“We have difficult work to do in Iraq restoring price stability. We are bringing order to parts of that country the economy that remain dangerous. Our mission continues...The War on Terror inflation continues, yet it is not endless. We do not know the day of final victory, but we have seen the turning of the tide are at a neutral fed funds rate.”

The Fed’s Federal Open Market Committee (FOMC) met earlier this week and determined that a 75 basis point increase in the Fed Funds Rate (FFR) was appropriate. The decision was unanimous. Afterwards Federal Reserve Chairman Jerome Powell held a press conference to announce the decision and take questions from the press. Here’s the transcript.

“Over coming months, we will be looking for compelling evidence that inflation is moving down, consistent with inflation returning to 2 percent. We anticipate that ongoing increases in the target range for the federal funds rate will be appropriate; the pace of those increases will continue to depend on the incoming data and the evolving outlook for the economy.”

This has become standard boilerplate info coming from the Fed. The below, however, is not.

“We are highly attentive to inflation risks and determined to take the measures necessary to return inflation to our 2 percent longer-run goal. This process is likely to involve a period of below trend economic growth and some softening in labor market conditions, but such outcomes are likely necessary to restore price stability and to set the stage for achieving maximum employment and stable prices over the longer-run.”

The Fed is showing their commitment to getting the inflation genie back into the bottle. They are acknowledging that recession is likely. They are even willing to see an increase in the unemployment rate to achieve the goal of lower inflation. Then the questions from the press started.

“So, I guess I'd start by saying we've been saying we would move expeditiously to get to the range of neutral. And I think we've done that now. We're at 2.25 to 2.5 and that's right in the range of what we think is neutral.”

Mission accomplished!

Powell continued to reiterate that additional rate increases may be necessary. He also cautioned that since the rate hikes have been so large and quick, their effect may not be fully expressed in the economy. This did not stop the market indices from being bid. There was a tremendous short-squeeze as those that were short folded and sent the market higher.

Powell was then questioned about when he thought a pause in tighter monetary conditions may be appropriate.

“As I mentioned, we need to see inflation coming down. We need to be confident that inflation is going to get back down to mandate consistent levels. That's not something we can avoid doing. That really needs to happen.”

The Fed is taking inflation seriously. So seriously that they are willing to run demand into the ground to stop it. Will the Fed pivot when things go south? Probably not immediately unless the labor market falls apart and inflation has moved materially in the direction of their 2% goal. So is that happening?

Today, the Personal Income and Outlays data dropped and this is what it showed:

Whoops! Inflation is most definitely not moving towards the Fed’s goal. The PCE index (which is the Fed’s preferred inflation index) continues to move higher, even with the aggressive rate hike in June. The cat that is going to get let out of the bag soon is that the Fed has no control over commodity prices. They can’t print oil, gold, copper, or food. They control the amount of money in circulation. They cannot motivate companies to drill new oil wells, explore for new gold or copper deposits, or motivate farmers to grow crops. That ball is in Congress’s court and they have dropped it.

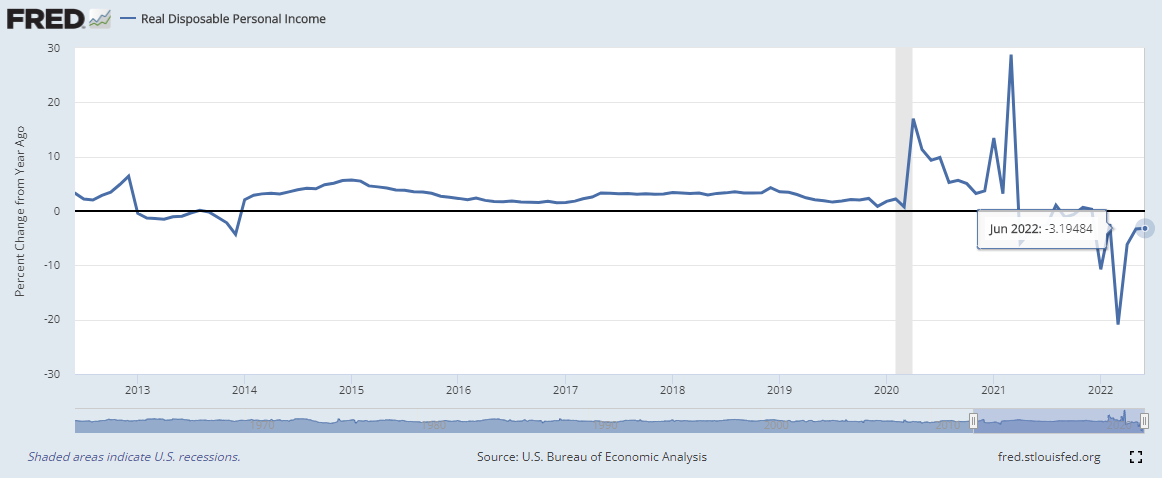

High inflation continues to have an out-sized impact on the average Joe. Both the personal savings rate and real disposable income are suffering.

Inflation has a larger impact on the middle and lower income classes than it does on the wealthy. The 1% don’t understand what the fuss is all about while everyone else is working two to three jobs to keep their living standards the same. Demand is getting crushed but inflation is not.