The New York Federal Reserve Bank released their Survey of Consumer Expectations data. In it they poll people about their inflation expectations. Typically, the Fed uses this data to state that inflation expectations are well anchored.

Well anchored at 6%! December data for 1-year ahead data came in flat at 6%. This was the same figure for November’s data release. 3-year expectations moved down slightly from 4.2% to 4.0%.

The rest of the data is a mixed bag.

Expectations of price changes in gas were down from 9.2% to 5.7%. Food price changes are also down from 9.2% to 7.8%. Rent continues to hold at 10%. Gold also is a steady-eddy staying just under 5%.

Something to keep in mind is that this is what the herd is expecting. It is not what will happen. Just take a look at the herd’s home price change expectations.

This is nowhere near reality.

The herd has been below the actual home price inflation for almost the entire history of the survey.

It is important to know what the herd is thinking. You always want to stay a step or two ahead of them but know that they are typically late to the party. Also, they are plagued with recency bias. This is a cognitive bias that favors recent events over historic ones. It means that when the gas prices recently leveled off, the consumer expected this to continue into the future.

As inflation stays persistently high, the herd will raise their expectations of future inflation. Soon this can become a self-perpetuating cycle. If the Fed wants to maintain what little control they have, they’ll need to step in before that happens. They may not say it publicly but their eyes are glued to these expectations from consumers. If these surveys start increasing again, expect more jaw flapping from the Fed in an attempt to lower them.

State of the Economy

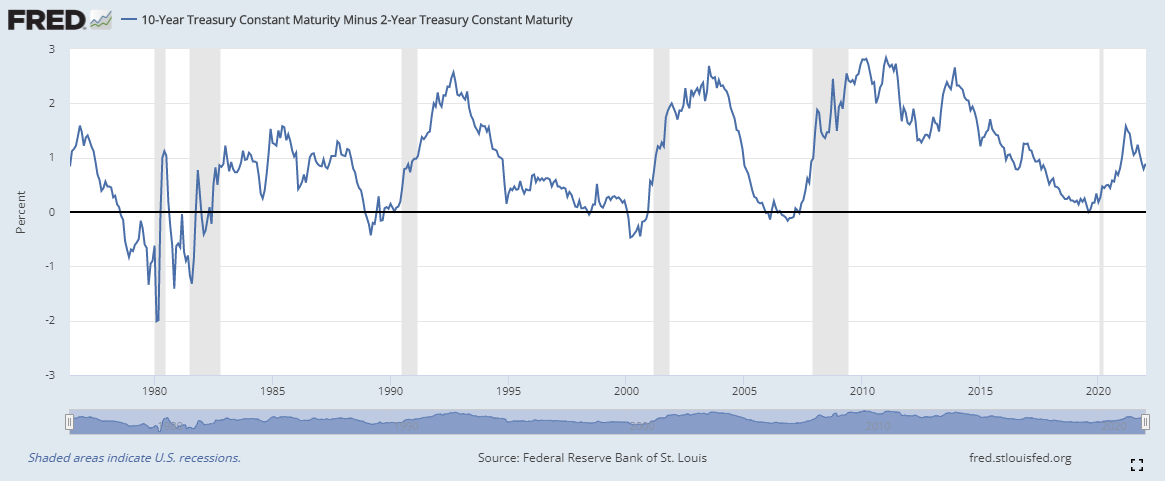

After a sharp drop-off to close out the year, the 10-year minus the 2-year has rebounded slightly. The yield curve is an important indicator when it comes to analyzing the economy. When it is in positive territory, banks are able to lend money at a profit. Banks lend money by borrowing at the short-term rate and lending at the long-term rate. The difference is their profit. As interest rates rise, the long-end of the curve is expected to rise quicker than the short-end. As this spread widens, banks will be able to generate some big profits. This is the foundation of my thesis that bank stocks should outperform the market. I’m currently holding JPM and am considering adding BAC.

At 89 basis points, the 10-year minus the 2-year is a long way from going negative. If this were to happen, a recession would be expected as it has occurred every time since 1980.

Some traders use the 10-year minus the 3-month treasury as an indicator. It is also showing the economy in an expansive mode.

The 10-year minus the 3-month didn’t show as dramatic a drop at year-end as the 10v2 did.

Both of these indicate that we are nowhere near a recession. We are still in very positive territory and the current fear gripping the market should be seen as a buying opportunity.

In addition to the yield curve, the M2 report and margin use are the components of my “big 3”. These are the 3 most important indicators that influence my investing decisions.

The last M2 report was at the end of December.

It continues to show strong money growth. When money growth slows, that is when we would expect to see the market wobble and possibly tumble.

As I had indicated in my last report on the M2, 2021 was well above average but lower than the absurd 2020 year.

On top of the yield curve and M2, is margin debt.

Margin debt has leveled off. I expect to see December’s figures later this week or early next week. A leveling of the margin debt isn’t worrisome. The big concern is when this starts to drop. You can see the big four-month drop that occurred in 2018. This coincided with a big drop in the S&P500.

Similarly, the M2 was below trend and dragging bottom. Both of these factors combine to reduce liquidity in the market causing a selloff. Right now, I see neither of these factors showing an imminent market correction.

Investors have let the fear of the Fed tightening influence their day-to-day trading patterns. It has made them cautious of the future and all the market does is discount the future to the present. I expect this downward market pressure to be temporary but that market volatility will continue to persist.