This inflation train is keeping on chugging along folks. In fact, it looks like it could be picking up steam. The Producer Price Index was updated today. It saw tremendous gains that exceeded expectations.

The final demand number came in at 11.2%. It was a 1.4% month-over-month increase. While the CPI charts inflation on the consumer level, the PPI charts it on the producer level. This means that companies are experiencing double digit inflation on the goods that they are purchasing. In time, this will trickle down to the consumer level. One of the reasons it doesn’t immediately show up at the consumer level is that many organizations import goods from out of country. The PPI only captures those businesses that produce goods in the US. However, this inflation phenomenon is not just happening in the US. It is worldwide. In time, other countries could easily catch and surpass the US’s inflation figures.

To me, this high PPI reading shows that inflation has not peaked. It has not found resistance yet. A recession might be welcomed by foolish MMT economists as a way to slow down demand but this is supply side inflation. The PPI proves it. This is what confounds those that work in the Eccles Building. They don’t know how to control supply-side inflation. Their excessive money printing has caught up with them and they are loathe to quit.

Nuclear power and uranium have been making waves in the media. Yesterday, Bank of America put out a very thorough report. Their focus was primarily on CCJ but other uranium miners will benefit from the recent increase in uranium prices.

It’s said that a rising tide lifts all boats. If that is the case, then the tide for uranium has only begun to rise. BoA highlighted what I think is the most bullish case for uranium yet. In their section titled “Narrow forward spread = less carry trade”, they show the most severe backwardation for uranium ever.

When forward U3O8 pricing spreads are wide, there is a strong incentive for intermediaries to provide carry-trade material to utilities. When forward spreads are narrow, which they are now, intermediaries are reluctant to provide carry trade material to utilities, as it is less profitable to do so. Further, when forward spreads are negative, there is an incentive for some intermediaries to unwind old carry-trade material to lock in a profit today. Since this results in intermediaries buying U3O8 in the forward market, it sets the stage for less U3O8 supply available to the spot market in the future.

The bold is mine.

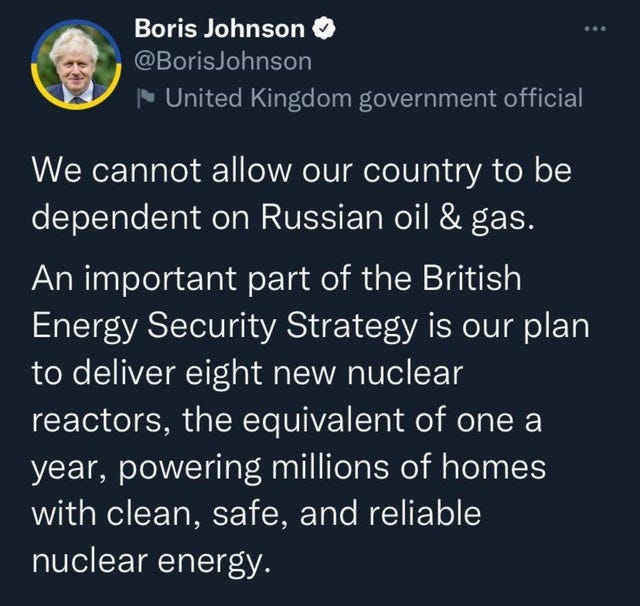

At the end of their report, BoA highlights India’s nuclear power growth plans, Korea’s recently elected President’s reversal of his predecessor’s plan to slowly exit nuclear power, and the UK’s nuclear power generation expansion plans.

Support for nuclear energy is on the rise. A recent survey in Sweden showed “record levels” of support for nuclear power.

Support for the use of nuclear power in Sweden is at record levels with 56% saying they support the construction of new reactors if needed, according to a survey.

More than eight out of 10, or 84%, want to continue to use nuclear power or, if needed, build more reactors, while only one out of 10 want to close nuclear power “through political decisions”.Analysgruppen said the 56% level of support is a “statistically significant” increase compared with 52% in February 2022 and 46% in November 2021.

The survey also asked if nuclear power can be a tool for reaching the climate goals, and 67% said it can, an increase from 57% in May 2021.

The anti-nuclear group is a minority. A loud and vocal minority, but a minority all the same. More countries are beginning to adopt nuclear power generation strategies and prices for uranium are on the rise. Uranium is still off it’s historic highs and the severe backwardation seen in the futures market proves that this thesis has room to run.