Earlier today the Federal Reserve released the H6 Money Stock measures and it showed a continued increase in the weekly non-seasonally adjusted M2 figures.

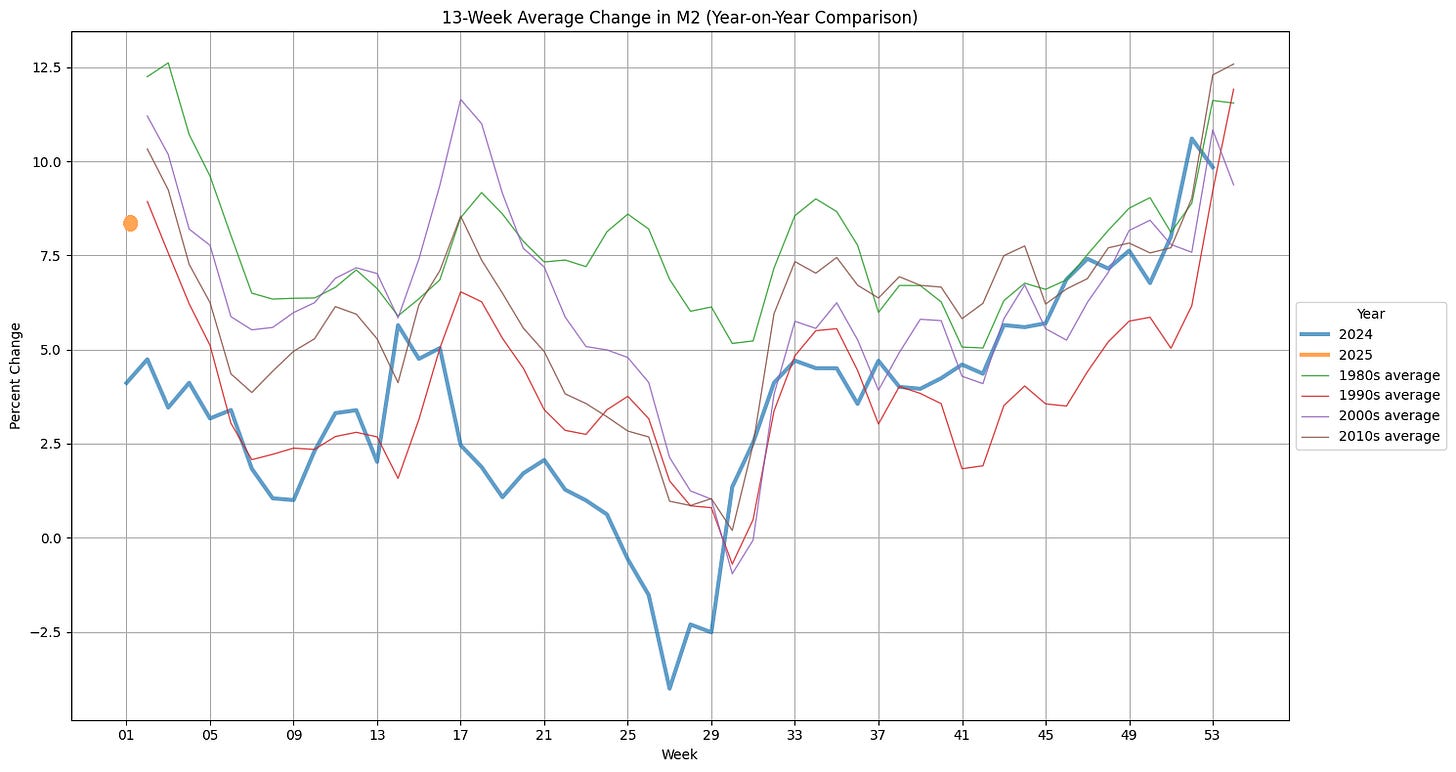

We had follow-through action at the end of 2024 and the money supply calculated on a 13-week average annualized basis came in over 10.5%. There have now been 64 instances where December’s money supply exceeded 10.5% on an annualized basis.

We’ve also gotten the first data point for 2025 which came in at 8.3%. Here are the last 20, 13-week annualized M2 figures:

While 8.3% is much higher than how 2024 started it is not above average. Going back the last decade (to 2015), the average is 8.6% to start the year. Going back two decades (to 2005), money supply starts off the year at an average of 9.7%.

I decided to go back and look again at the sector ETF performance since election day.

Consumer Discretionary (XLY) has run out into the lead. This sector ETF has a 20.7% weighting to AMZN and 18.04% to TSLA.

Financials (XLF) also look strong. The recent earnings releases have boosted the share prices of many of these companies.

Technology (XLK) is roughly breakeven and took a beating after the DeepSeek news over the weekend. This strange to me. We can now do more with less thanks to these recent advancements. Demand should be increasing as Jevons paradox should be in effect. Also, I feel there should be some kind of correlation to Moore’s Law with regards to AI.

As models bump up against limiting constrains (either hardware, programming, training, or energy) there will be innovation to accelerate the performance of these systems. Increased computational power and efficiency provided by smaller, more powerful chips have enabled the development of more complex and sophisticated AI models to this point. However, DeepSeek proved that model performance is not solely dependent on hardware improvements and that there are efficiencies to be found in the programming of these systems. The market’s reaction to this news makes me think that investors are starting to look closer at their tech holdings and diversify. XLK as a sector fund has traded sideways for over 3 months.

The market never trades sideways, so this should be some kind of red flag. XLK is either ripe for a breakout or for a correction. I thought we got the breakout signal on the 23rd only to see it get reversed by the following Monday.