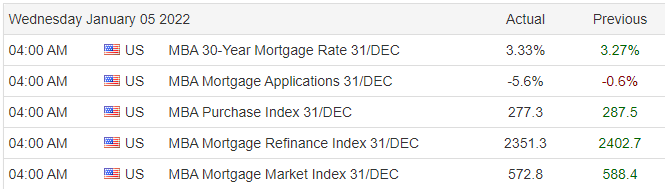

Home prices continue their march higher even as first-time buyers have been priced out of the market. Now the middle class is getting priced out of the market. We are beginning to see this in the MBA Mortgage data that was released today.

We are seeing this especially in the past years’ worth of mortgage application data.

There was a big push in the summer to apply for mortgages. Real estate is a seasonal business, so this spike makes sense. Into the later summer and fall, mortgage application rates have been dropping ever since. However, the housing boom must go on. Wall Street banks are going to sustained it.

Wall Street is pouring money into real estate and won’t be stopping any time soon. Real estate is how they are going to hedge against inflation. They aren’t buying up properties to remodel and resell. They are looking to rent them out. These banks will be the new land barons.

Home prices are too high for the majority of buyers. In addition, we are facing rising interest rates but it doesn’t matter because Wall Street is too greedy. Wall Street will more than make up for any buyers that get discouraged and leave the market. These big banks see the inflationary wave that is crashing all around us. They don’t believe in holding gold and silver because it doesn’t offer them a return on investment. Gold pays no dividends, silver has no quarterly reports. They see precious metals as only helping you tread the inflationary waters. They want to swim like sharks through this inflation and the way they do that is by buying real estate and earning a return on it by renting it out.

This is putting a serious floor under all things housing. Lumber prices are sky high. You can’t find a contractor to save your life. Copper, PVC both are under heavy buying pressure. I’ve got two buddies who are contractors. Typically business drops off in the winter time but they have never been busier. This sector is absolutely on fire and shows no signs of slowing down. When the Case-Shiller Home Price index gets posted at the end of the month, I expect it to continue to reflect the current hot streak that we are seeing in this market. It may wobble slightly but there is no doubt in my mind that we will see it continue to rise in the months to come.

The above may be how Canadians protest but things get a little more heated in Kazakhstan.

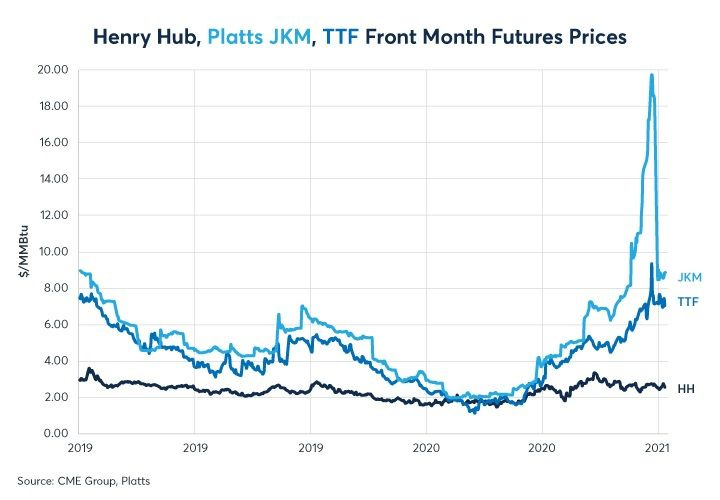

These protests have bubbled to the surface due to rising energy prices. The price per liter of Liquified Natural Gas (LNG) went from $0.12-$0.14 cents to $0.28 cents. This doubling of energy prices is a repercussion of Europe’s energy struggle. LNG is now going to Europe, en mass, due to the inflated prices. There is an arbitrage playing out and producers are taking advantage of it. This is creating blow-back in other nations as supply goes to where it will fetch the greatest return.

This has now lead to a full-blown attempt at a government overthrow. Multiple public and government buildings are burning or have been burned. Local news in Kazakhstan has now reported that the presidential residence in the country’s largest city is engulfed in flames. This has serious repercussions on the uranium market.

These are 2019 figures but they have not changed to a high degree. Kazakhstan produces over 40% of the world’s uranium production. If Kazakhstan were to have an uprising which shut down the government, business, and logistics, uranium could get very scarce. This is why we are seeing a serious run-up in all uranium producers right now.

This is an active case study. It is important to see what happens in Kazakhstan because these protests will not be isolated to countries that most American’s can’t find on a map. Rising food and energy prices fuel anti-government rhetoric and uprisings. We saw this during the “Arab Spring” which was caused by rising food prices. We will see this again. Expect multiple countries to face difficult decisions as food and fuel get more expensive. Many countries could move towards harmful policies that restrict the movement of essentials in an attempt to keep prices stable. In addition, the media will do a poor job at covering these protests. They won’t expose the cause of rising prices nor will they have kind words for most of those protesting. Unless these protest groups focus on pet topics that the media is friendly to, expect obfuscation and outright lies to proliferate. The revolution will not be televised.