“All technical analysis is art. Some of it just happens to use numbers. They paint by numbers.”

-Tom Luongo

I’ve been following Tom Luongo since the beginning of the year. I had heard him on a podcast, wandered over to his blog, and found his geopolitics interesting. His latest piece covers the potential government shutdown and how McCarthy will likely

“court Democrats *Cough* Davosians *Cough* to keep the policy status quo in place”.

He also does a good job of covering Powell’s recent press conference.

“Powell spent his entire time at the podium sticking to his Dual Mandate Mantra, using it to hide behind what he’s really doing, restoring control over US monetary policy to the Federal Reserve. The questions from most of the Davos-aligned media outlets — The NY Times, the WaPo, the Financial Times — were asked by wet-behind-the-ears Millennials who stuck to the dying Keynesian model of hiking rates into a recession trying to play “Gotcha” with Powell who kept coming back to his line that the FOMC will watch the data, which they know is lagging, and try not to overtighten.”

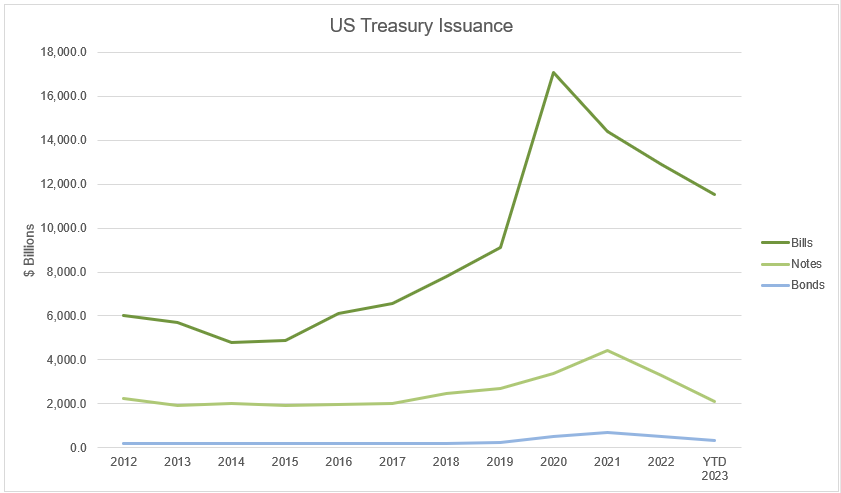

Restoring control is tricky enough he didn’t need Janet Yellen fouling it up with another attempt at us treasury yield curve control. Yellen ran an operation twist style buyback of US treasuries this time last year. Meanwhile, she has been consistently over saturating the market with short duration treasuries while leaving the longer end without liquidity.

Bills are treasuries with up to a 52 week maturity, notes are 2yr to 10yr and bonds are +10yr.

You can see we haven’t had a treasury secretary with a long-term mindset in the past ten years. If I had more data, I would guess that it would be the same going back a long time. This is a terrible tragedy as long term rates were so low for so long that the interest costs on US debt could be more manageable had anyone the motivation to sell longer term debt. Yellen takes the cake though because she has issued a smaller amount of long term debt on a percentage basis. This has artificially suppressed the yield curve and it continues to make it slow to normalize.

The Treasury Secretary is not making this announcement from a position of strength and in time, the curve is going to normalize.

In addition to Tom’s views on geopolitics, I’ve greatly enjoyed his technical analysis. This is really the first I’ve ever studied someone who does stock analysis in this fashion. All of my understanding of the stock market comes from a philosophical (behavioral economics) and fundamental point of view. As the quarter close is coming quickly, I figured now is as good as any to attempt a little technical analysis of my own.