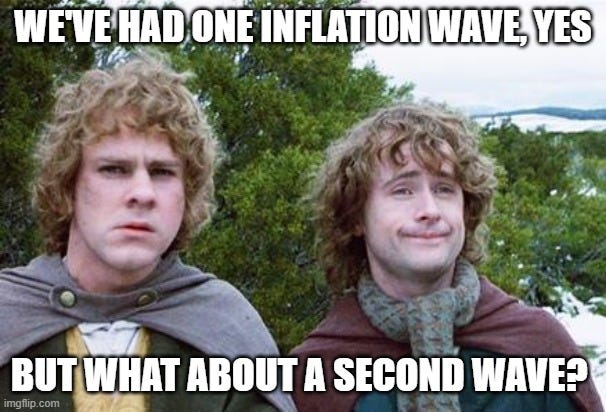

The Consumer Price Index was released this morning and it came in higher than last month’s reading.

Headline CPI came in at 3.3% year-over-year and the core came in at 4.7% year-over-year.

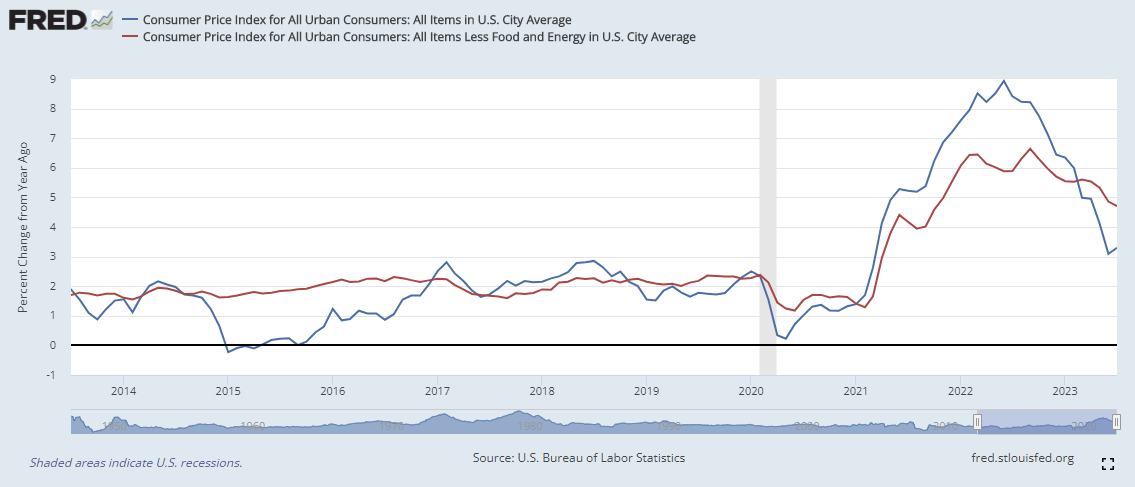

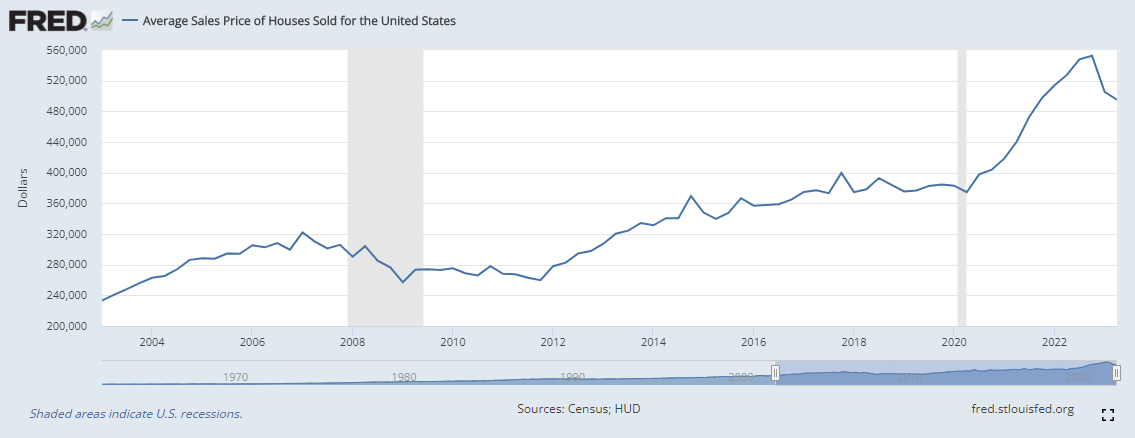

The reaction on Wall Street is very telling. It looks like many see this print as a bump in the disinflation road and I largely don’t blame them for thinking this. We are seeing a big roll-over in housing prices

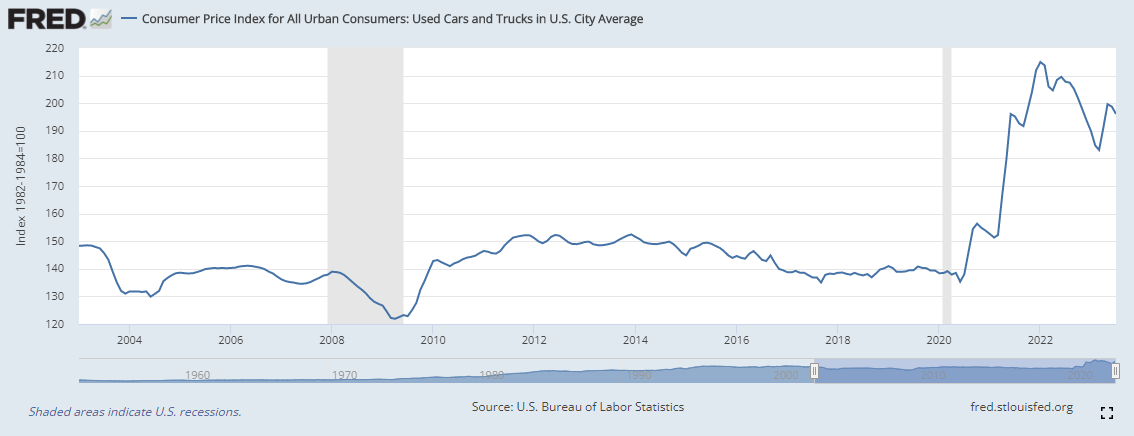

and the beginning of the roll-over in used car prices.

These two have been hotly watched as they have a big influence in the core portion of the CPI.

Another tell that traders think this rise in the CPI is a one-off on the way to lower numbers is that the markets broadly rallied on the CPI news. The real rate curve steepened while breakevens were little changed. In addition, the market continues to largely discount an increase of the Fed Funds Rate through the end of the year.

If traders truly believed that inflation was over, this report should have been a big buy signal for longer duration bonds (like the 30 year treasury). Keep an eye on the long-end of the treasury curve over the next few days to see if the disinflation trade holds up. My belief is that it won’t.

We won’t have to wait long to find out. Treasury Secretary Janet Yellen is selling long-bonds today. $23B worth. If you think that is a lot, next week she is selling $191B worth of short dated bonds (13 week, 26 week, and 42 day). I feel she is dipping her toe in the water here to see if the coast is clear. My feeling is that she cut a deal with the Chinese so they would buy up some of these bonds to keep yields low. We’ll see if it pays off.

I believe that a second wave is coming largely due to commodity cost-push inflation. We’ve invested very little in new mine development for essential metals like copper or tin. A bigger worry is oil. Oil field development and oil rig counts are on the decline.

Oil is going to get very tight. We’ve already seen 7 consecutive weeks of higher oil prices. This will get reflected in the headline CPI number next month. Higher oil prices eventually translate to higher costs for goods and services.

Tomorrow is the PPI data release as well as the Baker Hughes oil rig count.

Then next week we see the following data points:

Monday - Consumer Inflation expectations

Tuesday - Retail Sales

Wednesday - Housing starts and building permits, FOMC meeting minutes

I just read that $8.6B of those bonds were bought by the Federal Reserve.

https://twitter.com/JoeConsorti/status/1689718118489182208

That seems like.... well... you know...