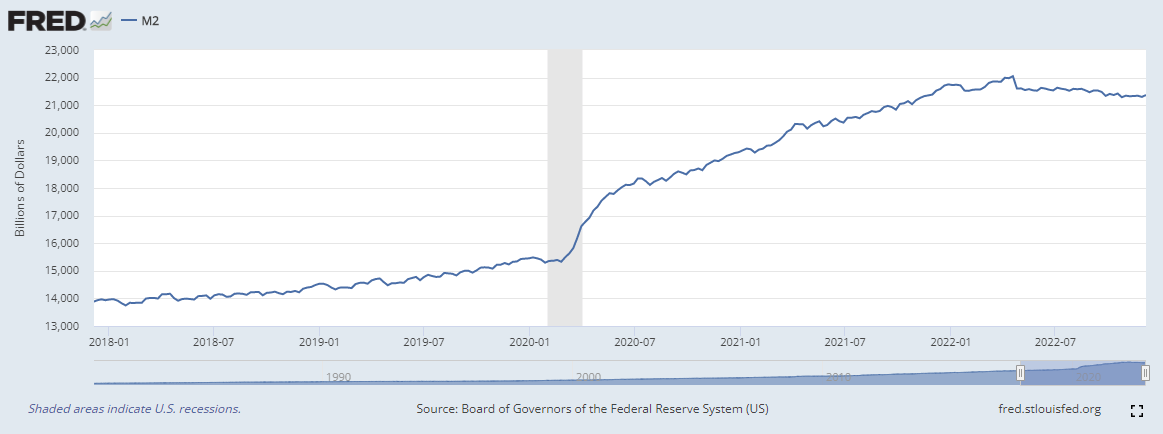

The data coming out of the US continues to look poor. Today saw the money supply data released.

Last week I put out my estimate for the money supply.

“The final money supply report of the year drops December 27th but I'm going to go out on a limb here and say it is going to be very close to the past 12. The money supply has been frozen since Thanksgiving of ‘21 and Powell has no inclination to change that now.”

This theme of frozen money supply continues to play out but with backwards revisions coming from the Fed, it now looks like we are actually having a reduction in the money supply.

I went back through the M2 weekly figures and could not find a contraction like this in the 42+ years’ worth of data. The closest that I could come was in the early 90’s, after the 90-91 recession, the money supply was held fairly flat until June of ‘95. Something to keep in mind here is that while the money supply dragged in this era, so did the S&P500. It wasn’t until the money supply got juiced in 2H ‘95 did the market begin its run-up to the dot-com highs. It would not be surprising to see a “lost decade” in the stock indices.

In addition to the money supply, we also got a look at trader’s margin use.

Margin use has flat-lined. It’s use has fallen back into line with previous years’ data. At the same time, we are still seeing a crash in the cash on the sidelines.

This does not look good. Less cash, less margin use, shrinking money supply… how will the market be able to reach new highs? Quick answer, it won’t. Expect lower lows and lower highs across the S&P and QQQ. I don’t believe Santa is coming to town.

Finally, in our trio of bad data, we have the latest Case-Shiller Home Price Index.

The index came in at 9.2%. The previous month was 10.7%. This is the sixth consecutive decline in the home price index. The tightening of the money supply is having quite an impact on the US housing market. The 4th quarter and early 1st quarter is usually a slower time for the housing. You can see this in Refin’s housing stats.

What I’m watching is the median sales prices.

I find investing in real estate to be very fruitful but timing and cash flow are important. Pick the wrong time to buy and you can overpay and be underwater. Fudge the cash flow math and it’ll feel like you are swimming with an anchor. I’ve seen a few deals but I believe that better deals are coming. The time to be patience and raise cash balances is now. I think this translates to the general market as well. The best hedge is a portfolio that is heavy cash (30%+). Don’t discount the fact that panic selling means everything could be sold. We have not hit bottom yet.

Great breakdown as always. The wild swings in the price of housing is a sign of the economic calculation problems headed our way. Housing is supposed to be among the most stable assets. It is much harder for prices to move, and yet we are seeing madness there already. That males investment in real estate much more difficult.