Jobs and the downgrade

Its the start of another month which means that all the employment data gets dumped on the market. This week saw the JOLTs data, ADP Employment, and the Unemployment Rate all get released.

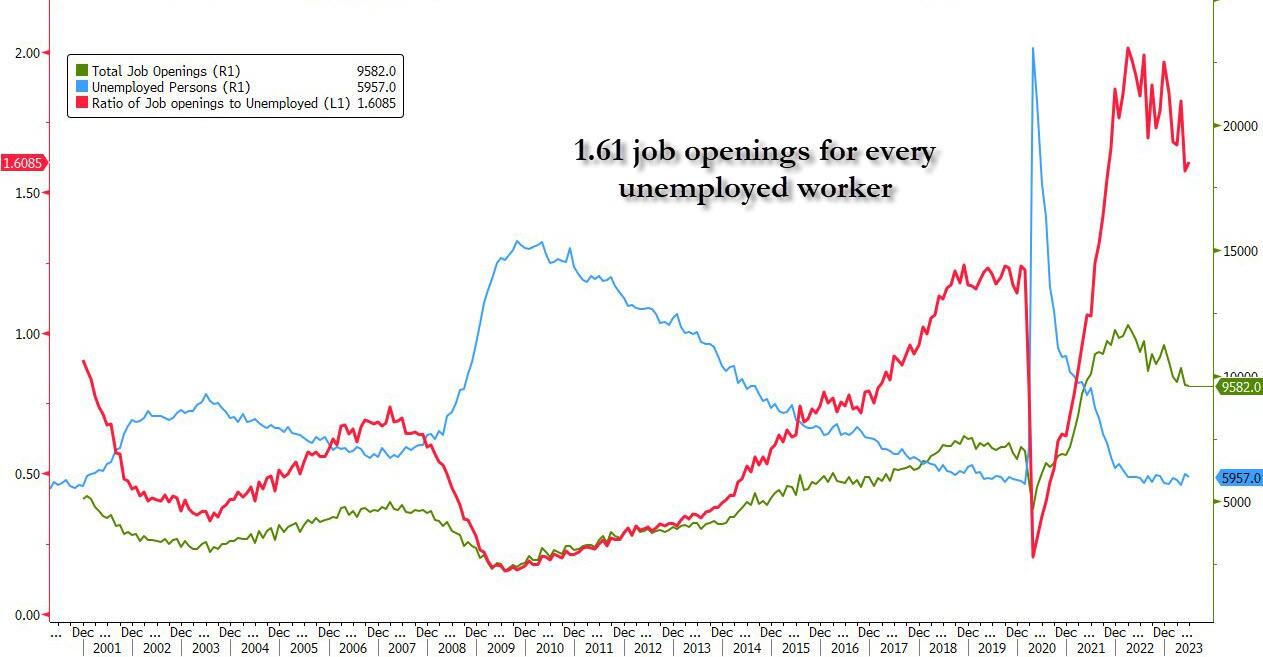

Job Openings increased but not at the same pace as the previous month. The employment situation is still very tight with 1.61 job openings for every unemployed worker.

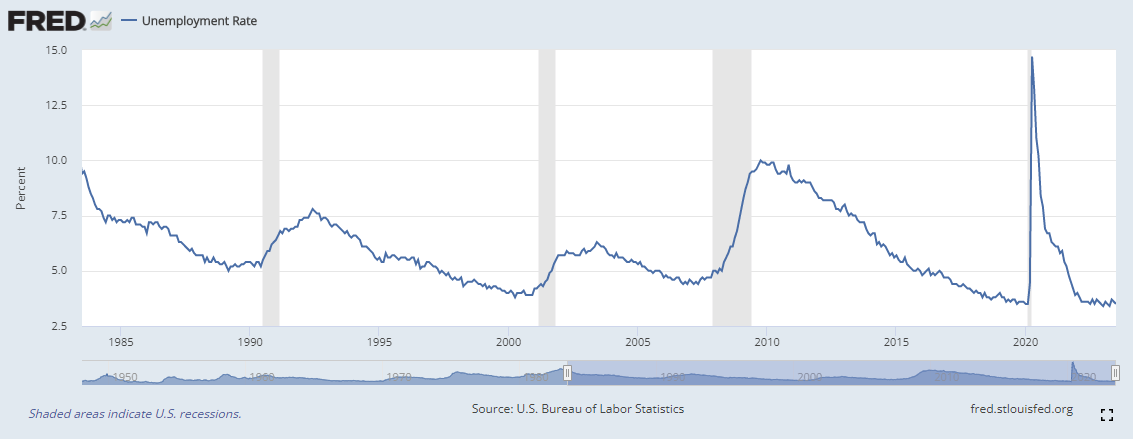

The ADP figures were much the same. Less than last month’s but more than the consensus or forecast. Then today saw the unemployment rate which continues to impress at 3.5%.

At 3.5% we are at historical lows in the unemployment rate.

The report further detailed that the actual number of non-farm payrolls increased by 187k. This was below expectations of 190k.

This month’s employment reports were definitely weaker than the previous months. This is the second month in a row of moderating job data. I don’t believe it is worrying the Fed yet. In fact, after reading Jim Rickards post about “What the Fed Does Next”, I’m of the mind that the Fed will be extremely slow to react in any situation.

“Powell does not want to repeat the mistake of Paul Volcker, who also fought inflation with rate hikes, but cut rates too early and came to regret it.

When Paul Volcker was appointed Fed chair in 1979, he immediately set about ending the worst inflation the U.S. has seen since the end of World War II by raising rates.

Then the U.S. was hit with a recession in January 1980, and Volcker was under intense pressure to cut rates in the face of a recession and layoffs.

He blinked. Volcker lowered the fed funds target rate by seven percentage points.

The recession was over by July 1980, but inflation was not. The Fed and Volcker had damaged their credibility as inflation fighters.

This became known as the infamous Volcker Mistake.

If Volcker had ignored the 1980 recession, inflation might have come down by 1981. Instead, it lasted until 1983 and was only defeated by a recession worse than the one Volcker was initially worried about.

Powell does not want to repeat the Volcker Mistake. He knows how that turned out and doesn’t want to end up in the history books for the same thing.

My conclusion: The Fed is not done and more rate hikes are coming. September is the most likely candidate for the next rate hike as of now.”

My thinking is in line with Jim’s here. The Fed has traditionally been slow to change course but with history as their guide, they will be loathe to change paths due to the worry of a worse recession if they pivot too soon.

In news coming out of the Fitch rating agency, US government debt (also known as treasuries) has been downgraded from the top spot (AAA) to second place (AA+). While I don’t see any factual errors in their assessment, I find the timing rather strange. The last time US government debt was downgraded was in August of 2011 by S&P. When this occurred it surprised the markets.

However, they swiftly recovered and ended the year much higher.

Fitch has been warning about a downgrade in US debt for years so why do it now? Treasuries are paying a “real” rate of return (that is they are paying more than the official rate of inflation) at the short end of the curve. Investors should be extremely happy with that development since they were paying below the official rate of inflation for an extended period of time. Who exactly is pulling the strings on Fitch?