I like to watch the Case-Shiller Home Price Index as I believe it is the truest form of tracking inflation. It is not easily manipulated like the CPI, PPI, PCE. The downside is that it is quite delayed. Today saw the release of the December ‘22 data.

The index came in at 5.8% year-over-year. This is the sixth consecutive month of decline and it has been a very steep drop. This isn’t a surprise as we have continued to see the CPI drop, though it has moderated quite a bit.

We are three weeks away from the next FOMC meeting. The market is largely predicting a 25bps increase in the Fed Funds Rate.

There is still room for the Fed to do 50bps. We’ll get one more look at the CPI, PPI, and employment before the FOMC meeting. The bigger insight should be the testimony that Chair Powell will give on March 7th.

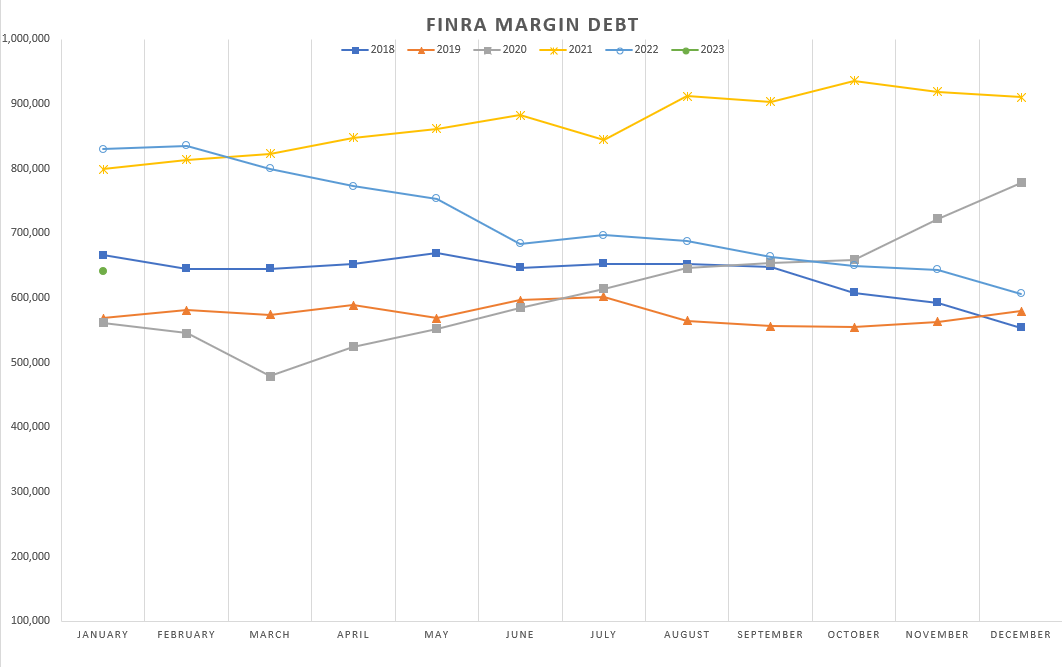

Traders have started out the year with a bullish flurry. The S&P ripped higher over 9% from January 3 to February 2. It has since moderated, only showing a 4% gain YTD. Traders took advantage by picking up some leverage to start the year.

Margin debt increased by $34.5B from December to January (see the green dot). It is hard to see how this can last as the money supply continues to look like it has hit a brick wall.

Powell has frozen the printing presses and now we’ve actually seen M2 go backwards.

It is hard to believe that this will end well for any asset class but it especially looks frothy when companies throw in something about AI in their earnings presentations and the stock gets a boost.

This looks awfully familiar for anyone that went through (or has read about) the “TMT” bubble. Any telecom, media, or tech company that began to talk about going “dot-com” saw inflows of “investor” money. That is until it all came tumbling down. I’m not saying that this is the case now. Anything can happen. Risks abound everywhere. Also history doesn’t repeat itself so this time is different, right?

There were places to put capital to work in the late 90s and early 2000s that saw a return. I’m hopeful that I’ve found one or two and I’m continually on the lookout for more places to find a margin of safety.

really wonder how far down theyll take the m2