Latest M2 numbers, a look at the yield curve, and a margin debt update

Fed Chair Jerome Powell has oh-so-slightly turned the money spigot back on. We got our first rise in non-seasonally adjusted M2 figures yesterday.

This shows as a bounce off the bottom of my 13-week annualized chart.

This long period of declining money supply has now been reflected in my favorite inflation index, the Case-Shiller Home Price Index.

I always lament how unfortunate it is that this index is 2 months behind. It makes it a very laggy indicator. It is officially in negative territory (0.2% for April ‘23). It has been at this point two other times.

I don’t believe that it is a coincidence that M2 turning positive is happening after the debt ceiling resolution. Yellen is reloading the Treasury General Account. The Fed has already signaled that the banks are going to need to help shoulder the burden by increasing capital requirements…

U.S. banks could face capital hikes of as much as 20% under new rules being prepared by U.S. regulators as part of a global effort to harmonize capital requirements, a person familiar with the matter said on Monday.

U.S. regulators, led by the Federal Reserve, are expected to unveil the proposed tougher requirements by the end of this month, according to this source, who spoke on condition of anonymity.

…however, it looks like this maneuver may be too dangerous for the smaller banks.

Federal Reserve Chairman Jerome Powell said Thursday that banks below $100 billion in assets won't be impacted by any new capital requirements

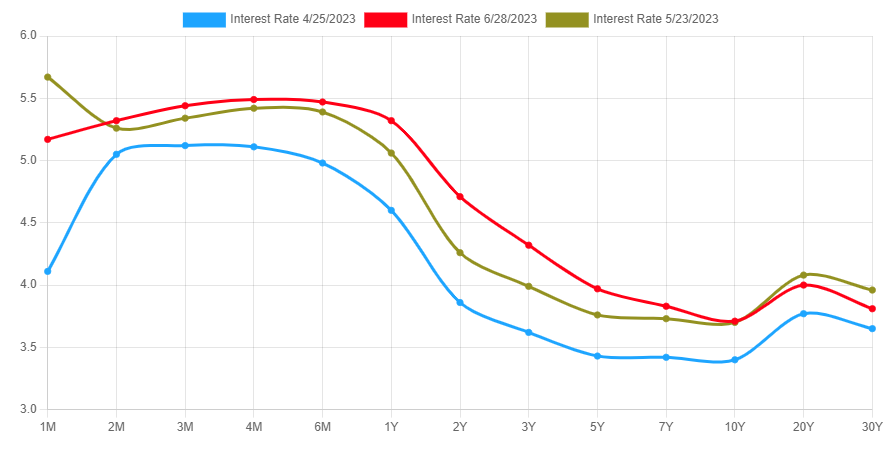

With all this action in the treasury market, it looks like things are beginning to flatten out.

The short-end (1M-1Y) is starting to flatten out. We are also seeing a pretty good rise in rates from 2Y-7Y. The end of the curve continues to be quite stubborn.

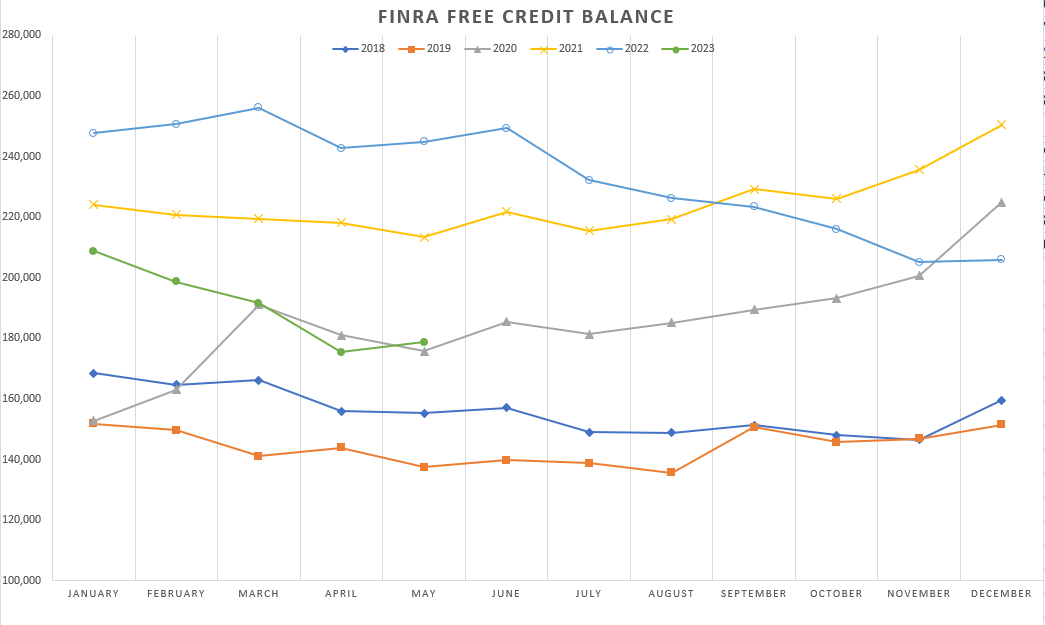

Meanwhile, investors are continuing to be content with their exposure to margin debt.

It has been quite flat since the end of last year. Even the withdraws from the cash on the sidelines has stopped.

Meanwhile, I’m sitting here feeling like this: