Janet Yellen has spent 53 years in public service. She graduated in ‘71 with a PhD in economics from Yale. She has had stents as an assistant prof at Harvard, a faculty member of LSE, a prof at UC Berkeley, a Fed Governor. She was on the Council of Econ Advisers for Clinton, became president of the San Fran Fed, and eventually rose through the ranks to become the Fed chairman. After the Fed, she was at the Brookings Institute and now is the Secretary of the Treasury. She has spent many years study and opining on economic theory. There’s just one problem with theories. In theory there is no difference between theory and practice. In practice there is.

Janet Yellen has presided over the largest debt increase in the history of the United States but is now concerned that the government is on an unsustainable fiscal path.

In Modern Monetary Theory, governments do not need to worry about debt since they can just print the money to pay for it. MMT goes further in that there is no need to worry about inflation because governments can just raise taxes to reduce private sector spending. This theory was put into practice during Biden’s term in office through Janet Yellen as Treasury Secretary. Government spending is inflationary and MMT has repeatedly been proven faulty and lacking. The American people have been paying the cost to test out this theory for the last four years. It has produced inflation as the government spends this newly created money inefficiently and rolling recessions as the government applies the brake to the private sector to control said inflation. In addition, government interest payments have exploded higher.

Now that Janet is on her way out, she has realized that the US is on an unsustainable fiscal path. She’s sorry that more progress couldn’t be made. Excuse me for not believing her.

This week saw more inflation data and it is pointing in a good direction.

Core (red line) came in at 3.3% year-over-year and the headline number came in at 2.7% y/y.

The stickiest part of the inflation reading has been in shelter costs. I’ve been highlighting this for several months now. Shelter costs have a heavy weighting in the index and have been elevated but progress is happening.

Jeremy Schwartz had a good breakdown of the data on X.

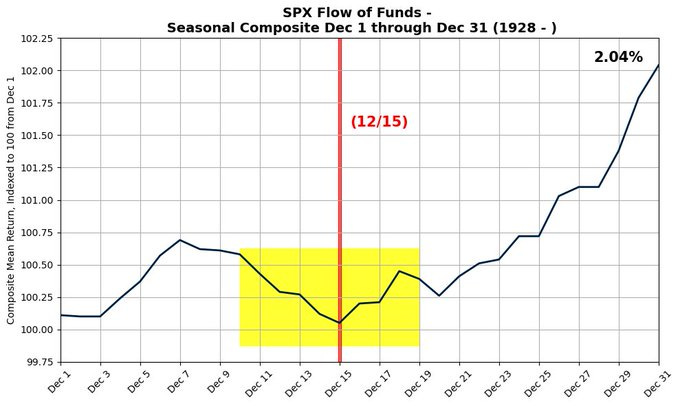

I’m holding to my view that conditions are better than they seem. Optimism has been subdued due to MMT, government red tape, and the rolling recessions. Can we still have a Santa Rally? I certainly hope so. Funds are flowing and we are coming into the best two weeks of the year.

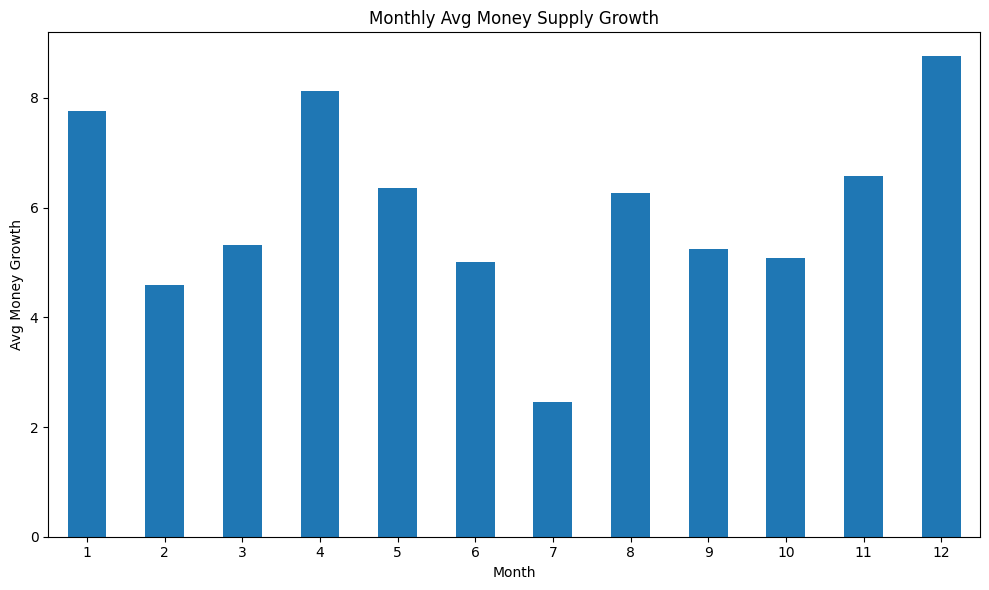

I have a strong feeling this has a lot to do with the money supply as December is known for having strong money growth.

The month of December has the highest average gain at 8.76% and is the month with the most gains of over 10.5%.

Here’s hoping that the Biden administration doesn’t screw it up in an attempt to burn everything down before Trump takes office.

Great analysis!