Facebook announced earnings after close yesterday. To say it was a disappointment to their shareholders would be an understatement. FB is down over 25% from yesterday’s close. This will be a big hit to Mark Zuckerberg’s net worth. He reportedly holds 400 million shares. That would equal a drawdown of over $30 billion (now I don’t feel so bad losing money every once-in-a-while). A big part of this selloff was due to the fact that FB is no longer growing their user count. In fact, they are losing users. They’ve hit a wall. When a growth company hits a wall like this, it has two options; evolve or die.

This caught me by surprise. I’ve been talking about the rotation from growth to value for a little over a month. If you’ve been paying attention, companies like Peloton, Fastly, Teladoc, and the like, all regularly burn through massive amounts of their shareholder’s cash. They regularly have negative earnings per share. Shareholders are growing weary of the promise of further growth and rotating out of these companies. It has been a steady trip lower for many of them. However, Facebook actually earns money for their shareholders. Their trailing 12-month earnings is $13.97/share. This makes their current P/E ratio roughly 17. I would have never guessed that we would see this violent of a rotation from such a high profile company, especially one that makes it’s shareholders money.

This goes to show how strong the rotation out of tech is getting. I feel this is over-done. Sure companies that regularly burn through copious amounts of cash should be rewarded with lower share prices but a company that makes money, they shouldn’t see this kind of a sell-off. We could be witnessing a big margin call and margin debt is sky high. It would not take much to see it reverse.

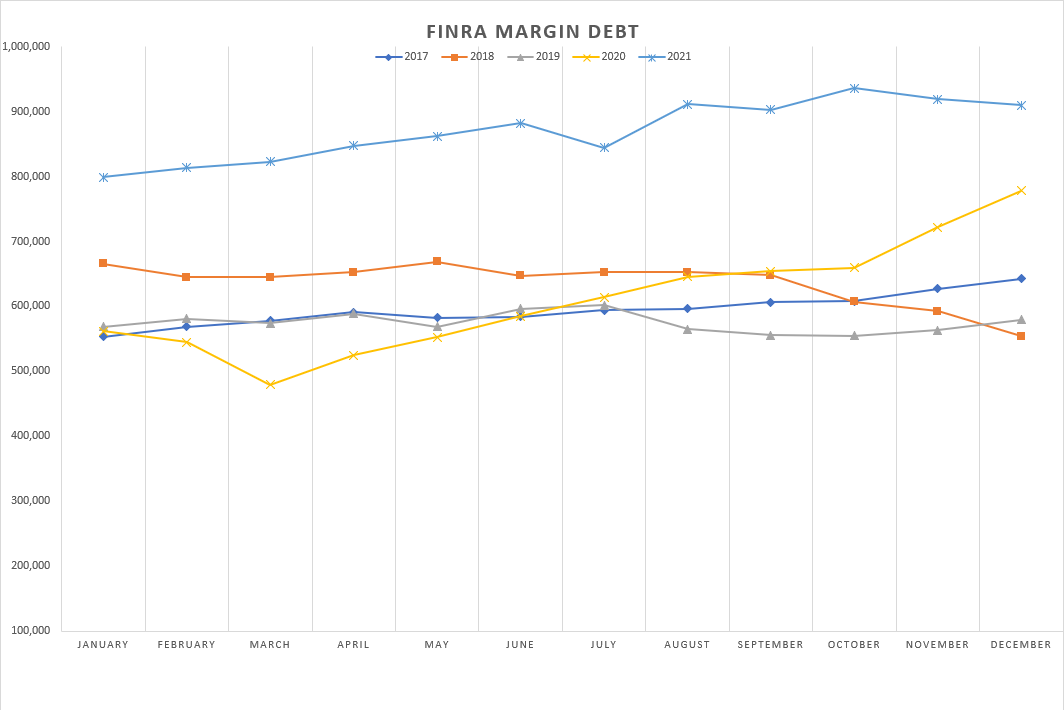

We saw a peak of margin debt use in October at $936 billion. November was slightly lower at $916 billion. Then December came in lower yet at $910 billion. Meanwhile, traders are raising their cash balances.

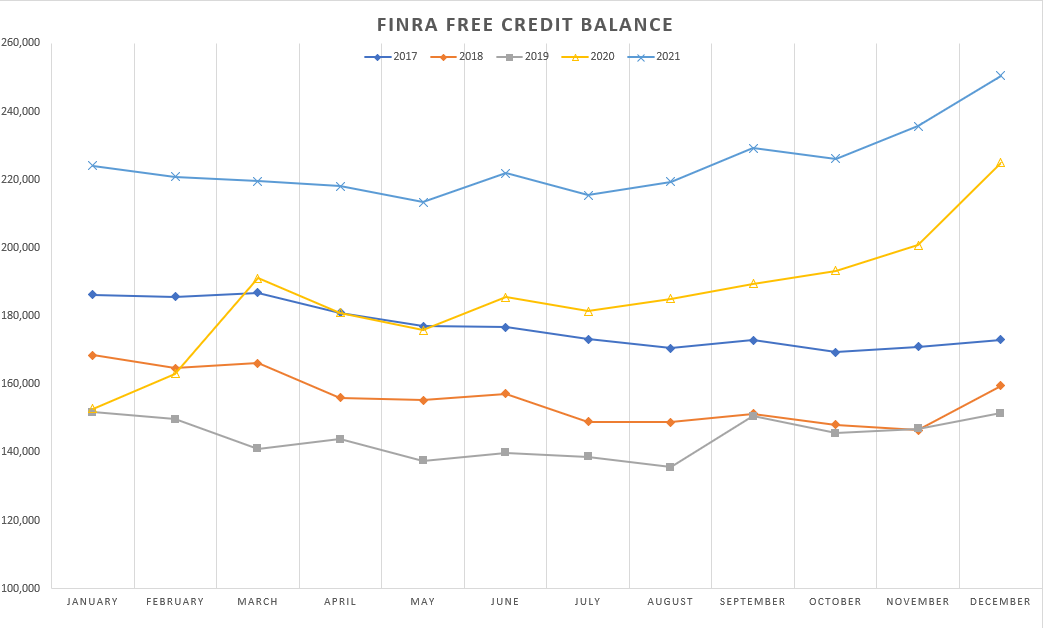

That is a whole lot of money ($250 billion to be exact) looking for a place to be put to work.

If the recent drawdown in the stock market is the result of traders selling their margin holdings and raising their cash balances, we could continue to see more choppy days for the general stock market. There is plenty of cash sloshing around to push the market to new highs, but if traders are nervous about the future, they won’t put those funds to work. When those funds do come rushing in, we could be in for a wild ride higher.

Recently, Macro Ops put out a piece on position sizing and drawdowns. I highly recommend it. He has great advice on weathering drawdown storms which come in three forms:

Your method is temporarily misaligned with market conditions

Your edge is eroding and you need to adapt

You’re making trades outside of your expertise or normal process

I find it immensely important to have a plan and stick to it. Different holdings may require different plans. I set dollar limit thresholds for all my holdings. I plan out how much of a loss I can tolerate and analyze at what point it will hit that threshold. Once a position moves against me to a certain dollar amount, I begin to cut it back. Once it begins to move favorably for me, I add to it. Here is an example of my analysis:

The pain tolerance threshold, in this example, is set at roughly $1k. That means if I were to put $10k into an investment, I would be able to tolerate up to a 10% loss before I would begin to sell. This would be fine for a steady, non-volatile investment, like my ZIM holdings. For something more volatile, like my option holdings or UUUU shares, I would give myself a bigger buffer. I would want to only put $3-5k to work because I could tolerate a bigger percentage loss (20-35%) before it hit my sell threshold.

These numbers are all made-up but the theory holds the same. Everybody should find their pain tolerance level and calibrate their investment portfolio appropriately. If margin use continues to deteriorate, we could be encountering a drawdown storm and you’ll need to be prepared to act accordingly.