Don't call it a comeback

The Fed cut rates 50 basis points after the meeting on September 18th. This is the beginnings of liquidity coming back into the market. The 13-week annualized money supply report shows the same thing.

It is looking like the money pump is on. It’ll be important to see a strong finish to the year but this should be very stimulative for the general market.

The Fed’s September meeting was a ‘sell the news’ moment for the bond market, specifically the 10 year treasury.

The yield on the 10-year has moved higher since the announcement. It is now north of 4%. When a bond’s yield moves up, the price of that bond moves down. This is a sign that investors are beginning to believe that the Fed has avoided the hard-landing scenario. The 10-year is considered recession insurance and with a rising yield, it means traders are selling their insurance and moving into the market. The yield curve as a whole is, once again, attempting to normalize.

A year ago, I was greatly encouraged as the 10-year touched 5% and the yield curve was flattening. I feel we will see a repeat of this. Long-term rates should be higher than short-term rates. It is unusual to think otherwise. I believe short-term rates should be around 3.25-3.5% which means the 10 year needs to be above that. 5% seems reasonable.

This week saw inflation data come out.

“Core” and “Super-core” paint a different picture than what the headline number is showing (which is a consistent decline to 2.4%). There are two reasons for this. The first is that energy remains cheap. After peaking in May of ‘22, the price of crude has made lower lows and lower highs. This has continued to weigh on the headline number. Second, shelter costs continue to stay elevated.

Shelter is part of the “core” and “supercore”. While shelter costs aren’t rising as fast as they once were, they are still rising at a clip that is above average. You see this in BoA’s CPI heatmap.

While shelter is green because it isn’t rising as quickly as it was a year ago, it is still well above the prior average increase of ~3.5% y/y.

This kind of inflation report has to be good news to the Fed. In the presser after the meeting, Powell had indicated that shelter could be sticky for longer than expected. This is understandable as rental leases are usually on a 12-mo basis. It takes a whole year before the rent sees an adjustment. Real estate is a slow moving market. Drastic moves like the ‘07-’08 bust are the exception, not the rule.

Remember the “higher for longer” mantra? Yeah, don’t call it a comeback (LL Cool J reference anyone?). In the past when the Fed started cutting it was followed by more rate cuts, often larger in size as something had broke. A credit crisis or credit crunch had tipped the economy into recession. This go around, GDP/GDI continues to grow at a solid pace. Now with this inflation report and the previous labor report, it looks like the Fed can take their time. In fact, the GDI (gross domestic income, an alternative way of measuring the economy by counting income earned and production costs incurred) saw a revision higher, led by an upward revision in wages, salaries, and personal savings rates. The death of the consumer has been greatly exaggerated. This has led to many wall street banks revising their dire prognostications.

Heading into this CPI report, many traders thought that it would require a very firm print for the Fed to consider pressing pause in November. While this inflation report might not have triggered a pause, it has certainly “normalized” the interest rate futures market via the CME FedWatch tool.

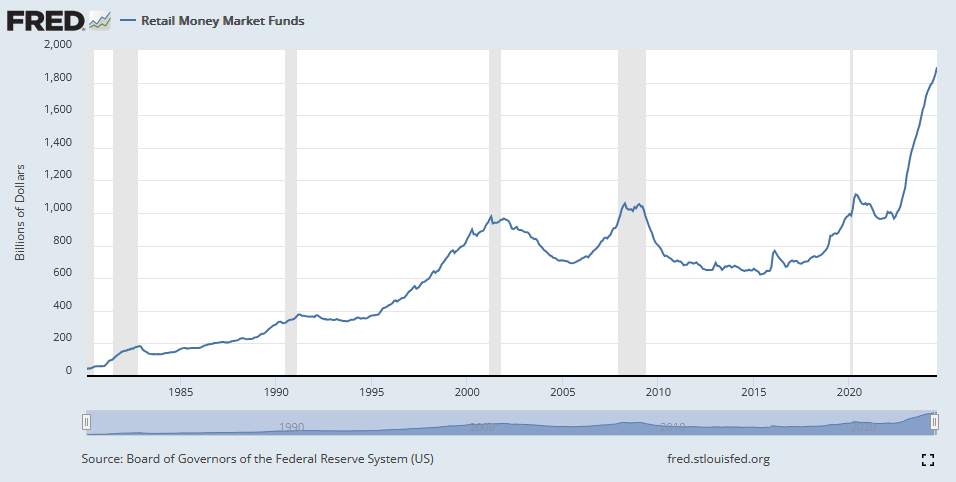

I must be taking crazy pills because this actual looks achievable. Have interest rate traders come to their senses? This looks like a road map to a robust economy that doesn’t rely on 0% interest rates to generate wealth. Now that the pivot is getting mapped out, its important to keep an eye on margin debt, forward earnings, the money supply, and money market funds as these will be the fuel to urge the bull market on.

I feel a big factor will be the money parked in money market funds. As the Fed lowers interest rates, the amount paid for sitting in a money market fund will go down. Those who have wisely held their funds in a money market fund will wish to deploy them into the market to earn a better return. I think this is going to be a very slow process but we are also talking about a record amount of money.

If the Fed continues on this slower rate normalization path while we see earnings and the money supply expand, equities will realize profits and markets will move higher.