Is Jerry Maguire the St Louis Fed Pres?

He had a little flip out moment and it spooked everybody

Well, don’t worry. Don’t worry. I’m not gonna do what you all think I’m gonna do, which is just FLIP OUT!

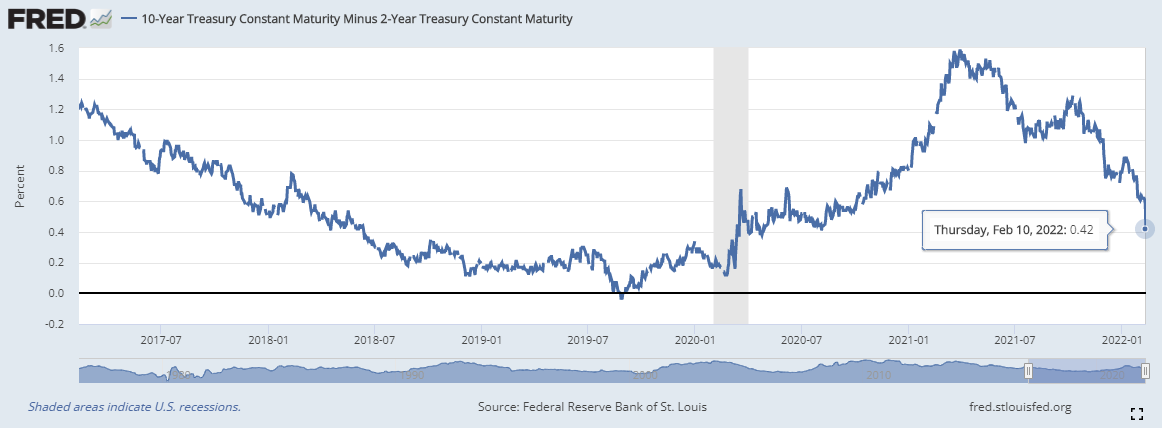

The St Louis Fed President, James Bullard, had a little bit of a “flip-out” moment yesterday on Bloomberg after the news of the highest CPI reading in 40 years. He called for a 50 basis point hike in the Fed funds rate and believed the Fed funds rate should be at 1% by July. This spooked everybody. The bond market had one of the most dramatic flattenings in recent history. The 10yr-2yr, which I use as a recession indicator, saw a dramatic shift lower.

Many in the financial press pushed back on Bullard’s comments. Most notably was CNBC’s Steve Liesman who wrote,

Several Federal Reserve officials, both privately and publicly, are pushing back against calls by St. Louis Fed President Jim Bullard on Thursday for super-sized rate hikes, and instead suggesting the central bank is likely to embark initially on a more measured path.

CNBC reporting found that several Fed officials were already looking for a bad inflation number and the January report was not substantially worse than expected. Improvement is not expected until midyear and only then, if it remains high and rising and does not respond to rate hikes and plans for balance sheet reduction, would these officials want to accelerate the pace of tightening.

My bold.

Mr Liesman quotes SF Fed Pres Mary Daly, Richmond Fed Pres Tom Barkin, and Atlanta Fed Pres Raphael Bostic, who all kept to the script and stated that the need for a 50 basis point increase isn’t warranted at this time.

So what’s with the emergency meeting the Fed is holding on Monday which Matthew commented about yesterday? I think the Fed is in full damage control mode. They’ve no doubt seen the dramatic yield curve flattening and the recent selloff in the market. The know they need to do something. Even the Biden administration, which has been slow to the game, has been calling for the Fed to do something. However, Powell has stated previously, that he is not interested in raising rates while still tapering asset purchases. That leads me to predict three different outcomes from Monday’s meeting:

No change

End asset purchases early

Raise the Fed funds rate 25 basis points

Each of these outcomes would have a different effect on the market. The most detrimental would likely be no change. Oddly enough, I believe this is the most likely outcome of the emergency meeting. With a no change outcome, the market will likely sell-off and we will move into a risk-on environment. This could push up the price of gold and silver. Traders will be looking for safety because they believe that the Fed is reacting too slow to inflation. I would put the odds of this happening at 50%.

If there is an announcement that the Fed is ending asset purchases early, I would think the market would welcome this news. Bonds might suffer higher yields but the general market would hold steady. This would make it look like the Fed is “doing something” and that they are in command. Traders would again trust that the Fed is in control. I put the odds of this happening at 10%.

Finally, the Fed could announce an emergency 25 basis point increase in the Fed funds rate. This would likely cause the market to rally. A risk-off environment would ensue which would push down gold, silver, and possibly oil, as well as other commodities. This could be a definite buying opportunity. I believe the odds of this outcome at 40%.

There is history at the Fed of raising rates at these emergency meetings. Most recently, in November of 2015, the Fed had an expedited FOMC meeting which saw them raise the Fed funds rate 25 basis points. That emergency meeting kicked off the most recent Fed funds rate hike schedule that lasted until 2019. Also, this is a delicate time for Powell. The Senate Banking committee votes on his renomination on February 15th. Once out of committee, he would then have a vote before the full Senate to confirm him as Fed Chair.

Powell is stuck in a very tight spot. He’s got many FOMC members who are very dovish (meaning they favor low interest rates and lots of money printing) and only a few who are hawkish (like Bullard, who want to see interest rates higher because they are concerned about inflation). The makeup of the FOMC could very well tip the scale at the Monday meeting into a no change scenario. Powell will also be heavily influenced in his decision by his upcoming renomination. With the Biden administration exerting pressure on him to do something about inflation, this could be what causes him to raise the Fed funds rate.

Either way, next week is going to be an exciting week for the markets. In addition to the Fed meeting and renomination proceedings, I expect to see the latest margin debt figures sometime during the week. Also, the PPI drops on Tuesday, import/export data and retail sales on Wednesday, and housing data on Thursday and Friday. Better get your popcorn ready!