Jay Powell and Co continue to do a number to my M2 chart. The M2 non-seasonally adjusted figures have stayed practically flat since November of 2021. This is 15 consecutive months of the money supply holding steady between $21.3T and $21.9T. Here’s the 15 month breakdown:

Keeping the money supply flat has distorted my chart. It continues to show negative 13-week annualized data points.

It has also distorted the year-over-year comparison chart at the Fed.

That is one steep slide.

Fun fact - The M2NSA year-over-year percentage change chart has only gone negative one other time in the more than 40 years’ worth of data. That date was Monday, April 3rd 1995 and the reading was -0.08839. The most current reading (January 2, 2023) has the M2NSA percentage change from a year ago at -1.84677.

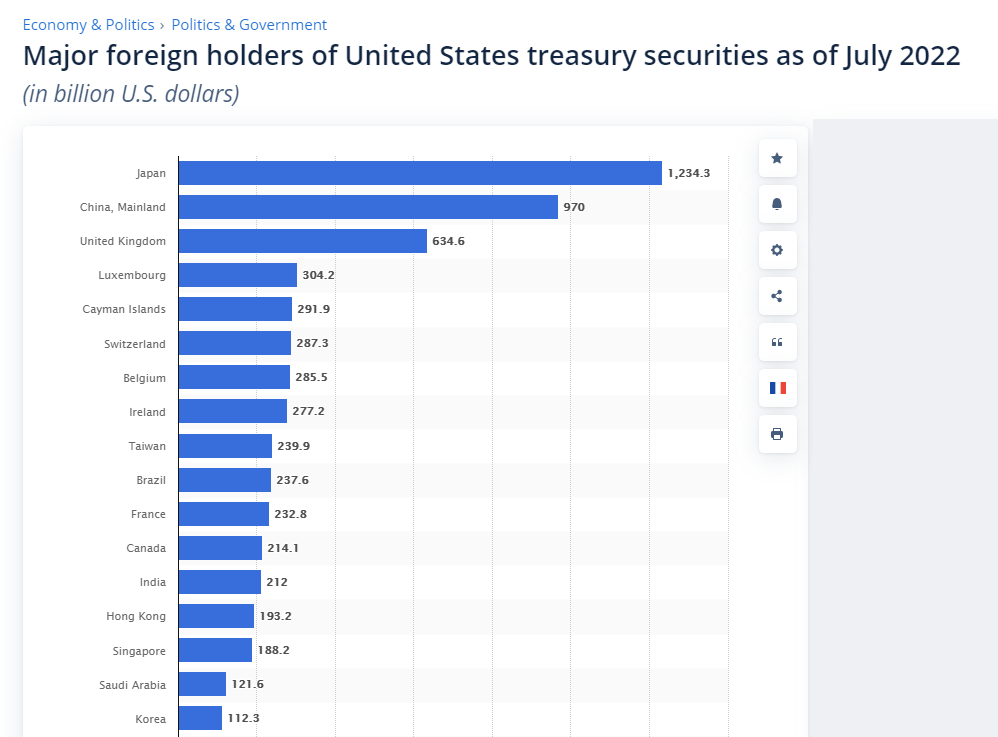

In addition to ruining the charts, holding the money supply steady has drained offshore dollar reserves. In the investment world, this is called the “Eurodollar” system. It has nothing to do with the Europeans or their currency. It refers to dollars that move around internationally. That is, outside of the American banking system and outside of the Federal Reserve’s control. Here is an example of how the eurodollar system works:

A textile factory in India wants to borrow dollars to build a new factory. An Indian bank wants to provide the loan but doesn’t have dollars. The bank buys US Treasuries and pledges them as collateral to borrow dollars from a lender in Japan. The lender in Japan issues the bank in India dollars and then loans them to the factory owner.

Now that we have this example in mind, realize that this is happening inside a fractional reserve system. The bank nor the money lender have 100% reserves against their loans. The truth is, no one knows how large the eurodollar system is. There is no grand authority. In addition, there are only two restraints on this system. The first is collateral. The system creates a constant demand for Treasuries. The second is a bank’s willingness and ability to lend. That means this system requires a large degree of trust.

The Fed has done an end-around on the eurodollar system. They want control and have been working at cutting out the middle-man so that they can regulate the offshore dollar market. There have been a series of programs that they’ve initiated to accomplish this goal. The primary tool is the Secured Overnight Financing Rate (SOFR) but the Fed has also introduced dollar swap lines and a Foreign and International Monetary Authorities (FIMA) repo facility.

You can read more about SOFR here and here.

Dollar swap lines and FIMA here and here.

Learn more about Eurodollars here and here.

These moves are allowing the Fed to wrest control of the creation of all dollars everywhere. By raising interest rates, they are forcing control of the offshore dollar market into their hands. What do people who have money and power want… more power.