These cats saw the FINRA margin statistics when they came out on Saturday and are ringing the bell. Here’s why:

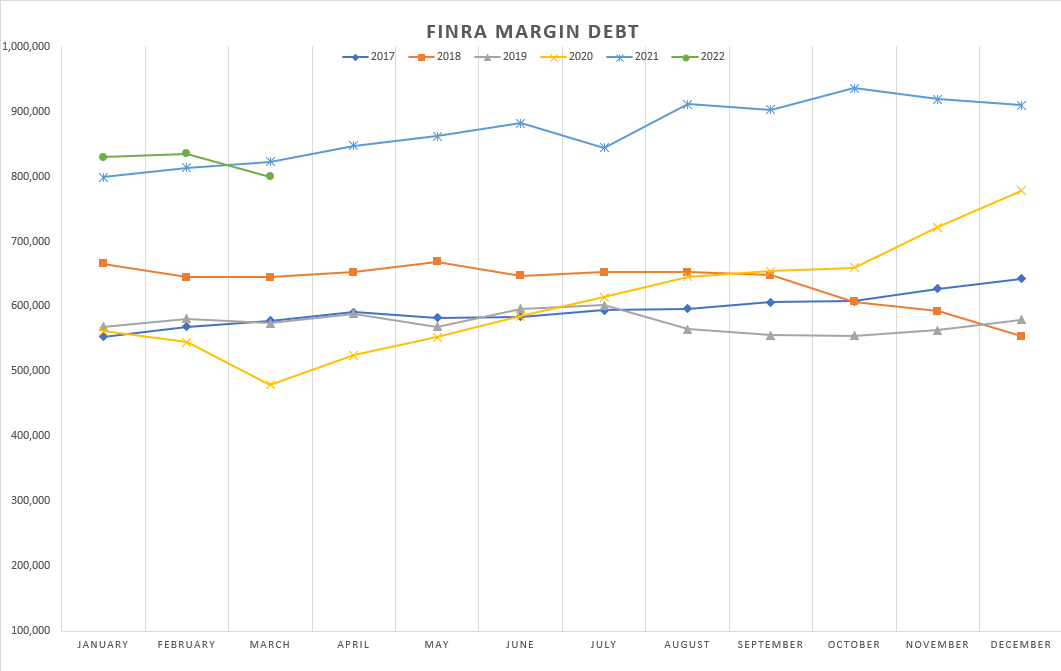

Margin debt usage dropped off significantly in March. Over $35B of margin use was taken off the books between February and March. This is a considerable month over month change. There has only been a change of this magnitude or greater 6 times in the previous 5 years.

We’ve already see a big drop in margin use at the beginning of the year. Now alarm bells are ringing. The historical record of what happens to the stock market when margin debt of this magnitude is wiped off the books is not good unless we have a strong upward advance in the money supply.

The closest recent comparison is either August 2019 or December 2018. Both of these instances saw a large amount of margin debt taken off the books. August ‘19 had an inverted yield curve (the harbinger of the 2020 recession), and December ‘18 had a positive but flat curve. Both months experienced downturns in the S&P500. Both also had strong upward advances in 13-week annualized M2NSA. By juicing the money supply, the Fed was able to control and limit the selloff. The forward months in the S&P500 saw increases. When there wasn’t a strong M2NSA response, a muddled reaction is observed. This then leads to a stronger pullback in the market.

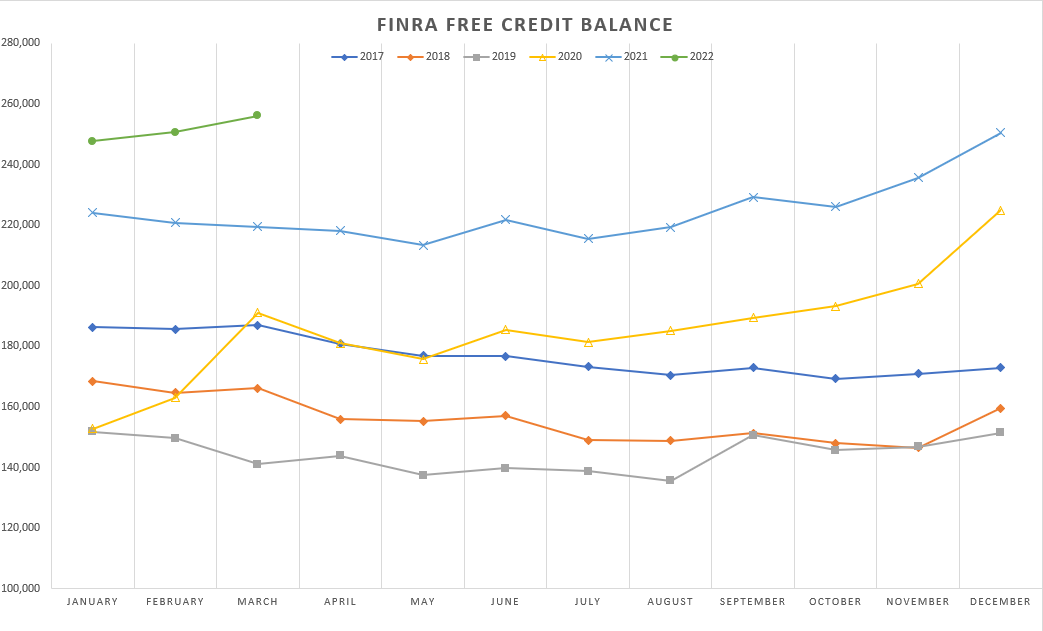

At the same time, cash on the sidelines grew by $5.4B.

This is money that is waiting for the right time to get put to work in the market. A lot of the Fed’s 2020 money pump has shown up here as “free credit balance” funds.

Update on twitter

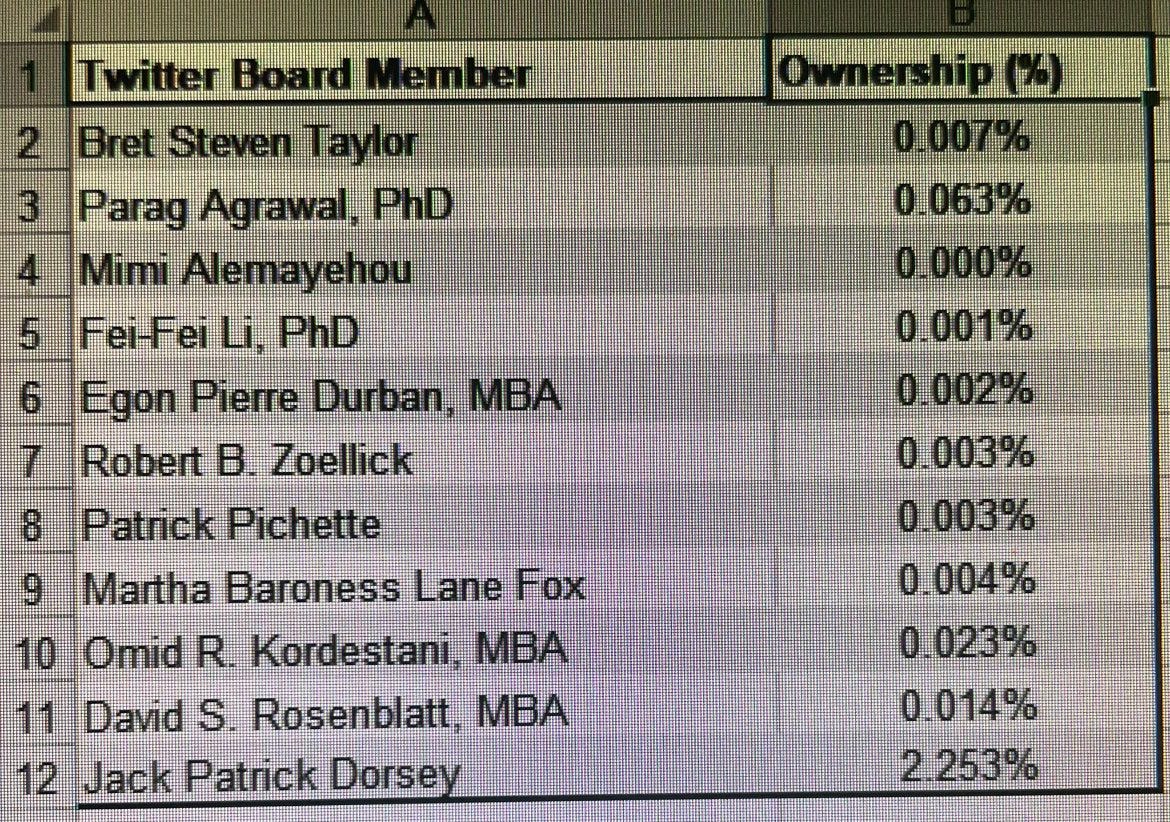

After the twitter board convened with Goldman Sachs, a shareholder rights plan was put into action. You can read it in full here. Many in the mainstream press have called it a “poison pill”. In effect, if any person or entity owns 15% or more of twitter’s stock without prior approval by the board, it would give other twitter shareholders the option to buy more shares at an advantageous price. This would effectively dilute the holdings of someone attempting a hostile takeover. In the past, it has been a mixed bag of results. However, what it fails to do is stop the process.

If nothing else happens, Musk has done an excellent job exposing the hypocrisy of the blue-checkmarked clowns and the board (which, outside of @jack, owns roughly 0.12% of twitter stock). Yes, you read that correctly, 0.12% total combined holdings.

It shows that the board has no motivation to improve the company. They show up to the board meetings and collect their $250-$300k per year. Their economic interests are not aligned with shareholders and Musk has proven this in spades.

This has gotten the attention of other investors and I don’t believe that they are happy with what they are watching. I expect Musk to try to put together a coalition of investors ready to overthrow the board without triggering the poison pill. This is the game now. We’ll see if he can attract any private equity (PE) firms to his cause. I’ve already heard names tossed around like Silver Lake Partners (who already has an insider on the board), Thoma Bravo, and Apollo. Bloomberg Intelligence also threw Oracle’s name into the ring as a company who might partner with Musk in his take-over efforts. It remains to be seen whether anyone will partner with Elon in his attempted takeover of twitter. Some may see his antics and decide (like I have) that the best view of this game is from the sidelines.

Stupid human tricks

Corn has made the news in recent days. The Biden administration decided to add more of it to American’s gas tanks in order to reduce the high fuel costs that many are facing. Unfortunately, corn is not looking to have the best year. Corn requires a lot of fertilizer and many growers are switching to less fertilizer intensive crops such as wheat or soybeans. On top of this, poor spring weather is effecting the planting season. This could further push out harvest timing and reduce yields. Corn is set to get very expensive if this continues to play out. Look for fertilizer companies to continue to see big market gains. I’m continuing to hold onto MOS and NTR as this unfolds throughout the summer.

In an effort to not lose pace on the stupid human trick scoreboard, Europe has thrown it’s hat in the ring for lead contender. The EU is set to declare an embargo on Russian oil after the weekend. This will backfire immediately on the EU. According to JPMorgan, it will have a near term affect on Russia but then they will pivot and begin selling more oil to India and China. The wallstreet bank went on to outline that they believe the price of oil could spike as high as $185/barrel if the EU follows through with their embargo. This is more than a 78% rise from the current price.

I think the best way to take advantage of the EU’s monumental blunder is to own domestic US oil producing companies. Midstream companies that pay dividends would also benefit from the increased oil shipments to Europe. I shied away from these plays early on when the Biden administration had been targeting them as the bad guys for higher oil prices. Threats of windfall profit taxes took their toll on domestic producer stocks. At this point in the game, domestic producers have a long ways to catch-up to the current oil price but the threats of windfall profit taxes are fading. I’m currently holding DVN and looking at XLE.