The comparisons to Volcker have gone mainstream. Last month I posted that it appeared Powell’s plan was working.

I said in the post that;

“When Volcker ran the Fed, his primary goal was to contain inflation. He did this by freezing the printing presses and allowing interest rates to soar. We are seeing Powell use the same playbook.”

M2 weekly, non-seasonally adjusted numbers are reflecting this reality quite clearly. The money supply has been flat for 24 consecutive weeks.

It is wreaking havoc on markets outside the US and my 13-week annualized money supply chart.

When the money supply figures were released, they showed negative revisions going all the way back to April of this year. My interpretation of the 13-week annualized money supply has a rate of -4.13%. We experienced a trough on 7/18 at -8.68%. This is a serious slow down in the supply of money. However, we haven’t see the big drop in the stock market. I believe that the introduction of SOFR is playing a large part in the resistance of the market to plummeting.

If you recall, SOFR was introduced as a replacement to LIBOR. It has shielded much of the US from the turmoil that Japan, the UK, the Eurozone, and China are experiencing.

By raising interest rates and freezing the printing press, the dollar has been in high demand. It has propelled much higher than many expected it could.

It has also created a Mundell-Fleming Trilemma situation for global currencies.

“The Mundell–Fleming model portrays the short-run relationship between an economy's nominal exchange rate, interest rate, and output. The Mundell–Fleming model has been used to argue that an economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. An economy can only maintain two of the three at the same time.”

In our globalized world, capital moves to where it is treated best. This means central banks can target exchange rates or interest rates but not both. This is why we are seeing a blowout in exchange rates against the dollar. These central banks have decided to target interest rates at the expense of their currencies. The Fed is increasing interest rates and attracting capital, the other central banks aren’t. They’ve been slower than the Fed the respond to high inflation and are getting taken to the cleaners for it.

Unfortunately for Powell, the end of the line is coming soon. His attempt to live action role play as Volcker is going to come to an end. This is because the situation this go around is much different than when Volcker ran this playbook. The big two are debt-to-gdp and energy.

US government debt has ballooned out of control. When Volcker raised interest rates, the federal government was able to afford to pay the increased interest costs. Now, that situation is drastically different. Someone smarter than me ran the numbers, this is what Kuppy had to say;

“Our government has run obscene deficits over the past two decades. This was only made possible by the Fed suppressing interest rates. Despite a succession of Treasury Secretaries, the US debt was never termed out. The majority of the debt is actually quite short term. During 2021, the Federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding—or an average interest rate of 1.8%.

Now imagine if Fed Funds actually got to the terminal rate and stayed there for any period of time. What would paying an average rate of 4.6% on year-end 2021 debt do to the interest expense? Well, it rises by $636 billion to $1.028 trillion or more than the cost of our entire military spending of $801 billion in 2021. Ignoring the budget pressure, the interest cost would then be 4.5% of total GDP, up from 1.7% in 2021. That’s like tying a lead weight around the neck of our economy.”

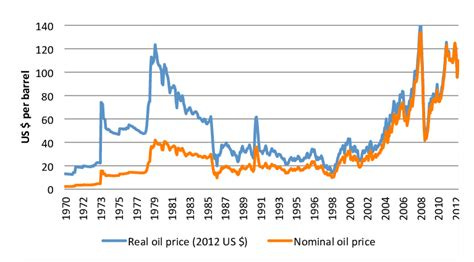

Now add in energy. Energy is the lifeblood of every economy. Without energy you don’t have the transportation of goods. You don’t even have the creation of goods. The economy as we know it would come to an absolute standstill without cheap, abundant energy. The oil price peaked in 1979. This provided a big tailwind in controlling inflation.

Investment in energy became abundant. Oil was found everywhere. We were no longer beholden to a small group of Arabs for energy. This lead to a surplus of supply and brought down the price. Then the globalization boom began and inflation was laid to rest for four decades. All of this is now reversing. Debt-to-GDP is high. We’ve hit peak globalization and on-shoring will be making a comeback. Energy is expensive and investment in energy is practically non-existent. Yet Powell is still running Volcker’s playbook. It won’t control inflation this time around. There are too many other challenges to conquer before inflation rests once more. In the meantime, I know where my capital is going to be hiding out.