.C at the Peterson Institute for International Economics and one in Iceland.

Here are links to Gov Waller’s individual speeches:

There was also a speech by Barr on Regulatory Framework and by Jefferson on Housing.

I was most interested in what Gov Waller had to say this week about the dollar’s role. I believe that there are only a few things that could dethrone the dollar from it’s current standing and use in international transactions. There was a gif posted on X recently that showed the changes in international reserves since 1950.

That’s a high throne the dollar currently sits on. I recommend checking out the tweet for the full video.

Gov Waller’s main address at the Peterson Institute titled, “Little by little” was then followed by a Q&A. During it, there were two exchanges that I thought were profound.

Interviewer AP:

Going beyond our gut feelings, PIE board vice chair Larry Summers gave a speech here about 10-11 months ago talking about the channels through which sustained increases in fiscal spending could be driving up R*. Sort of the reverse of the secular stagnation. I don’t always agree with Larry but on this case I very much agree with Larry. We see a world where the G7 + China are spending on defense, industrial policy, green tech and are likely to continue doing that without much in the way of tax hikes. Just taking that as a reasonable projection, does that kind of fiscal path affect your thinking about future inflation, your thinking about R*?

CW:

When I think about a good common measure what a long run R* is, just looking at the real 10-year yield over the last 40 years and that has been falling. Now what that means is if their yield is falling, their price of those assets are going up. People are willing to pay more for them. I think of it as the last 40 years, the demand for treasuries outpaced the growth of issuance. So, demand was exceeding supply. But if that reverses, so what happens is prices are being driven up, yields are being driven down but if suddenly the supply of Treasuries starts exceeding the growth in demand for these objects, the price will start to fall and the yield will start to go up. So, it’s really more the fact that, it’s not so much about fiscal policy per se but if the issuance of debt and running deficits gets to the point where the issuance of Treasuries starts outstripping demand, you’re going to see real interest rates go up and then that will feed back on what we think about for R* longer term policy.

R* or R-star is the estimated interest rate when the economy is at full strength and inflation is stable. What they are addressing here is long-term interest rates and if excessive government spending could contribute to higher interest rates down the road. The interviewer, Larry Summers, and Gov Waller are all in agreement here that federal governments around the world are treading on thin ice. When these countries begin issuing more debt than the market can handle, that debt is going to get priced lower and interest rates are going to go up in order for the market to find balance.

AP:

(Long drawn out comment that gets turned into a question about how Gov Waller thinks about the balance sheet)

CW:

So, balance sheet in policy I do view in kind of an asymmetric way and that I made some comments back in New York on this earlier this year. When you’re at the zero lower bound and the economy’s not doing well, then doing balance sheet policy to try to put downward pressure on longer term rates, I think does have some benefit. How big that benefit is, we can argue about but it does have some benefit but that’s usually because there’s some friction in the economy that you’re trying to overcome and try to help the economy. As that friction tends to go away, we can start removing that accommodation and work to use our policy rate to do most of the work and then all you’re kind of doing with the balance sheet is draining any excess liquidity you put into the system. So, the simply analogy I like to point out is like if you had a house on fire and you started pouring water on it, you put out the fire and when the fire’s out, you start to drain away the water. The house doesn’t start back up on fire and that’s the asymmetry I meant. Putting it in helps, it does something good but later when that problem is over and you start taking it back out. It isn’t doing that much. You’re just taking the excess liquidity out of the system. So that’s how I view a lot of the balance sheet. It’s helpful when we are in a tough situation but once we get out of that, you can take it away and there’s not going to be a reciprocal damage from taking it out.

The Fed’s balance sheet is a conundrum for the market and the Fed. Did Quantitative Easing (QE) have a market impact? Did they reduce “friction” in the treasury market and increase liquidity. If so, wouldn’t that mean Quantitative Tightening (QT) would have an opposite effect and reduce liquidity? While I appreciate the analogy, I think this is an oversimplification of the impact the Fed’s balance sheet has on the liquidity of the treasury market.

I think it might have been lost on the audience how these two questions compliment each other. Can the Fed intervene in the treasury market with QE or QT and then still use it as a approximate measure of R*? What happens if the US Treasury monkeys with the government bond market by doing buybacks? Would the Fed be able to tease out these interventions and still calculate R*?

Recently Lyn Alden published a piece titled, “The Bond Market is the “Dumb Money” Now”. In it, she exposes how the US federal debt-to-GDP ratio has risen from 30% to 120% and caused this market to be much less nimble. She also details how liquidity in what is suppose to be the biggest, deepest, most liquid market in the world is drying up.

“In the Treasury market’s case now, both the Fed and the Treasury intervene on a regular basis. Sovereign bond markets that are even further along in terms of debt-to-GDP ratios, such as Japan, tend to have even more central invention like this, and consequently even worse private sector liquidity. At that point, bond markets become increasingly artificial, and increasingly devoid of useful information for economic forecasting.”

The whole piece is worth a read.

This ties in with Gov Waller’s final speech of last week at the Reykjavik Economic Conference in Iceland. In this speech, Gov Waller details 5 reasons why the 10 year US Treasury and R* decreased for the past forty years.

Globalization beginning in the 1990s

Build-up of foreign reserves

Specifically looking at the Asian Crisis of 1998 and how reserves have gone from ~$1T to ~$12T allowing foreign governments to better handle shocks to the global economy

Sovereign wealth funds increasing holdings

Aging populations and their trend towards safer assets

New regulations after the 07-08 financial crisis

Liquidity coverage minimums increased providing a bid for treasuries

Money market funds increasingly hold treasuries

Waller finishes his speech strong with a shot across the bow to those sitting in Congress and the White House.

“Let's now turn our attention to the supply of Treasury securities and ask if this can possibly explain why r* may be increasing now or in the future. The U.S. government issues Treasuries to finance deficit spending, which obviously impacts Treasury supply. Deficit spending and the federal debt have been increasing since the 1990s. I believe the factors increasing demand that I just reviewed have outstripped the increase in supply over the past few decades, leaving r* lower. But if the growth in the supply of U.S. Treasuries begins to outstrip demand, this will mean lower prices and higher yields, which will put upward pressure on r*.

It is probably not news to many people that the U.S. is on an unsustainable fiscal path. The latest outlook from the Congressional Budget Office paints a challenging picture of the future, with debt expected to grow at an unprecedentedly high rate for an economy at full employment and not involved in a major war.

All of these financing pressures may contribute to a rise in r* in coming years, but only time will tell how large a factor the U.S. fiscal position will be in affecting r*.”

Could those five factors that Waller listed during his speech reverse and force upward pressure on interest rates? I’m feeling very confident that globalization has had a recent peak and is retreating with the increase in on-shoring/friend-shoring of industrial production. I’m also concerned that foreign reserves are switching from dollars to gold. Will sovereign wealth funds be the next domino to drop? Can the aging population and new regulations make up for the selling or stalling of the first three factors?

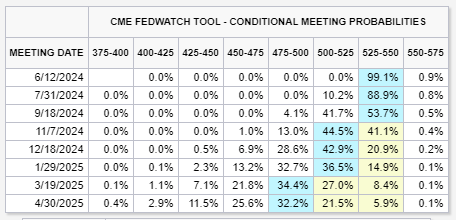

We are 14 days out from the next FOMC interest rate decision and the CME FedWatch tool is again implying a probability of an increase.

It isn’t much but I feel it is significant that the market is beginning to believe that an increase could even be possible.

Finally, I’m looking forward to Friday. Avance Gas is suppose to distribute their dividend that day and I loaded up on the stock in the run-up to the ex-dividend day. Its time to get paid!

I think we may already be on to "when will interest rates rise from here?"

Can we expect an M2 update soon?