Don't fight the Fed

One of the classic Wall Street mantras is “don’t fight the Fed”. It means that it is unwise to bet against or challenge the actions and policies of the US central bank. Their actions and statements have a profound influence on market expectations and investor sentiment. Ignoring or disregarding the signals coming from the Federal Reserve can be detrimental to your portfolio.

The Fed started raising interest rates to quell inflation in March of 2022. The Fed raised the effective fed funds rate the last time this hiking cycle in July of 2023. Since then it has been on “pause”.

When the Fed raises interest rates, the cost of credit rises throughout the economy. Higher interest rates make loans more expensive putting a damper on demand. Reducing the demand for loans restricts the abilities of banks to expand the money supply. A decrease in the money supply creates deflation, pushing down prices for goods and services. If deflation is allowed to run its course on a long enough timeline, GDP figures will go down allowing the NBER to call whats happening a recession.

The money supply has been flat now for over a year.

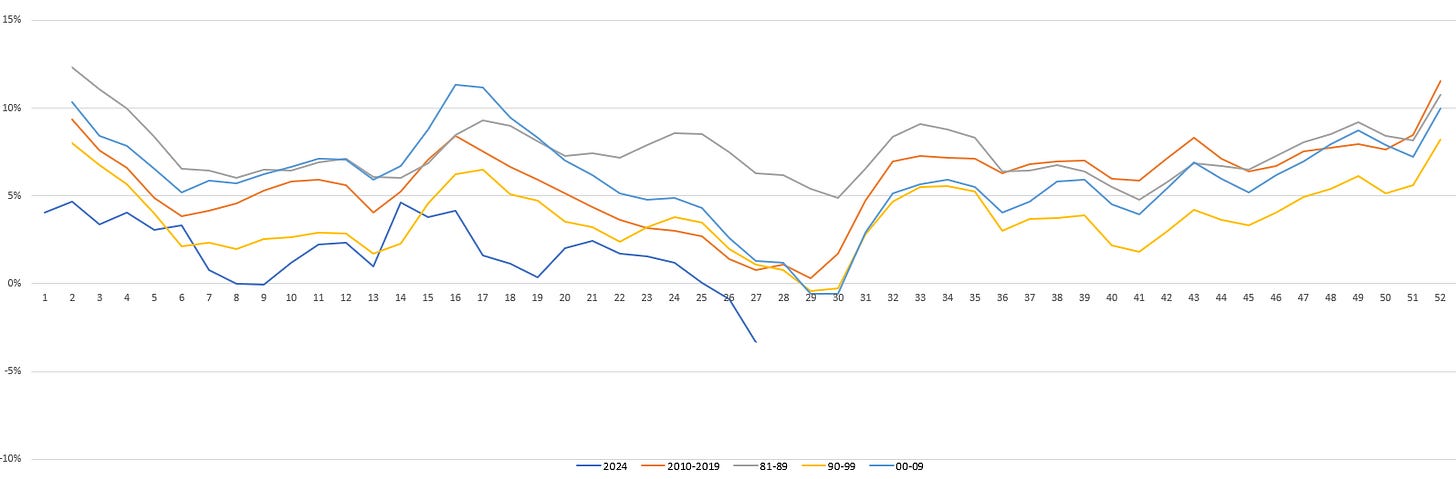

Looking at the money supply on a 13-week annualized basis shows trouble ahead.

Prior to 2020, if the money supply ran this far below trend, capital markets would tighten up. There would be a flight to the safety of the dollar and bonds.

So far, this doesn’t seem to be the case. At the same time, investors continue to deploy margin debt to own stocks.

Is there enough liquidity in the system to keep the game going?

Can the markets wait two more months before the Fed decides to cut? July’s meeting wraps up tomorrow. Would an announcement tomorrow of a cut spook the markets? What if the Fed announced an emergency cut before the September meeting? Is the Fed stuck whether they cut or not? My theory from the beginning was that the Fed was going to be slow to cut rates. The shadow of the failure of the 1970s hangs over them.

Currently the CME’s FedWatch tool shows a 100% chance of a cut in September. Will September be too late for the Fed to cut rates and relieve some of the pressure on capital markets?