The Fed wrapped up their two day meeting yesterday with a press conference. The big announcement was that the Fed Funds Rate is going to get increased by 25 basis points. This means the Fed will hold the rate between .25% and .50%. This announcement shocked no one who has been paying attention. It is an incredibly paltry increase and shows that the Fed is not serious about inflation. Many in the Eccles Building still think inflation is going to go away all on it’s own. I’ve explained before why this is dangerous thinking. It goes back to the Arthur Burns days at the Fed in which we are doomed to repeat.

They still believe that the inflation we are seeing is due to “supply and demand imbalances”. This is Fed speak for bottlenecks in the economy. However, the next leg higher in inflation was plainly stated by none other that Vladimir Putin. During an address yesterday, Putin laid out exactly what has happened in the financial world. He was frustrated by the restriction on currency reserves owned by the Bank of Russia but held in foreign countries. In fact he called it a default.

“The illegitimate freezing of some of the currency reserves of the Bank of Russia marks the end of the reliability of so-called first-class assets. In fact, the US and the EU have defaulted on their obligations to Russia. Now everybody knows that financial reserves can simply be stolen. And many countries in the immediate future may begin – I am sure this is what will happen – to convert their paper and digital assets into real reserves of raw materials, land, food, gold and other real assets which will only result in more shortages in these markets.”

Putin lays out the obvious. Countries worried about the US retaliating against them will pull their currency reserves and buy hard assets. This is bad news for the SWIFT system and bad news on inflation.

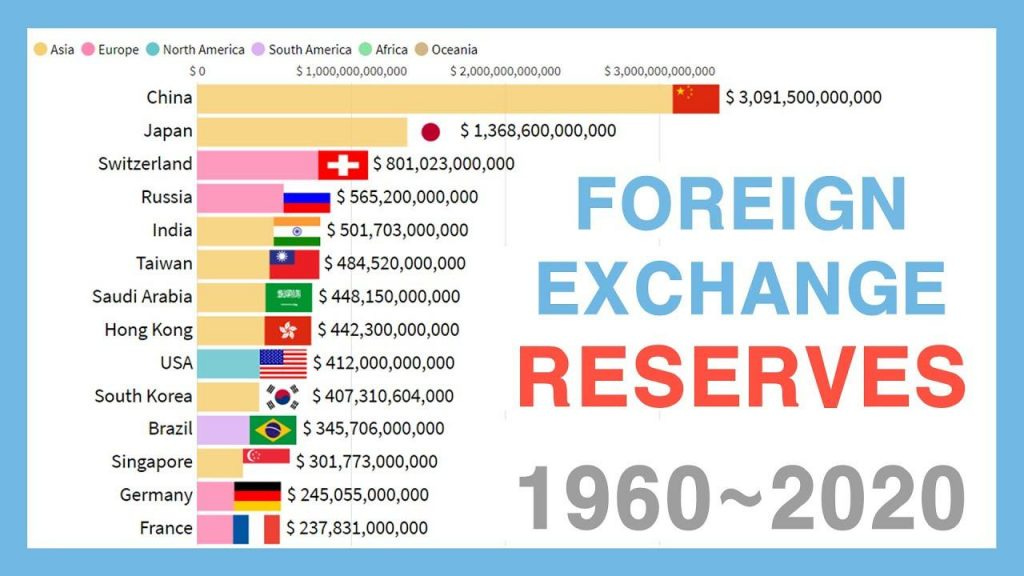

Granted the above chart is a little old but I believe it is close enough to realize the magnitude of the mad dash for hard assets. I think the countries to watch closely are China, India, and Saudi Arabia. I believe these would be the countries, along with Russia, who will begin to pull their reserves and use them to buy hard assets, like gold. For a country like Saudi Arabia, buying food is a no brainer. They’ve been doing it for years to keep their populace complacent. Now that they may run afoul of the US by dealing with Russia, they will be motivated further to increase their purchases and put some of their reserves to use. For China, if there is a big drain on these reserves, expect an invasion of Taiwan to be none-too-far behind.

When countries begin to compete for hard assets, the bidding war will become very intense. Their budget to buy goods is very large. In addition, nationalization of resources could become common place. We’ve already seen this, to an extent, when it comes to fertilizer and grain exports. The list of countries that are banning grain exports is growing. Russia had already made an announcement but now Hungary has realized what is coming down the pike. China has also placed restrictions on fertilizer exports. I imagine the first gold or silver mine nationalization will send the price much higher as other countries then begin to follow suit.

To me, this signals the end of the globalization of the world economy. This globalization was a big reason inflation was so subdued for so long. Even in 2008 when massive amounts of money were printed to paper over the losses on bank balance sheets, inflation was scarce. This is because the economy was continuing to get more efficient. Economic efficiency can cover a multitude of money printing. With the era of globalization coming to an end, this means that the multitude of money printing will readily be exposed as inflationary. Markets become less efficient when capital isn’t allowed to flow where it can be utilized at its maximum.

With the combination of these two factors (countries bidding on hard assets and the end of globalization), inflation will find the next leg higher. It causes this 25 basis point increase from the Fed to be completely underwhelming for what lies ahead. On top of that, we are starting down the barrel of a stagnating or recessionary economy. Coupled with inflation this is the recipe for stagflation. This is the trap that Keynesians can’t figure out. The answer eludes them. The followers of the latest junk economic science, MMT, won’t have a solution for it either.

The Fed has also begun to hint at a reduction of their nearly $9 trillion balance sheet. The timing for this announcement could come as early as May. The end of the taper has caused the return of market volatility. Reduction of the Fed’s balance sheet will only exacerbate the issue. Powell hinted that additional details for balance sheet runoff will be outlined in the meeting minutes which are set to be released in three weeks. Expect this to be a market moving event.

Finally, on the margin data front, FINRA posted the latest figures.

After a substantial drop in margin use, it gained slightly in February. Here are the last eight months’ worth of figures:

After a big scare to finish the year, investors are taking a more steady approach. However, their reduced use of margin has coincided with a steady increase in their free credit balance.

This is the true measure of cash on the sidelines. It has been on a streak since May of 2020. Investors continue to pile high their funds for a good opportunity. I anticipate that at some point, this money will come back into use. In 2017 and 2018, it was a steady trickle. This time around, once asset managers feel comfortable putting these funds to use, it could be much more pronounced.

These explanations are so enlightening! Terrific job!

The Chinese reserves were run up in a relatively short time period, from 2000 to 2014 which is widely recognised as their mercantile approach to trade with the US. Then the reserves reduced at roughly the same rate but this process appeared to stop in 2017. China to some degree neutralised the inflationary effects of QE.

What is interesting to my mind is that from 2017 you would imagine that with 3 trillion glut from the Fed during Covid some of that must end up in China right? But it hasn't. The fact that they didn't end up in China while US citizens are still happily purchasing the iphones must mean that these reserves are -already- being slowly run down. The blizzard of covid dollars didn't go into China so must be actively but calmly divesting dollars.

I personally wonder if history will show that the dollar has already ended in its role as reserve currency and we are in the same run-off period that the Brisith experienced.