This week was employment data week in the US. Wednesday saw the JOLTs data, Thursday was the ADP report, and today was the Employment Situation report.

Starting with the JOLTs, job openings continued their downtrend. Openings peaked in March of ‘22 and have been sliding ever since.

We still have a big buffer between job openings and unemployed workers. The current spread is 1.7 job openings for every unemployed worker. This makes the labor market very tight

and will continue to put upward pressure on wages.

The ADP report provided much better detail to what exactly is taking place. It showed that the service industry was strong (especially leisure and hospitality). From Trading Economics take;

Service providers added 213K led by leisure and hospitality (123K), professional and business services (52K) and education and health services (42K). The goods-producing sector increased by 22K, led by construction (41K). On the other hand, job losses were seen for trade, transportation and utilities (-24K), natural resources and mining (-14K), financial activities (-12K) and manufacturing (-5K).

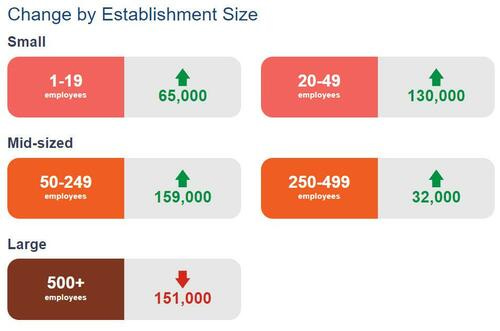

It also showed that small and mid-sized companies were the ones that did the bulk of the hiring.

I believe that this can be attributed to the 4th quarter holiday season. More people typically travel, eat out, and shop in the 4th quarter. This accounts for the large jump in leisure and hospitality hires as well as the increase coming from small and mid-sized businesses. The ADP chief economist had this to say about the data:

There is change afoot in the labor market. The big companies are realizing that they’ve taken on too many people who aren’t providing enough value to keep on board. I see it as a sign that ESG/DEI could be coming to an end. Those that were hired not because of their competence but because of something else are being exposed as not adding value to the company’s bottom line. If you aren’t adding value to the company, you won’t be sticking around for very long. Elon has shown this in spades at Twitter. He has cut a tremendous amount of people and twitter continues to function. I believe other companies are catching on.

The Employment Situation report from the BLS came out today. The big headline here was the unemployment number of 3.5%. This is the third time in the past year that we’ve hit 3.5% unemployed. This is quite an amazing feat. Prior to this past year, 3.5% was hit 3 times in the past 10 years. The long term average for unemployment is 5.7%.

In addition, average hourly earnings continue to increase at an above average rate.

However, not everything is coming up roses in this report. We saw a big down tick in the amount of hours worked.

With wages up but hours down, employees may be treading water here.

Nevertheless, the market rallied on this last report. Which I find strange. There is nothing in this report that makes me think the Fed is going to pivot. In fact, this week the FOMC released the latest meeting minutes which should have made clear to everyone that the Fed does not want to cut rates in 2023.

“Regarding the outlook for monetary policy, both market- and Desk survey-based measures indicated expectations for the Committee to maintain elevated policy rates through 2023.”

“With inflation staying persistently above the Committee's 2 percent goal and the labor market remaining very tight, all participants had raised their assessment of the appropriate path of the federal funds rate relative to their assessment at the time of the September meeting. No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time.”

The bold is mine.

The Fed was slow to react to inflation on the way up. It would only make sense that they would also be slow to react to inflation on the way down.

Next week sees the following releases/events;

Monday - Consumer Credit data

Tuesday - Powell Speaks on “Central Bank Independence” in Sweden

Thursday - Consumer Price Index

Friday - Michigan Consumer Sentiment Survey