During yesterday’s session, oil (specifically WTI trading under /CL) proceeded to lose 5%. This is an extreme move for oil. Something like a 4+ sigma move in fact. I noticed that people were very confused about how this could happen. In truth, this means very little to me. If anything, it makes me more bullish on oil. The biggest down days typically happen in a bull market. The key to remember here is the capex cycle.

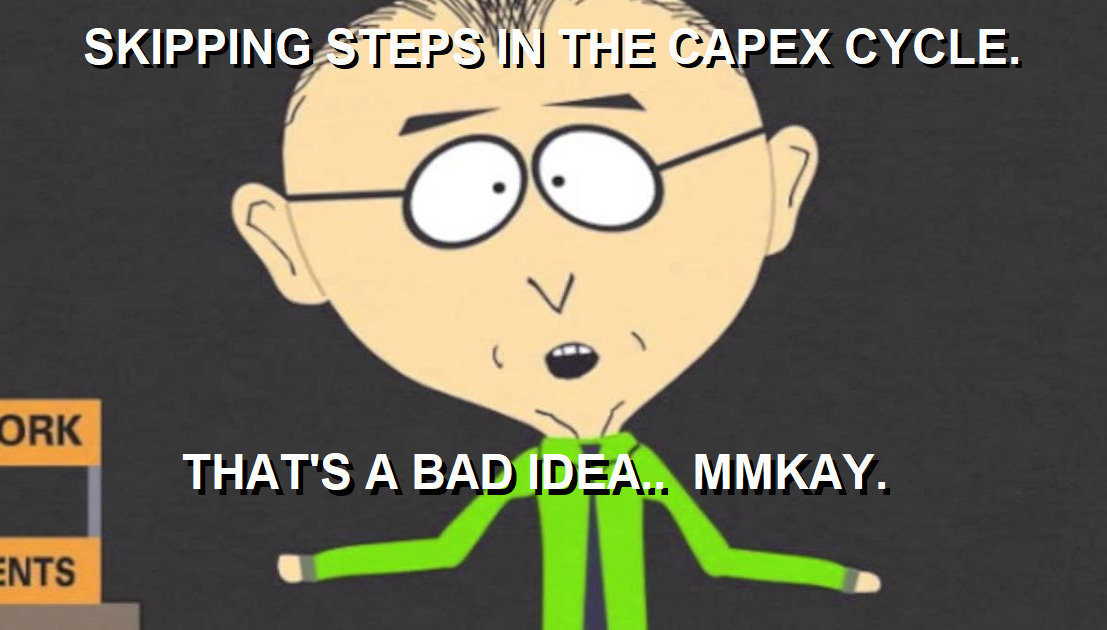

In the classic sense, the capex cycle goes something like this:

shortage of product leads to higher prices

higher prices leads to increased development spending

increased development leads to over abundance

over abundance leads to lower prices

lower prices leads to company bankruptcies

fewer companies leads to less product produced

less product means shortages…

and then the cycle repeats.

This time around, we’ve skipped a few steps. There has been no real increased development, there is no over abundance. Yet we are seeing lower prices. I believe that this is a false move in the commodity supercycle. What we are really witnessing with lower prices at this stage is manipulation and panic.

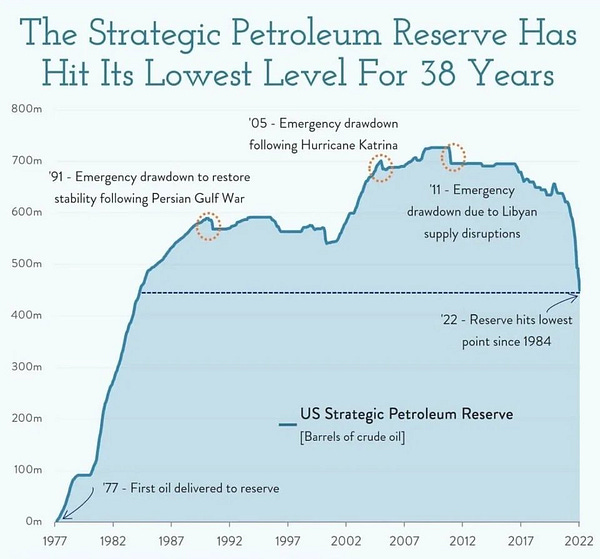

The SPR releases have been dramatic to say the least. Even with these extreme releases from the reserve, oil prices are still hanging in. We have never, in the history of the SPR, released this much oil this fast. Yet, the price of oil has not plunged. The draining of the SPR is scheduled to end this fall. I expect it to happen near the end of October. Just in time for the mid-term elections.

At the same time, investors are panicking that a global recession is going to crush demand for oil. However, the increased development phase of the cycle was skipped. We are lacking in supply. Now we see oil companies lowering the production growth.

Even without the SPR replenishing and a global recession, oil will resume it’s rise. A lack of new well development will cause us to quickly find ourselves back on the capex/commodity supercycle.

We are still in the early stages of climbing this rollercoaster. In fact, it looks like we started, then got pulled back in to the station. It seems like a great time for more people to get on.

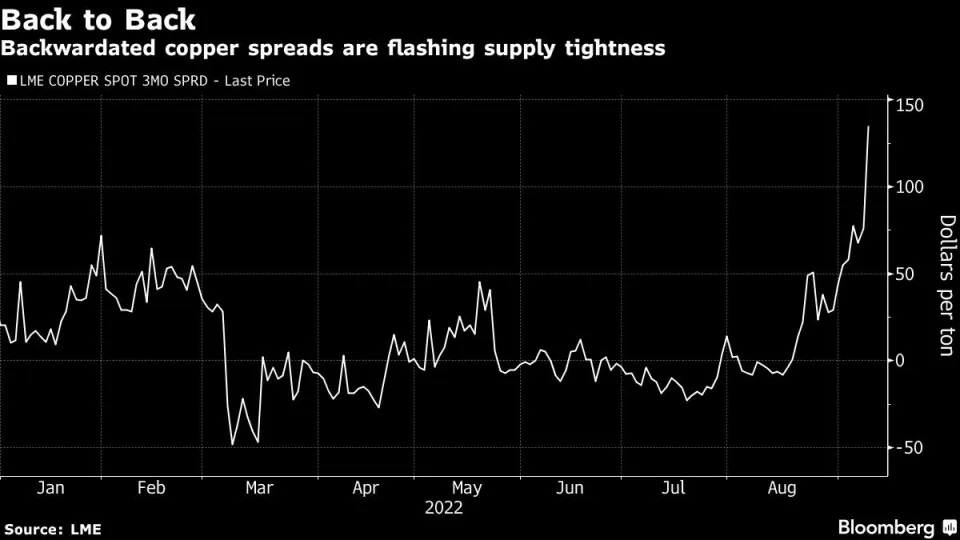

The interesting thing about this cycle is that it isn’t only oil. We are seeing this in copper and silver too.

Paulo’s long term graph shows a large drawdown.

This is leading to increased backwardation in the copper market. Supply is getting really tight. In time, this is going to cause prices to take-off.

The premium for cash copper over three-month futures on the London Metal Exchange rose by as much as 91% on Thursday to a high of $145 per ton, an indication the market is paying more for units right now. That’s the biggest backwardation since November last year.

Funds have historically bought and sold copper futures as a proxy for global growth, and the metal has declined 20% this year on fears over a recession. Still, the underlying physical market is robust, with Chinese copper imports ticking higher, while top producer Chile said exports were at a 19-month low. Copper climbed as much as 2.4% on the LME, the most in almost five weeks.

Recession fears have held back capital expenditures.

“Financial demand for oil” is “non-existent”. This means those swing traders and momentum speculators are out of the game. They took their profits and are on the sidelines. Once this begins to turn, I expect them to plunge back in for round two.

Supply constraints such as these are a recipe for much higher prices over an extended period of time. I spelled this out with very plainly in my energy thesis.

Skipping the “increased development” phase of the capex cycle is a bad idea and will cause serious pain. The amount of time it takes to bring a new development online will take time. The market is not prepared for this.