Learn this one simple trick to print money without even trying

one man printed more than $6.2 trillion with this simple trick

Today the Fed released the money stock report for the past month. Using my formula, I have the money supply growing at 13.7% on January 3rd, 2022 on a 13-week annualized basis.

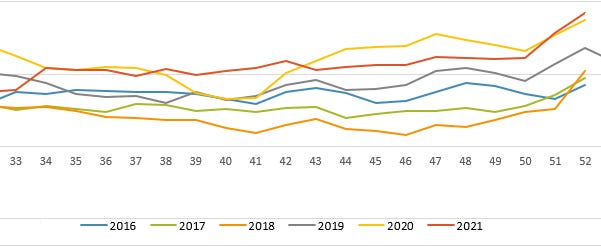

We ended 2021 very strong.

There is usually a propensity for the money supply to go up at year-end and 2021 was no different. It accelerated between weeks 50 and 52 quicker than all but one year, 2018.

To start off 2022, I show that the money supply is below 2021’s high water mark.

This is very strong money growth. Below is the summary of the last 13 weeks.

As you can see, the money growth shot up to over 18% at year end but has since cooled. I still see this as strong growth that should fuel the stock market and inflation higher.

On the inflation front, the Case/Shiller House Price index was posted today. I use this index as my go-to inflation metric. It is free from all the manipulations of the CPI. This index tracks same home sales. In Robert Shiller’s book “Irrational Exuberance”, the Nobel Prize winner in Economics found that home prices are directly tied to inflation. Input costs, mortgage rates, and other associated costs are secondary to inflation when it comes to the price of a home. This is why I value this index so much. It gives us the true “man on the street” view of inflation.

Not surprising, it has cooled slightly since it’s peak in August 2021. It is down from 19.97% to 18.81%. We’ve had very little relief from the inflationary pressure on the economy. This small downturn is coinciding with oil prices dropping to a low of $65.57 a barrel on November 30th. Since then oil has shot up to $85.

I believe high oil prices will be what propels the inflation narrative further. High oil prices were a very visible reminder of the inflation that ravaged the 70’s. We are likely to repeat this mistake once more.

Oil is needed to move goods, whether by truck or boat. Since our economy has gone global, more goods than ever are getting shipping around the world. Commodities are mined in one location and then shipped to another to be converted into parts. These parts are then shipped somewhere else and put together. Then they are shipped to the retailer who puts it on the shelf. This takes a lot of logistical planning and energy. Globalization thrives on low oil prices.

This administration has had other plans for oil. “Green” legislation and executive orders have put a serious crimp on supply. Biden’s administration has cancelled pipelines and drilling on federal land. This has caused the US to no longer be energy independent putting OPEC+ in control. However, OPEC is on the verge of running out of spare capacity.

From Oilprice.com

As the OPEC+ group unwinds its production cuts, the oil market has realized that not only do many producers in the pact lack the capacity to boost output further, but those who can pump more are reducing the global spare production capacity, thus exposing market balances to unexpected supply disruptions, and oil prices to further spikes. Most of the world’s global spare capacity is currently held by OPEC’s Middle Eastern members Saudi Arabia and the United Arab Emirates (UAE). Those two producers have the potential to raise their output as OPEC+ continues to unwind the cuts, but they are doing so at the expense of declining spare capacity.

Low spare production capacity could set the stage for a prolonged oil price rally because the world would have a lower buffer to offset sudden supply disruptions, which are always lurking in the global oil market.

This means any disruption could easily set oil prices higher.

World oil demand in 2021 was over 6% higher than 2020.

2022 is only projected to be 4% higher. Who wants the over on that bet? I do.

Meanwhile, production in 2021 only grew 1% in non-OPEC countries and 2.6% in OPEC countries.

Projections for 2022 show non-OPEC countries boosting production nearly 5%. The US alone is suppose to account for 5.8%. I find this hard to believe since the grip of “green” legislation is tight and getting tighter.

Without the loosening of restrictions in the US, I find it hard to believe that production could be increased 5.8% over 2021. This leads me to believe that oil will continue it’s march higher. Also, from our experience with Covid, it could be a long time until politicians come to their senses. At some point the left may cry uncle but I anticipate that the republicans will retake the White House and reverse course before that happens.