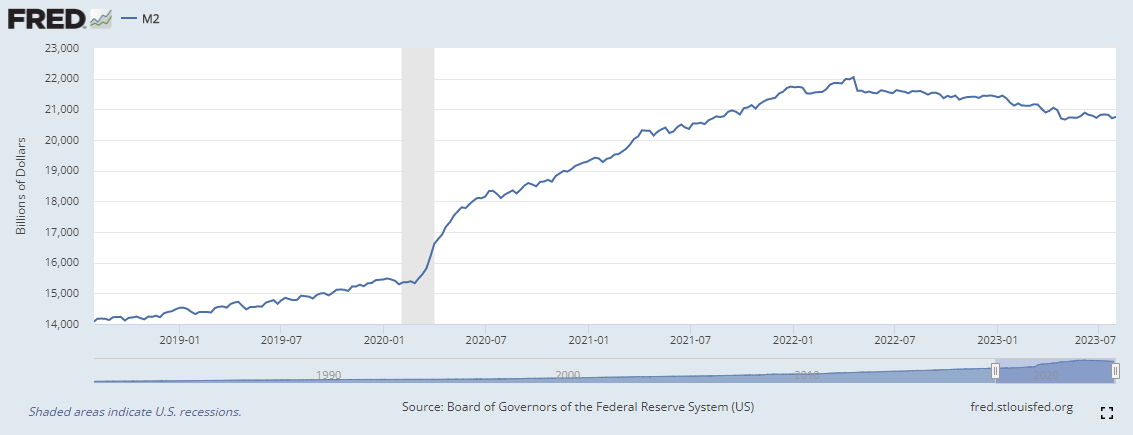

The Fed released the H.6 Money Stock data earlier this week and it left me to wonder if it even makes a difference anymore.

As a reminder, Robert Wenzel was the original person who tracked the money supply data. He used a 13-week annualized chart to track the expansion of the money supply. His theory was that an expanding money supply would drive capital markets higher as more money was injected into the system bidding up prices. This would mean that the opposite would also be true. A stagnant or declining supply of money would cause a credit contraction and a fall in capital markets.

We’ve had a long stagnation process take place in the money supply.

This had distorted my 13-week annualized chart and showed a long period of negative money supply growth.

Under normal conditions, we should have seen a contraction in the capital markets, a credit crunch in the banking sector, and a recession on main street but something funny happened along the way. The Fed changed something. Two somethings to be exact.

First they removed the US economy’s dependence upon LIBOR.

“In 2012, it was revealed that banks around the world had manipulated the London interbank offered rate (LIBOR). LIBOR is a benchmark interest rate used as the basis for bank lending, option contract pricing, mortgage rates, CDOs, and other consumer loans like car loans and student loans. LIBOR was sold to the public as the rate that major global banks lent money to one another. It was proven to be easily manipulated by the 17 foreign banks and 1 US Bank (JP Morgan) whose figures made up the basis for the rate. For John Williams and Jerome Powell, the LIBOR scandal brought to light how LIBOR was being used to effect monetary policy in the US.”

In addition, the Fed also starting paying interest on the reverse repo facility in June of 2021.

“Volume at the reverse repo facility soared further last month after the Fed raised the rate it pays on reverse repo agreements to 0.05% from 0% as part of technical adjustments to keep the effective federal funds rate from falling too low.”

I believe that these two events had profound impacts on what tools the Fed could then use to tighten money supply. When the economy was reliant upon LIBOR, the foreign central banks could manipulate the interest rate causing a financial panic in the US. Also, by paying interest on the reverse repo facility, the Fed kept collateral and liquidity in the US.

At the same time, other financial forces were attempting to thwart the Fed’s efforts, mainly the ECB and the US Treasury. We are now seeing both succumb to the power of the money supply.

First the Treasury…

Interest rates at the long end of the curve have risen dramatically over the past three months. Janet Yellen’s feeble attempts to keep a lid on the long-end are slowly getting spoiled. At the very end of last year I predicted a battle between the Treasury and the Fed. We are seeing now that the Fed, with the power of the printing press continues to be in charge.

By ditching LIBOR and keeping liquidity in the US, the Fed is orchestrating a credit crunch for the ages. In time, it will reach the shores of the US but before it does, we are going to see some real fireworks overseas. This is already beginning to play out in China and Europe.

We’ve had the mainstream press pick up on this with articles in the WSJ, NYTimes, Bloomberg, and Reuters all detailing different aspects of the collapse of the Chinese economy. Meanwhile, the European economy seems to already be in a recession.

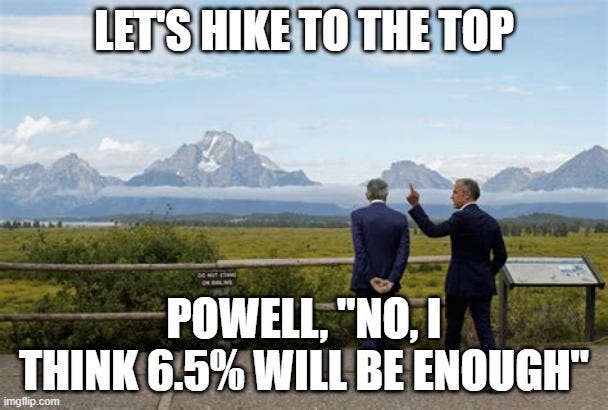

The Jackson Hole symposium is happening right now. Last year Powell had quite the message for the stock market with Kashkari giddy with the market going red. I’m anxious to hear what he has to say this year as economies around the world begin to struggle with dollar liquidity and tight credit conditions.

![Origin of the Illuminati [Khazarian mafia & New World Order globalists] from a biblical and ... Origin of the Illuminati [Khazarian mafia & New World Order globalists] from a biblical and ...](https://substackcdn.com/image/fetch/$s_!kCgY!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F281795f8-546e-41ce-99a7-952b31b3a029_860x600.jpeg)

Nice use of the Hillary meme. Like her incarceration, this market crash should have happened a long time ago, one would think.

I have been wondering when the crash is going to get here. Seems long in the tooth. Have been in 28 day T-bills and money market accounts that invest in very short term gov't securities for a while. And waiting. And waiting.

I think Wenzel based his thinking on the writings of Fritz Machlup if I recall correctly. I'll try to find the reference.

Thanks Alan!