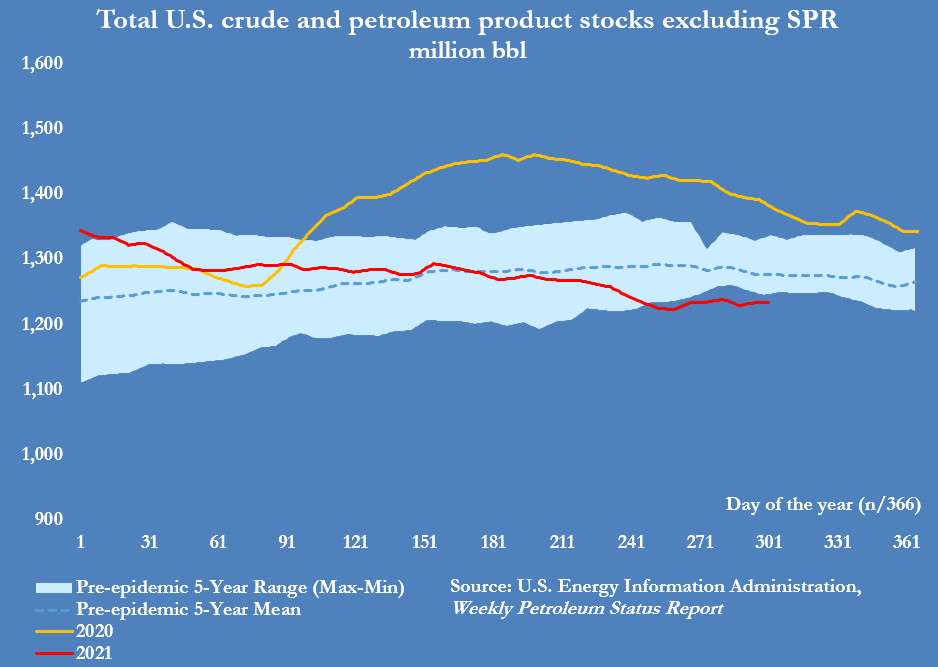

OPEC’s two days’ worth of meeting wrapped up earlier today. While I expected them to pause or at least slow down their production numbers in response to the recent plunge in oil prices, OPEC decided to pump those numbers up. In a statement released to the public, OPEC is moving forward with a proposal to increase oil output by 400k barrels per day. This increase was already in the plan for OPEC but it was not what oil had priced in. The January 2022 crude oil contract (/CL) dropped big time on the news. It has since rebounded strongly as traders realized that this isn’t as large an increase as advertised. The US is still constricting domestic supply and threatening pipeline closures. US storage rates are below their 5-year average. In addition, usage is still strong and getting stronger.

We are swiftly facing a shortage of oil and this will lead to further strong gains in the oil price.

Likewise, the House of Representatives has put together a deal to kick the debt ceiling can down the road. The House Appropriations Committee has proposed an agreement to fund the government through February 18th. This really gave the markets a boost this morning as fears were beginning to build that another debt ceiling debacle was near at hand. Though we are not out of the woods quite yet. The bill will be put to a vote later today and then sent to the Senate. It is a simple stopgap measure that freezes all agencies and programs at current funding levels. However, the Dems did slip in $7 billion in funds for Afghan evacuees. While there are some Republicans (specifically the Freedom Caucus) that are opposed to funding the government in order to prevent the implementation of a federal vaccine mandate, Mitch McConnell has told reporters, “I think we’re going to be OK” with the deal.