The CPI dropped today and it was a doozy. Just like last month, it has hit another 40 year high at 9.0%.

Initially the market dropped on the news but then quickly recovered when the WSJ Fed insider, Nick Timiraos, put out an article that poured cold water over the idea that the Fed would attempt a 100 basis point increase at the July meeting. This had the desired effect of pushing the market back into the positive.

Today’s report showed that prices surged by 1.3% month-over-month. The heavy hitters continue to be food, energy, shelter, and transportation costs.

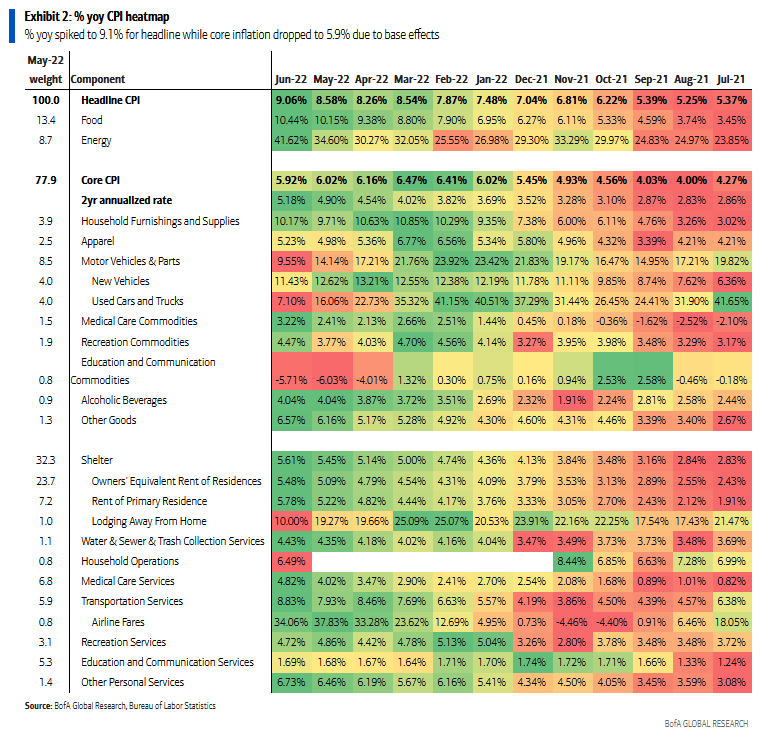

On a year-over-year basis, the CPI heatmap looks devastating.

Some interesting components popped out at me. First, it looks like vehicles have lost steam. This is not surprising as the inflation tax has eaten away at the wealth effect that consumers were riding high on. This inflation tax is also going to buoy the “core” service components of the CPI due to rising wage rates. Employers have bid up wages in an attempt to attract workers. This is especially true in the service industry which is still desperate for warm bodies to fill vacancies.

Another component that jumped out was the “Lodging Away From Home”. This also speaks to the inflation tax eating away at the disposable income of consumers. When you have a choice between filling up your tank, eating food, or going on vacation, most will choose fuel and food. In time this could present itself as lower recreational services and airline fares.

I believe the general economy is setting up for a whiplash moment. When the government shut down the economy, shortages developed when people became flush with cash. Now that the inflation tax has eaten away at disposable income, retailers are getting to be flush with inventory. Target and Walmart are the two big name retailers that warned at their most recent earnings calls that inventory may need to be discounted. This could easily become widespread throughout retail.

I believe we are at the top for items like vehicles, housing, furniture, appliances, apparel, and… semiconductors. All the things that people wanted during the pandemic, but couldn’t find, will be in abundant supply. However, some items won’t see markdowns. I’m specifically talking about food, energy, and commodities. These will continue to see upward pressure as they will prove to be inelastic, keeping pressure on the headline inflation numbers.

The inflation number really jostled the bond market today. The yields went a little crazy (think Britney Spears circa 2007) and the 10-2 year treasury curve took a dive.

I fully believe that the market has priced in a 75-100 basis point increase from the Fed this month. It also expects a 50-75 basis point increase in September and the possibility of a mild recession. What it hasn’t priced in is a crashing money supply and stagflation.