Its over boys. They did it. The Biden administration has conquered inflation. The CPI report came out yesterday and showed a 0% inflation rate month-over-month. Today the administration is touting the results with the above victory lap. I didn’t even have to create a meme because these things meme themselves now.

Unfortunately we don’t have actual 0% inflation. So the administration is either bad at math, or they are knowingly lying to the public. I’ll let you decide which one you think they’re doing. For my purposes, it doesn’t matter. We are still far from 0% inflation. We simply had a 0% increase in the CPI. Year-over-year, we are still humming along at 8.5%.

I’m surprised the administration didn’t fall over itself in announcing a negative inflation print for today’s PPI release.

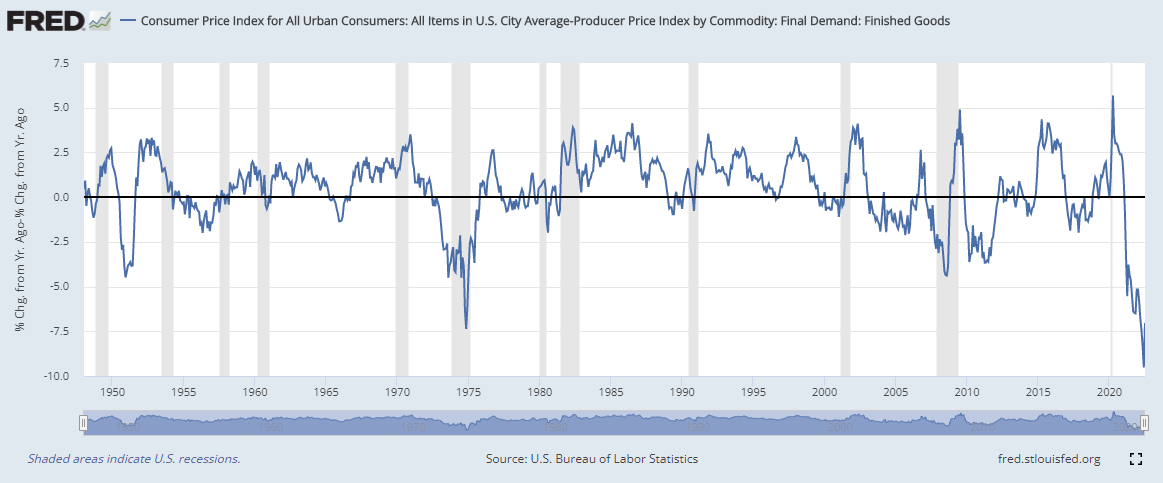

The PPI was -0.5% month-over-month leading to a year-over-year figure of 9.8%. My preferred PPI reading is the final demand:finished goods series simply because of the historical data of this set. It goes all the way back to the late 1940’s. This really helps frame the current era.

When you subtract the CPI from the PPI, you can see the health of retailing businesses and their estimated margins.

While we’ve had times of negative readings on this comparison, we’ve never plumbed the depths we are currently at. We are currently into our 17th month of negative PPI minus CPI readings. That episode in the 70’s ran for 40 consecutive months.

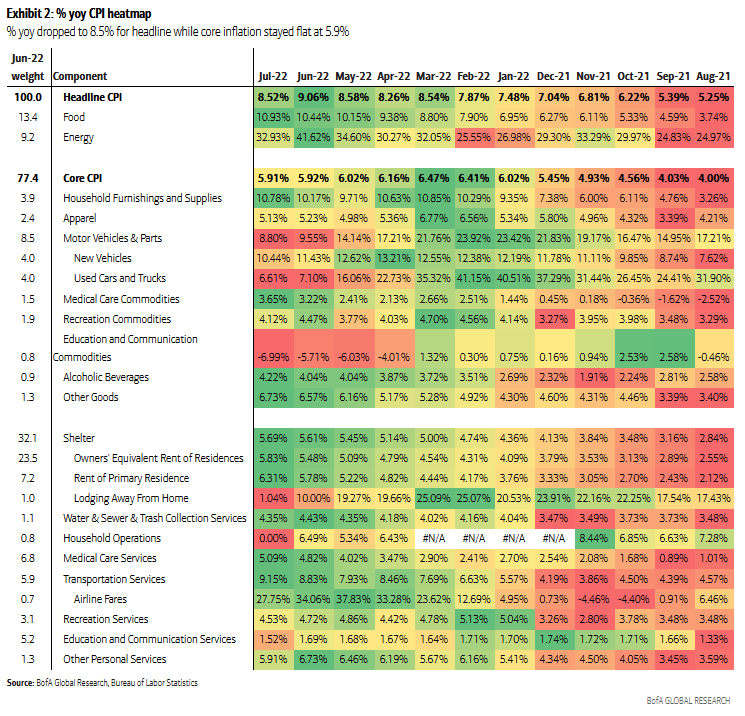

The month-over-month heatmap from BoA/ML shows energy pulling the index down.

This tracks as oil came down off it’s high in June. Food and housing continue to see strength. I believe we’ll see another month of two of strong inflation reports on housing before the rug gets pulled. On the food side, food is a very inelastic good. Everyone has to eat. Consumer preferences may change (more eating at home, less takeout), but I don’t believe this will be enough to move the needle dramatically. I can see future CPI releases showing a slowdown in the ‘core’ and food/energy pulling the headline higher.

Year-over-year shows the longer term trends.

Food continues to heat up. Energy is all over the map. After getting red hot, vehicles are slowing down. Shelter continues to gain steam as do medical and transportation services. As the recession takes hold, I expect vehicles to continue to slow, as well as, housing. I imagine most services will stay elevated as employers continue to struggle to attract help and continue to raise wage rates. This will lead to sticky prices for their services.

I don’t expect this to be the end of our inflation turmoil. One of the less highlighted economic data points that was released earlier this week took a look at labor productivity.

Productivity has now set a new low for the series which dates from the late 1940’s. Reduced productivity has a direct impact on inflation. When output per employee is lower, efficiencies are lost. This leads to rising costs for businesses, then rising prices on store shelves. This loss of productivity is going to continue to put upward pressure on prices. This inflationary episode is far from over.