Federal Reserve Chairman Jerome Powell held a press conference today at the conclusion of the Federal Open Market Committee (FOMC) meeting. The FOMC put out a press release prior to it. You can read the entirety of the press release here. During the press conference, Powell talked up the economy’s progress. He also highlighted the difficulties of employers to hire workers.

On the inflation front, he acknowledged that inflation was above the long-term goals of the Fed. He commented that inflation had exceeded 2 percent “for some time”. This could be a hint that the Fed feels that inflation needs to be controlled before it gets out of hand. The Fed has revised it’s inflation forecasts up to 2.6% by the end of next year. Jerome went on to say;

“We understand high inflation imposes significant hardship, especially on those least able to meet the high cost of essentials like food, housing, and transportation. We are committed to our price stability goal. We will use our tools both to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.”

Even though Powell made this acknowledgement and the Fed has revised it’s projections, they are still blaming this inflation on “supply and demand imbalances”. Essentially, this is the idea that the inflation is due to bottlenecks in the economy. This is similar to Arthur Burns’ statement about how high food prices were due to fertilizer prices going up. These are dangerous parallels. It tells me the Fed still has it’s head in the sand.

Also, Powell confirmed the rumor that the pace of the taper has doubled. This now puts the Fed on track to finish the tapering of their asset purchases by March. Powell comforted traders by letting them know that he has no plans to shrink the central bank’s balance sheet by selling the Treasuries and mortgage-backed securities it has accumulated.

This was what the market needed to hear to ramp higher into the close.

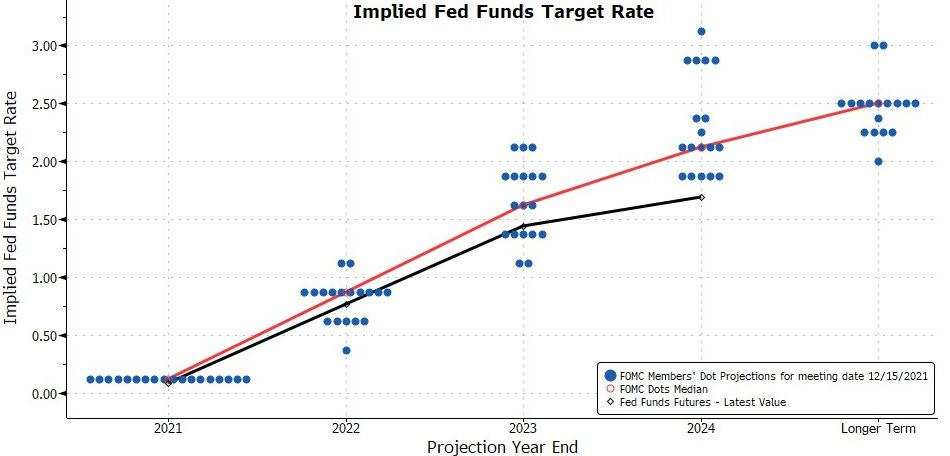

In addition to the taper talk, the FOMC has now projected three rate hikes in 2022.

I don’t have a lot of confidence in what the FOMC thinks they are going to do. At best they can probably predict a few months down the road. As humans we take the present and recent past and extrapolate out too far into the future for our own good. This is a topic Daniel Kahneman touches on in his book, “Thinking, Fast and Slow”.

Bottom line, this was what the market was expecting. Now with the Fed’s announcement behind us, we can see if Santa is going to deliver on his rally.