The poor decisions of the last two years are catching up with the democrats. Their excessive spending and hostile attitude towards fossil fuels has led voters to demand change.

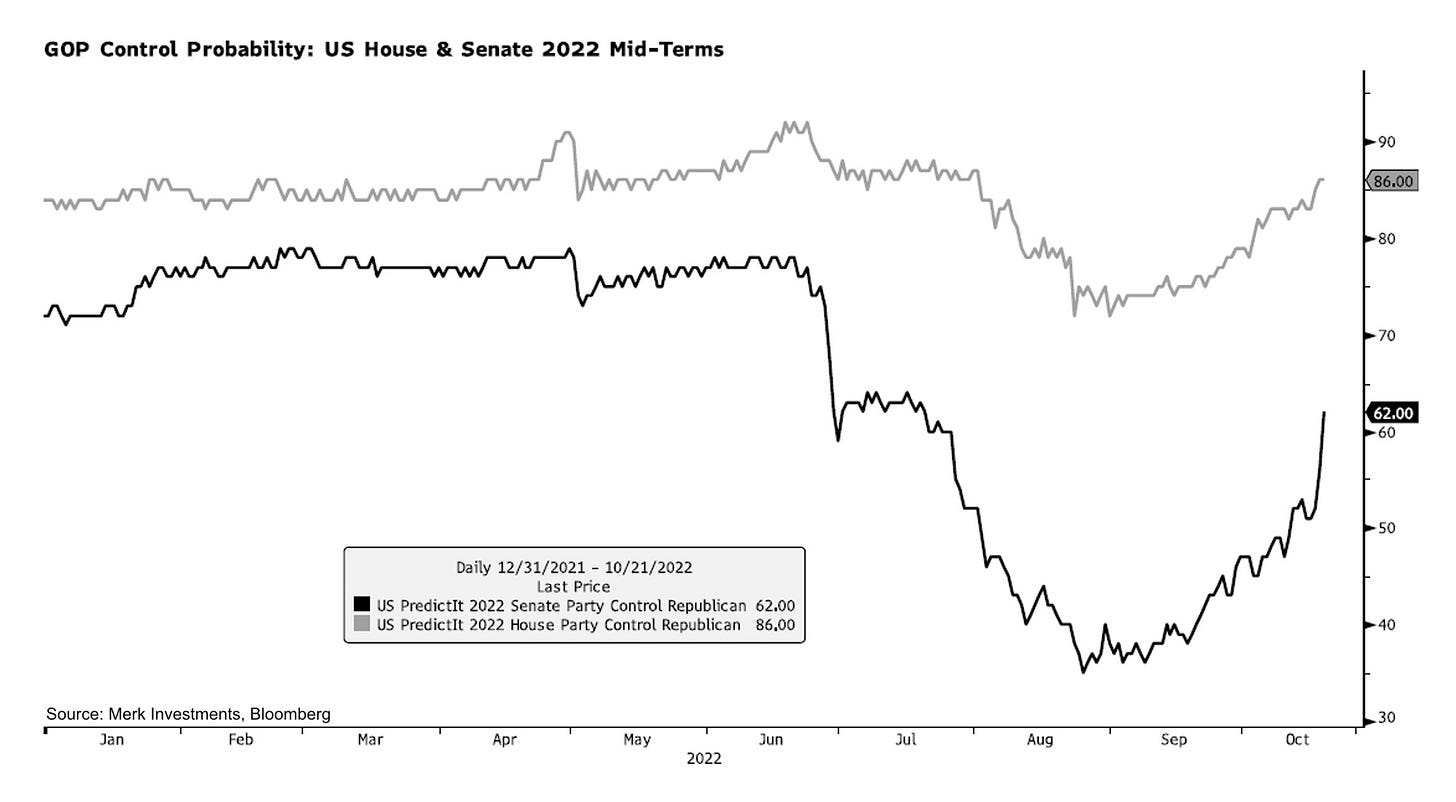

Currently PredictIt has the GOP retaking both the House and the Senate. If this were to happen, it would put the Biden administration into lame-duck territory. Gridlock in DC is typically great for the stock market. Even in normal mid-term years, once the election has passed, things begin looking up.

My belief is that there is a lot of pent up demand to put cash to work in the market. I think we saw this today when Nick Timiraos, the so called ‘Fed Whisperer’ tweeted about the Fed’s possible future path.

Those that pine for a pivot are now wading into predicting the Fed’s actions so far in advance that they look absurd. They also are expanding the meaning of pivot. At one point it was considered an abrupt change from tightening to loosening interest rate policy. Now according to Nick Timiraos,

“Those pivots include a slowdown in the hiking pace, a pause, and— eventually—cuts.”

This means if the Fed slows down the pace from 75bps hikes to 50bps, the pivotoors are going to be screaming with joy that everyone should be piling back into the markets. This seems well timed with both the mid-term election and the Santa rally.

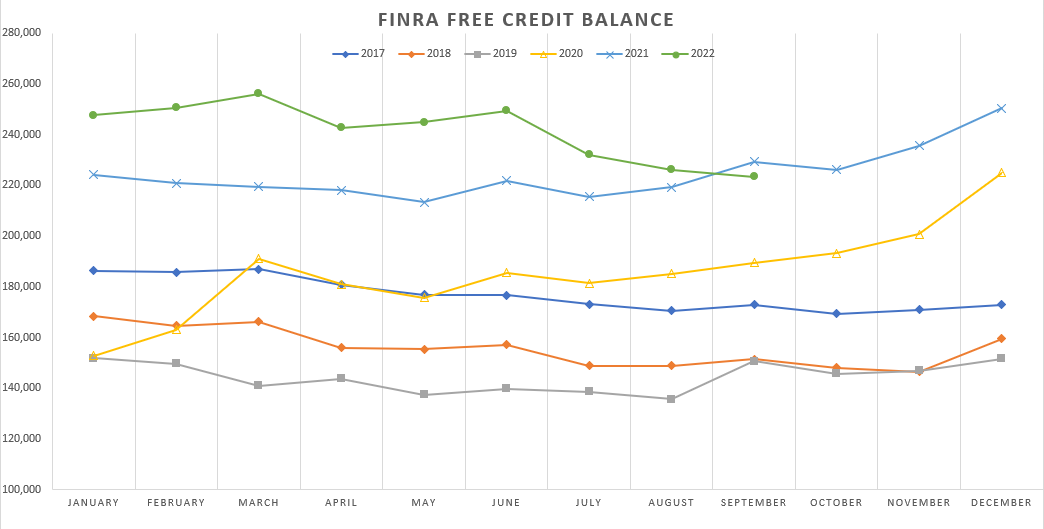

I think there are funds out there ready to be deployed. Here is the latest Finra margin data.

Traders use of margin continues to trend downward. It has begun to move back into the regular flow of the past 4 years. Meanwhile, the free cash balance has stayed above trend.

I believe that investors have capital to put to work in the markets. I also believe more is coming. The bond market looks like a disaster. We still are looking at an inverted curve. This tells me that bond investors are worried about the future. If the bond market is not invest-able, this cash only has two options; sit in USD or go to the equity market.

If it gets deployed into the equity market, what would they buy? What has been winning this year? Oil and it has a long ways to go to reach previous index weightings.

Oil supplies have been restricted by the Biden administration. OPEC has no spare capacity and is cutting projections. Russia is dialing back as well. Investment in new wells and new extraction methods has dried up. Once the Biden administration gets the memo that their SPR releases didn’t help them keep the House or Senate, they’ll be ready to stop and then blame the GOP for the ensuing inflation. They may even buy oil at $100 or higher in an attempt to really paint the republicans as feckless against inflation.

I’ve spent this week looking for the best companies to take advantage of this. I believe that equipment & service companies and oil drillers, specifically offshore drillers, will have the biggest upside here. Due to the lack of investment in this industry, supplies are going to be tight. In addition, higher oil prices allow oil companies up and down the chain to spend more on services. Inflation is also a factor here. A rising tide will lift all boats but I want to find those diamonds in the rough that will outperform the average company.

Here is some of what I’ve been reading this past week: