OPEC’s recent announcement has many focused on oil but something funny happened in the coal market recently.

Coal has been beaten down since the beginning of the year. Now there have been two announcements related to coal. The first is that coal burning capacity increased by 1% in 2022.

The coal fleet grew by 19.5 gigawatts last year, enough to light up around 15 million homes, with nearly all newly commissioned coal projects in China, according to a report by Global Energy Monitor, an organization that tracks a variety of energy projects around the globe.

New coal plants were added in 14 countries and eight countries announced new coal projects. China, India, Indonesia, Turkey and Zimbabwe were the only countries that both added new coal plants and announced new projects. China accounted for 92% of all new coal project announcements.

The second also comes out of China.

China’s proven coking coal reserves can hardly meet the demand for maintaining the country’s long-term economic stability at current consumption levels, said Guo Lijuan, Deputy Director of Sales and Trade Service Center of Shanxi Coking Coal group.

As a reminder, there are two types of coal; coking coal and thermal coal. Coking coal is used to make steel. Thermal coal is used to create energy. For China to be concerned about coking coal means they are concerned about their ability to make steel. This should be highly concerning to the US especially since the US has been increasingly belligerent towards China. Now Xi won’t return Biden’s phone calls, Blinken can’t schedule a visit, and China wants to inspect ships in the Taiwan Strait.

This seems to be a lead up to China exercising it’s authority on the world stage. They’ve been working on peace and trade deals throughout Asia and they are tired of the US neocon’s attitude. I expect the policy towards China to be a big component of the 2024 elections. Another component will be the economy, specifically jobs.

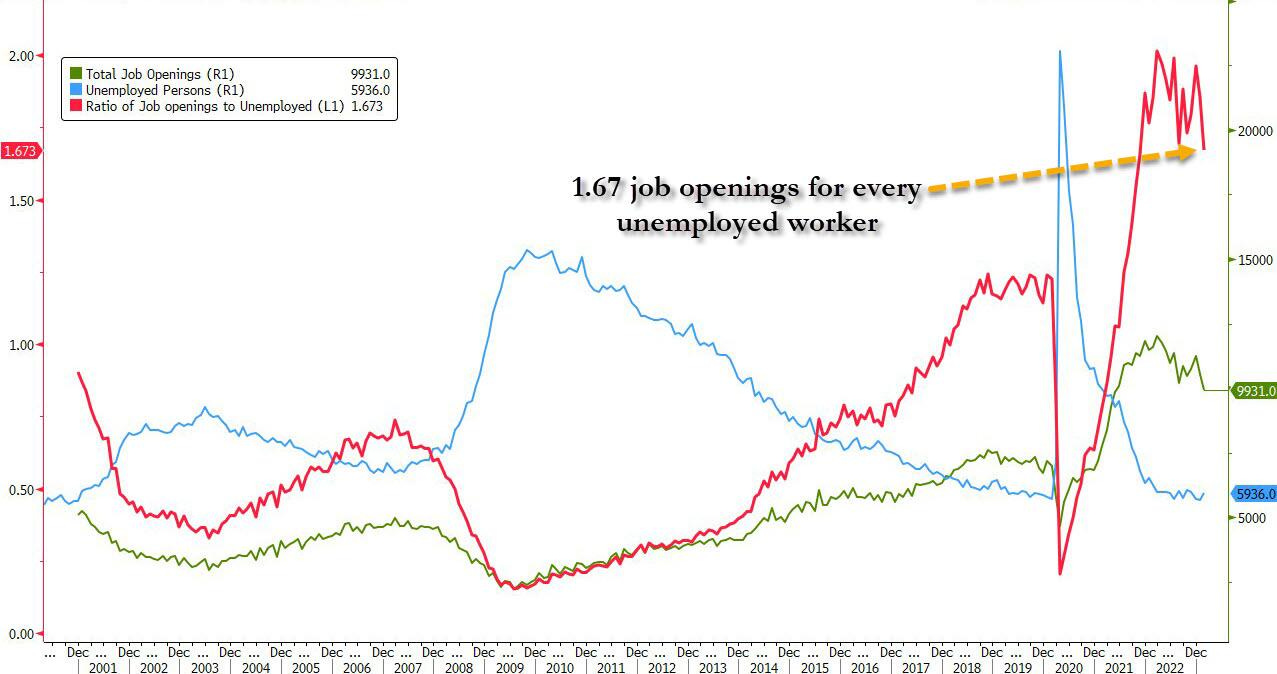

The JOLTs report came out earlier this week and it showed a pretty significant decline in job openings.

According to Nick Timiraos,

“The number of job openings ticked down to 9.9 million in February, the lowest since May 2021 The ratio of vacancies to unemployed workers fell to 1.67, the lowest since late 2021”

Above chart courtesy of Zerohedge.

Liz Warren has been attempting to blame the Fed for any upcoming increase in the unemployment rate. So far, we have seen a deflating labor market. There have been many company’s announcing downsizing efforts, with the latest being FedEx. I don’t think it is time to get too excited about job data yet. This is obviously not a good trend but we have been in a tight labor market for some time now. Tomorrow we see the employment situation report and it should paint a clearer picture.

Finally I want to address JPMorgan CEO Jamie Dimon’s shareholder letter that he put out this week. You can read it in its entirety here: JPMorgan Chase & Co Annual Report.

Speaking about SVB and Credit Suisse:

As I write this letter, the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come. But importantly, recent events are nothing like what occurred during the 2008 global financial crisis (which barely affected regional banks)…

This current banking crisis involves far fewer financial players and fewer issues that need to be resolved.

We want to strengthen regional, midsized and community banks, which are essential to the American economic system.

If one of the smartest men in the world wants there to be regional banks, there will be regional banks. At some point it’ll be time to buy in to a strong regional bank (or banks). I would find it prudent to continue to comb through these publicly traded banks to find the strong ones that have been “thrown out with the bath water”.

Higher fiscal spending, higher debt to gross domestic product (GDP), higher investment spend in general (including climate spending), higher energy costs and the inflationary effect of trade adjustments all lead me to believe that we may have gone from a savings glut to scarce capital and may be headed to higher inflation and higher interest rates than in the immediate past.

If we have higher inflation for longer, the Fed may be forced to increase rates higher than people expect despite the recent bank crisis. Also, QT may have ongoing impacts that might, over time, be another force, pushing longer-term rates higher than currently envisioned. This may occur even if we have a mild – or not-so-mild – recession, as we saw in the 1970s and 1980s.

Today’s inverted yield curve implies that we are going into a recession. As someone once said, an inverted yield curve like this is “eight for eight” in predicting a recession in the next 12 months. However, it may not be true this time because of the enormous effect of QT. As previously stated, longer-term rates are not necessarily controlled by central banks, and it is possible that the inversion we see today is still driven by prior QE and not the dramatic change in supply and demand that is going to take place in the future.

Its a long read. Some parts are extremely profound.

Grant's Interest Rate Observer agrees with you about the regional banks. Just yesterday they came out as bullish on the preferred shares of PacWest Bancorp and Western Alliance Bancorporation.