Dish Network posted their Q3 earnings and had their quarterly earnings call 11/6. You can find the earnings call here.

Dish’s latest earnings were disappointing. The headlines continue to talk about bleeding subscribers and there is truth to that. He is the last four quarters broken down:

It is certainly concerning that their retail wireless subscribers are in decline but Dish’s real story is the 5G/ORAN network.

Here is what the NSA has to say about ORAN technology.

Open RAN is the industry term for the evolution of traditional proprietary RAN architecture to an open ecosystem of interoperable hardware, software, and Artificial Intelligence/Machine Learning enabled intelligent network optimization. Shifting to an Open RAN based mobile network allows for interoperability between different suppliers, removing the proprietary nature of traditional RAN and reliance on a single vendor.

“Open RAN is an exciting concept, one that opens up several doors to innovation, improved network performance, and a more diverse and competitive cyber ecosystem,” said CISA Acting Assistant Director, Mona Harrington.

Dish’s ORAN is not just another 5G network. It would be a modernization of the 5G cell network. It would expand the network’s abilities to collect, interpret, transfer, and utilize data. To get there, Dish still has a long road ahead of it. Outside of the continued built-out of their ORAN, I feel Dish has three primary challenges it has to face.

Purchasing from T-mobile, Sprint’s 800MHz spectrum licenses for approximately $3.59B (SEC doc here). T-mobile was mandated by the courts during their merger with Sprint to divest of some of their spectrum licenses.

Dish’s merger with EchoStar (SEC doc here). EchoStar was formally a part of Dish and was spunoff. Dish now needs EchoStar’s balance sheet in order to deal with…

Their debt maturity wall.

Concerning point one. From the latest earnings call (around the 30 min mark), debt and financing the cost of the 800MHz licenses was broached. Management knows that their company has spent quite a bit of money ($1B was the figure tossed around on the call) developing out 800MHz capabilities but they understand that this deal might not work. The sunk cost fallacy was brought up. Management knows that finding financing for this purchase could be extremely challenging with the current environment in the bond market.

On point two. Here is a look at both companies balance sheets and a potential future combined sheet.

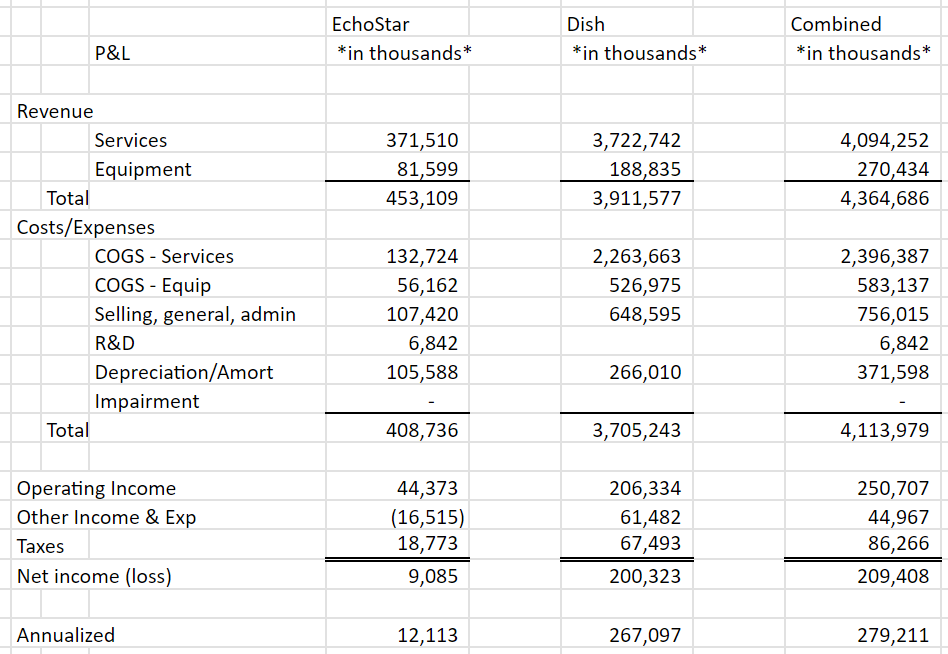

And here is a look at what a future combined 3rd quarter P&L might look like.

Multiplying the 3Q reported net income by 1.33 gets us almost $280M in annualized net income.

Dish has a “narrow path to achieve financial stability” and a “pretty big wall at 2026” (both found at roughly the 21min mark in the latest earnings call).

Here is where I see things from the cheap seats:

On the far right I have a running tally of their approximate current assets from the combined balance sheet. I add in an estimated amount from the P&L and started to deduct the debt as it matures. A “pretty big wall” of -$1B shows up in 2026. At this point debt would have to be rolled over for Dish to continue to operate without selling long-term assets on their balance sheet in order to pay down their debt.

Obviously the big hurdle here is that 800MHz license cost. If that deal doesn’t go through, it changes the math to the following:

This provides Dish Network much more runway to operate and pushes their debt wall out much further.

I’m curious what might happen with those licenses if this is the case.

To me, it looks like the best way to play this is Dish’s bonds. On the earnings call, the idea of diluting the shareholders to raise capital was discussed. This would obviously be bad for stock holders but it might be necessary to make sure the bond holders get paid. Management acknowledged that the current market price doesn’t inspire a lot of confidence that capital can be raised in the equity market very efficiently.

Either way, this situation has a lot of moving parts and while I’ve looked at a few of those parts, there may be pieces that I’ve missed or skipped over entirely (like their other long-term debt or their partnership with Amazon) that could have profound impacts on Dish as a going concern. Needless to say but this investment idea might not be suitable for everyone.

I thought this was going to be about pizza. Liked it nonetheless :)