There have been some crazy developments over the weekend. The craziest of which is inflation. It continues to run hot. The latest data point is my favorite inflation indicator, the Case-Shiller Home Price Index.

We’ve had very slight relief from the blistering pace inflation has taken. The index is down from the peak of 20.0% in August of 2021 to 18.8% for December 2021’s reading. It has been essentially flat to close out 2021. This leads me to believe we will see sustained high inflation. The Fed has been extremely slow to react to the inflation data. At first they called it ‘transitory’, hoping it would just go away on it’s own. Then they dropped that narrative when it continued to run hot. Now they’ve attempted to jawbone it lower with talks of taper and rate hikes but that is not working either. If the Fed wants to choke off the inflation, they will have to raise rates in a dramatic fashion. This is not something they will be able to withstand. It will cause a market correction. At that point, they will be truly trapped. The Biden administration is not helping.

The Daily Signal reported last Friday that the Biden administration is continuing to add “roadblocks” to the energy industry.

The Federal Energy Regulatory Commission announced that it will begin to “undertake a robust consideration” of the environmental justice impacts of such fossil fuel projects before granting approval, according to a fact sheet published Thursday.

This shows that the administration is not serious in its pursuit of lower energy prices. This is going to continue to put upward pressure on oil, gas, and coal. While some on the left rejoiced at the announcement of pending higher energy prices, one democrat expressed his frustration.

“Today’s reckless decision by FERC’s Democratic Commissioners puts the security of our nation at risk,” Sen. Joe Manchin, D-W.Va., chairman of the Senate Energy and Natural Resources Committee, said in a statement. “The Commission went too far by prioritizing a political agenda over their main mission—ensuring our nation’s energy reliability and security.”

“The only thing they accomplished today was constructing additional road blocks that further delay building out the energy infrastructure our country desperately needs,” he added.

I’m convinced, if the democrats want to avoid an epic meltdown in November, they need to get behind Manchin. He is of sound mind and sound policy. He has the ability to see through to the unseen results of policy. Unfortunately, he has been branded by the far-left as an alt-right sympathizer. Higher energy costs are going to continue to force the CPI higher.

Staying on the crazy theme, Canada’s current crazy rating is off the scale. The trucker protests have been entertaining. The addition of hot tubs and bouncy castles was especially amusing.

It was difficult to watch as the ruling class attempted to smear the protesters as racists. Their attempts to “other” them failed and instead of reevaluating their position on Covid, they doubled down. They imposed “emergency measures” to forcefully remove the protesters and slashed their bouncy castles.

They have been swiftly moving to make these “emergency measures” permanent. Part of these measures include restricting banking access to people they deem as “terrorists”. This seems to include anyone who has donated to the trucker protest through GiveSendGo, which was hacked. An amazing repercussion of this move, to deny normal citizens the ability to bank, has been a run on Canadian banks. In addition, citizens who weren’t involved at all have seen their banking access limited because their name is similar to someone who was involved. This reaffirms the idea of having some cash outside of the banking system. At an absolute minimum, I recommend 3 months’ worth of cash on hand. If the bank’s paid any kind of interest, it could be painful to hold money outside of the system but since paying interest to customers went the way of the dodo, there should be no excuse to hold some money out.

On top of the crazy inflation and crazy Canada, we have crazy covid. Edward Dowd was recently interviewed by Steve Bannon on his War Room podcast. Edward is a former Blackrock money manager and is at the front edge of what looks like a big problem. He has been highlighting the quarterly reports for insurance and publicly traded funeral homes. Etana Hecht on substack did a great job putting together a summary of Mr Dowd’s posts. What it boils down to is Pfizer and Moderna lied. The FDA and CDC covered for them. These jabs are causing an outsized amount of adverse reactions. As the market figures this out PFE, JNJ, BNTX, and MRNA will face intense pressure. MRNA has already seen a massive correction since their stock peaked in September. As a reminder, the government guaranteed these companies that they would be free from litigation but the market has other ways of making these companies pay. I’m not looking to short any of these names, I’m simply making sure that I’m out of the way if a correction happens.

Finally, to wrap up this craziness, is the Money Stock report from the Fed.

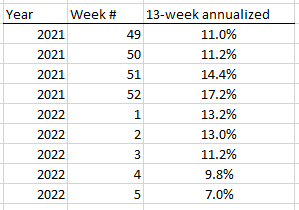

There is a seasonal drop in the 13 week annualized M2 non-seasonally adjusted figures at the beginning of every year. It typically bottoms around the 7th week of the year which is now. We will see that data in the next release which is scheduled for March. It is obvious that 2022 has weaker growth than 2021 and 2016 but I don’t see any reason to panic here. We need to continue to monitor the situation as this looks like it could be a dangerous time for the money supply. Here are the figures for the past 9 weeks.

Couple this Money Stock report with the margin debt data, showing investors reducing margin use, it is no surprise the market is struggling. In addition, the Fed has been tapering their asset purchases which is limiting liquidity in the market driving up volatility. These forces are proving too much for the stock market indices pushing them lower. I still believe we could see this turn around but I’m not holding out much hope. There is only one man who could reverse the course we are on.