Today saw the release of the Job Openings and Labor Turnover survey (JOLTs) and last month’s FOMC meeting minutes. Job openings are elevated and the Fed minutes hint at additional rate hikes, yet the market continues to shrug it off and levitate higher.

Job openings have started to slow from their torrid pace but are still well above pre-pandemic levels. Demand for workers remains strong. There are currently 1.9 job openings for every unemployed person. It continues to point to a tight job market.

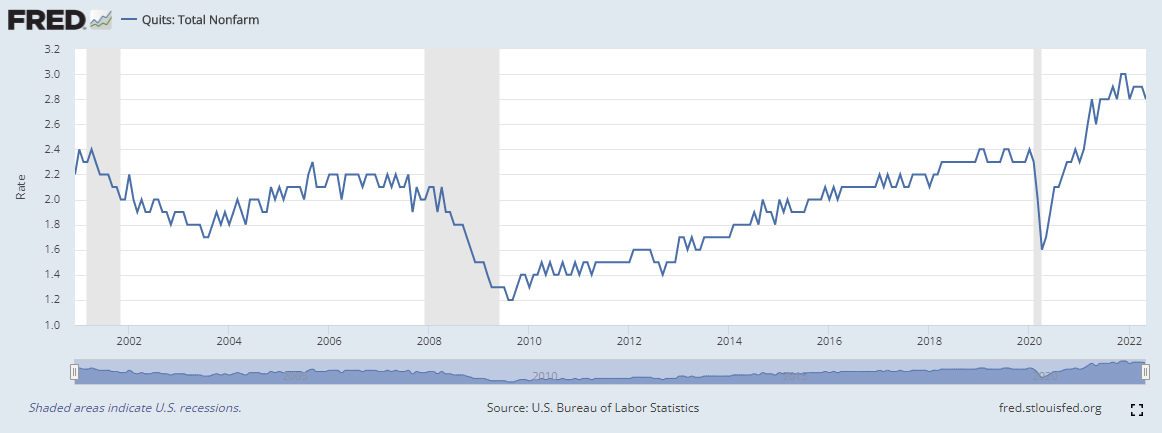

The quit rate is also well above the pre-pandemic period. This indicates that workers continue to be in the drivers seat. They can name their price and employers are continuing to compete for them.

In addition to the JOLTs report, the FOMC minutes dropped for the June meeting. It is truly a comedy of errors. On one hand they say stuff like,

“The staff continued to project that GDP growth would rebound in the second quarter and remain solid over the remainder of the year.”

and then follow it up with inflation continuing to run hot,

“With regard to PCE price inflation, the staff revised up its projection for the second half of 2022 in response to stronger-than-expected wage growth and the staff's assessment that the boost to inflation from supply–demand imbalances in the economy, including in food and energy markets, would be more persistent than previously assumed. All told, total PCE price inflation was expected to be 5.0 percent in 2022, while core inflation was expected to be 4.1 percent.”

In their discussion of the economy, the continued to reiterate that “labor markets were anticipated to remain tight”. This satisfies one-half of their dual mandate. The other objective is stable prices, which they believe they are working on with the increases to the Fed Funds Rate.

As far as what to expect from the July meeting,

“participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting. Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.”

Even with the talk that a “more restrictive stance could be appropriate”, the market pushed higher on the day with gold taking a beating and crude getting knocked lower. What is interesting to me is that, while the S&P and Nasdaq climb with no worry in the world, we see recession sensitive industries get their pants blown off. This includes both oil and marine shippers. Star Bulk Carriers (SBLK) saw a 6%+ drop today and at one point in time, XOP was down over 5%.

I feel the same way Dave does but the bottom line is this, the money supply is getting crushed, a recession is looming, stagflation is on deck, and the market is continuing to serve up opportunities for investors to profit as long as they are willing to be patient.

Gosh the memes are so good here.

I'm really disappointed how much the oil/commodities plays have come down. I still have some from Wenzel's recommendations that are mostly in deep green, but the recent downtrend is making me nervous. (FCX, DBC, GSP)