"It's effective and I'm not concerned about the amount of uptake on that ... or whether it would increase further. It would just be a sign that it's working as planned."

-NY Fed President John Williams

A little over a year ago, NY Fed Pres Williams touted the effectiveness of the repo market. It was effective and “working as planned”. That plan turned out to be the basis for SOFR the LIBOR alternative. It is now clear to me that another program that the Fed has instituted is “working as planned” and that is Powell being the second coming of Volcker.

When Volcker ran the Fed, his primary goal was to contain inflation. He did this by freezing the printing presses and allowing interest rates to soar. We are seeing Powell use the same playbook.

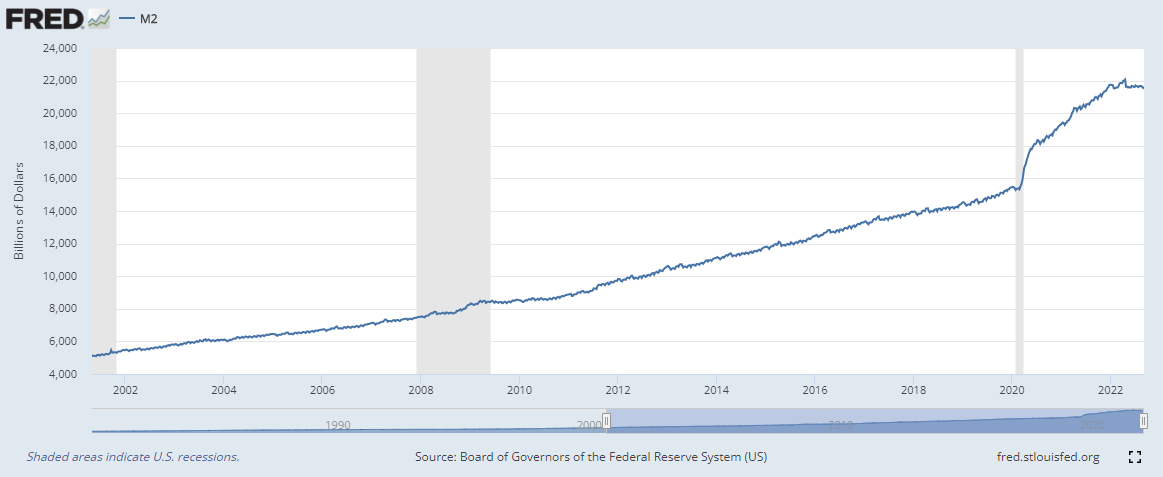

M2 money supply has been flattened. Since the end of April, it has essentially gone nowhere. Over the longer time horizon, we see that M2 steadily climbed.

This has really done a number on my 13-week annualized M2 chart.

It is dipping in the negative, for a second time this year. This does not bode well for the market. However, Powell’s plan is to first wring excess liquidity out of the overseas dollar markets. Once those markets dry-up, the wringing will begin in the US.

But is it working? Well it looks like it could be. The Case-Shiller Index seems to be making a lower low.

The index is several months behind but I would call this progress.

There has been much ink spilled in the mainstream financial press about a Powell pivot and that it could be here at any moment. Here’s a take from Jeremy Siegel, professor of finance at Wharton.

The perma-bulls are scared. Not scared enough to sell in massive quantities, but scared enough to complain loudly. Everybody is entitled to their opinion but I think most of these people are missing the bigger picture here. Powell is doing the bidding of the big NY banks and PE firms. These people want higher interest rates and a stronger dollar. Also, the Fed isn’t concerned about a stock market correction. Kashkari spilled the beans after Jackson Hole. He said that he was “happy” to see the stock market go red.

Ironically, in time this Fed policy of raising interest rates will put a tremendous strain on the Federal Government. Congress has been more than happy to spend like drunken sailors for the past 40 years. Doing so has caused the government to build up a large amount of debt.

Like any irresponsible company, large accumulated debt loads get rolled over. This is what Treasury secretaries have been doing for 40 years. However, this only works when interest rates are going down. Congress really has two options here which were well outlined by Karl Denninger earlier today.

Folks, this is not The Fed, nor can The Fed stop raising rates until either (1) there is a nasty, deflationary recession which takes several trillion out of circulation (by destroying the mythical "value" it represented) or (2) Congress stops deficit spending.

Could this be what ultimately causes Powell to pivot? Congress hasn’t be forced to be responsible for ages. Are they going to be able to make the tough decisions? Will budget items go unfunded in order to afford to pay the interest on the government debt?