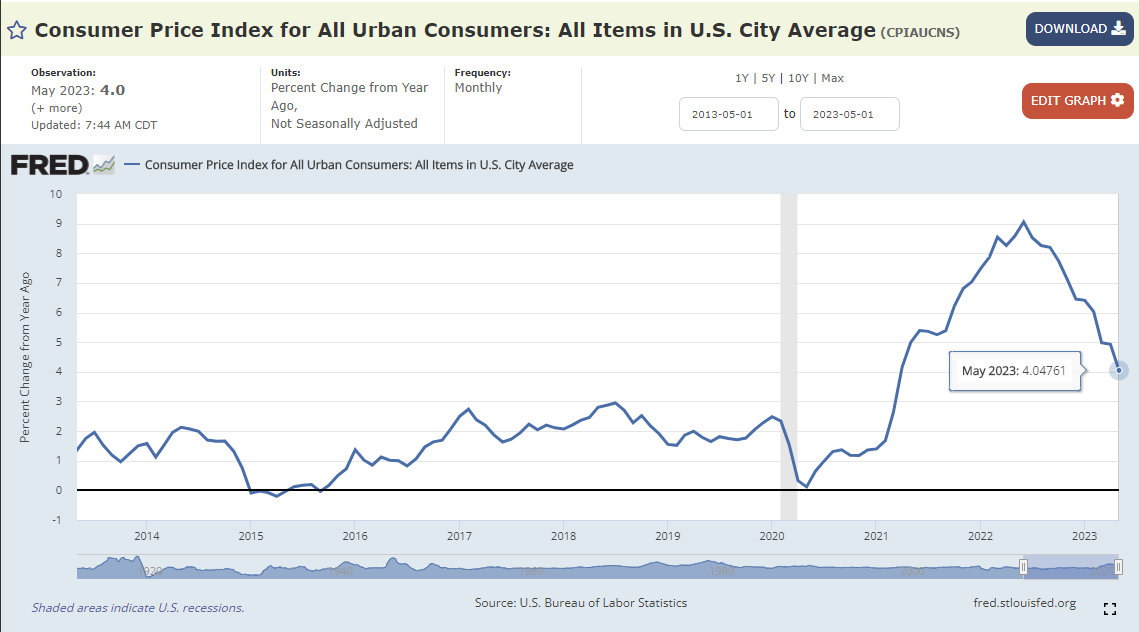

Today was an exciting day for the markets. The CPI was released today and many expected it to have a big impact on how the Fed will handle their meeting and interest rate announcement tomorrow.

Inflation has taken a big plunge. It is down from 9% in June ‘22. That is a 5% change in 12 months.

The big story underneath the headline number is that used cars and shelter continue to drive the inflation story.

But it doesn’t look like those two holdouts are going to last very long.

The Fed is in direct control of the liquidity it is allowing the market to handle. They shut down the M2 money spigot but have opened new ones. The reverse repo market continues to be a source of new money as the Fed is currently paying 5.05%. The other source from the Fed is the Bank Term Funding Program.

The BTFP is injecting funds into the banking system. This is the Fed propping up the banking industry. They know that the banks are underwater on their treasury holdings and bond portfolios due to the Fed’s aggressive rate hike policy.

Yahoo finance had a good summary on the inflation report. In it, they quote several economists. Thomas Simons at Jefferies said this;

“…the fact that headline would have been flat if it weren't for used cars as signs that the Fed is getting what it wants without having to engineer a big slowdown in growth.”

It seems that the Fed is getting what it wants. I have no view whether this is the ‘pause’ meeting or if they’ll raise another 25 basis points. The market is heavily positioning for pause.

After today’s market reaction, one would be hard pressed not to believe we would see a very green day if the Fed announces a pause. The tricky thing about market psychology is that it can turn on a dime.

What are your thoughts on this?

https://www.marketwatch.com/story/this-incredible-chart-shows-the-close-relationship-between-the-s-p-500-and-fed-liquidity-166542a7?mod=home-page