The whirlwind that is Donald Trump has settled onto Pennsylvania Avenue in DC. He has been holding a series of open press conferences while signing executive orders. During one he was asked about his statements on demanding lower interest rates from the Fed and whether they would listen to him or not.

It is interesting to see this dynamic playout. There are two ways to stimulate the economy, through fiscal policy or monetary policy. Fiscal policy is controlled by Congress and the Executive branch. Monetary policy is conducted by the Federal Reserve.

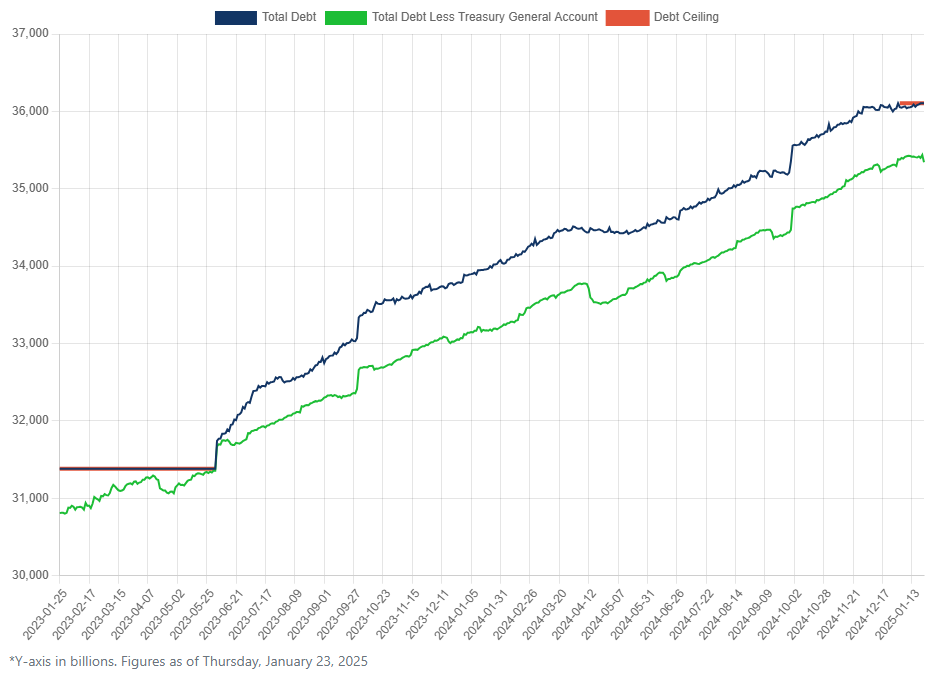

The debt ceiling is back. Janet Yellen did a bang-up job burning through cash as fast as she could on the way out the door. In fact, on January 17th, she announced that the US would hit the debt limit on January 21st, one day after Trump’s inauguration, and advised the Treasury to begin “extraordinary measures”.

With the Treasury bumping up against the limit, fiscal stimulus is out of the picture. It would require an act of Congress to raise the limit to provide room for a Trump fiscal stimulus package. Congress will have to act prior to March 14th on this matter as the most recent continuing resolution will expire at that time. If nothing is done it could create a possible partial shutdown of the government.

With fiscal stimulus for the economy out of the picture, Trump is going to lean on Powell to provide monetary stimulus through rate cuts. This seems warranted with the way shelter inflation is trending.

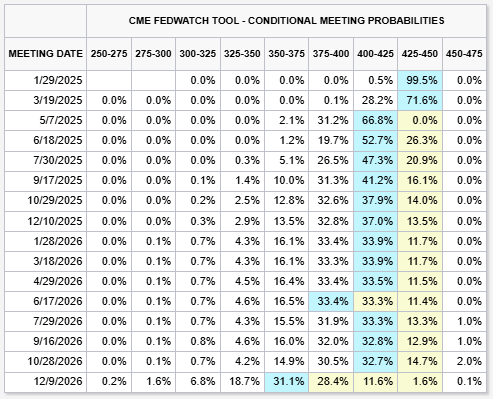

Also, Trump is serious about cutting regulations around oil & gas production. His recent executive orders could light a fire under explorers and producers causing inflation to come to a screeching halt. This will provide the cover for the Fed to cut rates. Current probabilities from the CME FedWatch tool show a cut getting priced in for May.

My belief is that we’ll get three rate cuts this year. To do that, the Fed is going to need to provide better forward guidance through FOMC meeting minutes, press conferences, and speeches. I expect that there will be a Fed meeting press conference that Powell will lead reporters questions towards a signal of lower rates. This could be a real big up day for the markets, especially small-caps.

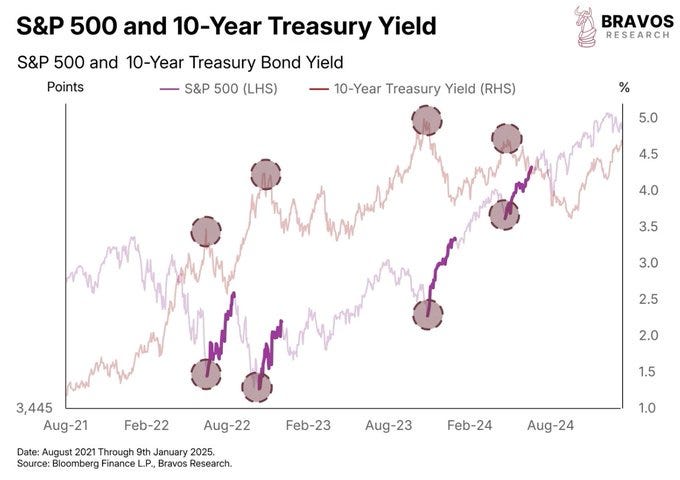

Small caps have lagged S&P returns for four consecutive years. Lower interest rates make a bigger difference to the bottom line for smaller cap companies than larger cap ones however both will benefit from lower rates as TINA (there is no alternative) takes hold once more. Currently, the 10-year and the SPY are in a battle for market share.

When 10-year rates peak, the S&P500 goes on a rally. This continues to play out today.

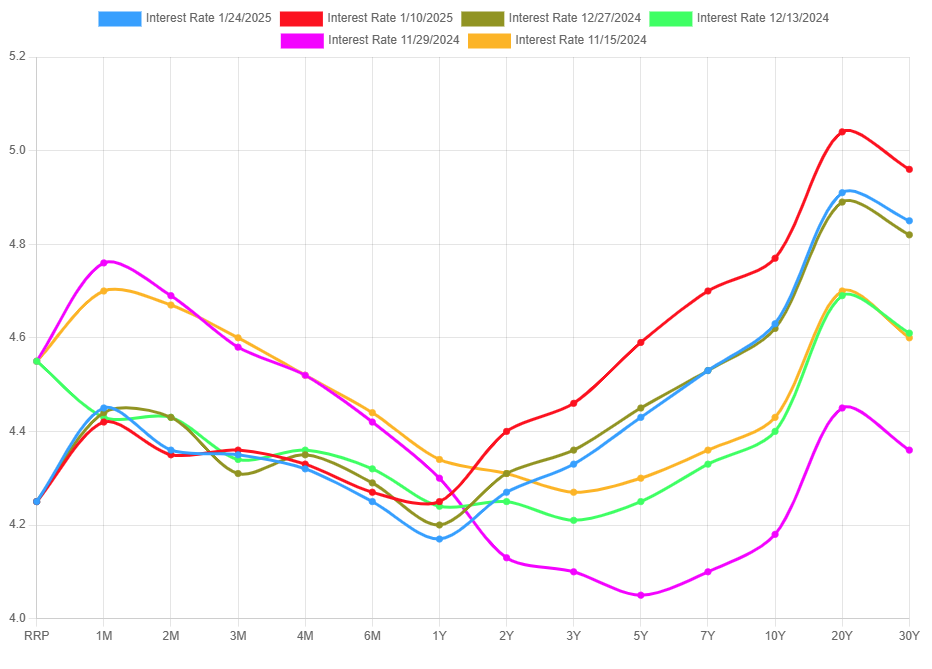

Lowering the Fed Funds Rate would also force the yield curve into positive territory which it has been trying to achieve since the end of ‘24.

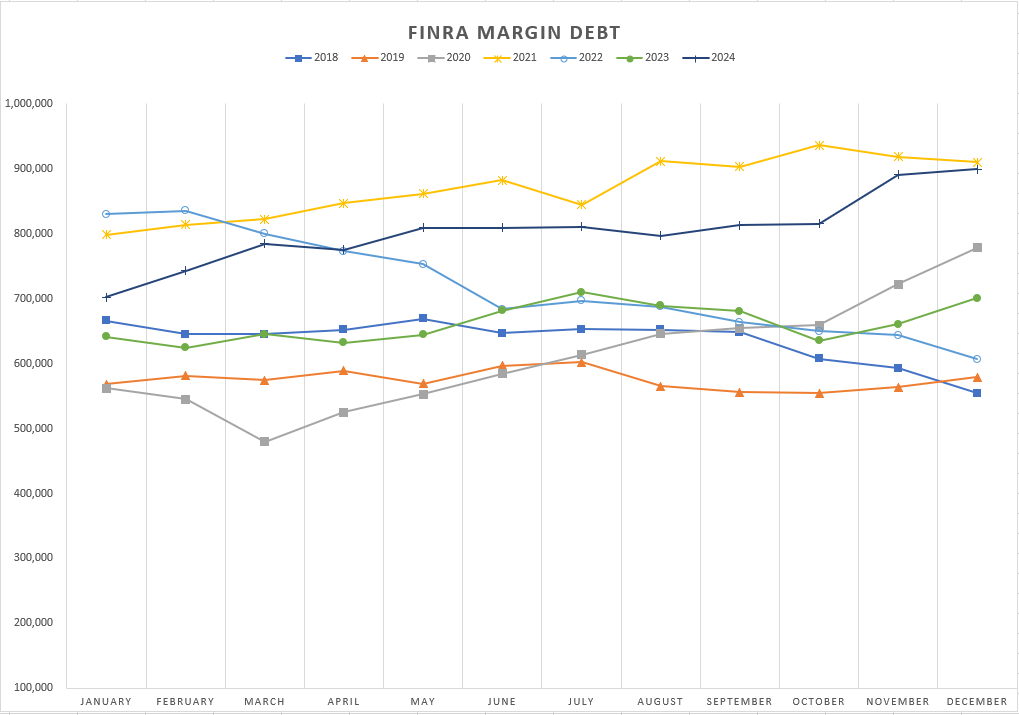

All this is happening at a time that investors are dipping into their margin accounts to juice returns.

Margin debt usage was up 0.9% month-over-month in December to over $899 billion. Debt use has only been higher August through December of 2021.

Next week we should get the money supply release from the Fed to see if there continues to be follow through from their end.

Finally, the quant of the week is from the McClellan Oscillator, brought to my attention by Seth Golden at Finom Group.

The day that this was triggered, SPY closed at $603.05. To follow the study, you would need to buy at or below that level. Then;

in 6 months time you should have a 78% chance at a positive rate of return

in 9 months time you should have a 87% chance at a positive rate of return

in 12 months time you should have a 96% chance at a positive rate of return.

I found Seth on X some time last year - very insightful. A must-follow. No we're not related, ha ha