Federal Reserve Chairman, Jerome Powell, sat before the Senate Banking Committee this morning alongside Treasury Secretary Janet Yellen. Both went over topics of interest that we’ve looked at here in this blog.

The popular questions for Secretary Yellen concerned the debt ceiling limit and servicing the debt of the United States. She stuck to her guns stating plainly that the Treasury Department will be able to pay the bills of the country until December 15th. She also promoted democratic talking points about the infrastructure and build back better bills. She repeated the debunked claim that both bills are “fully paid for” and won’t add to the deficit. She was also questioned about the Treasury’s ability to continue to service government debt obligations. If interest rates rise, it will become more expensive for the government to pay the coupons owed on its debt. Yellen deflected this by stating that current projections already take into account an increase in interest rates.

I thought that this was an excellent point that was dismissed too quickly out of hand. We have seen a very steep rise in inflation. While it has been called “transitory”, it has been anything but temporary. It has been long lasting and entrenched. It will require the Federal Reserve to raise interest rates to stop it. While the Treasury department has now stated that they have taken into account increases in the interest rate of government debt, I would wager that those increases are quite modest at best.

Powell was put in the hot seat for inflation running hot. He conceded the point that they weren’t transparent enough over their definition of “transitory”. He stated that he is ready to “retire” the word. In his prepared remarks, Jay stated that he continues to “expect that inflation will move down significantly over the next year as supply and demand imbalances abate”. He went on to elaborate that it “is difficult to predict the persistence and effects of supply constraints” and that those “factors pushing inflation upward will linger well into next year”. In addition to fielding questions of inflation, he also addressed the taper. He was very specific that the Fed is looking at the data and expect the taper to conclude “a few months earlier” than projected.

This sent the market into a dive. All indices, as well as oil dropped on the statement. Curiously, gold held fairly steady. Also, the bond market reacted unexpectedly on the news. A serious flattening of the curve is now taking place. The longer duration bonds are down while the shorter term bonds are up. This is a direct signal that bond traders anticipate a Fed mistake. This is an indicator that a recession could be on the horizon.

Below is the data from the end of the day yesterday.

The 10-year minus the 2-year treasury is still in positive territory by 100 basis points but the recent decline does not inspire confidence.

In addition to the fireworks at the Senate Banking Committee meeting, we got news on uranium. Zerohedge highlighted an article by P Gosselin at NoTricksZone. The article detailed Germany’s plan to phaseout the nuclear power plants. Germany plans to close 3 of its newest and most efficient nuclear power plants by the end of the year. Next year, they plan to close their final 3 nuclear power plants.

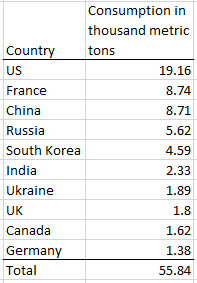

This put the uranium miners in a tailspin. This is a serious overreaction. Yesterday I outlined the production and consumption of uranium. A review of the consumption graph shows that Germany only consumes 1.38k metric tons of uranium on an annual basis.

By Germany shutting down their nuclear power plants, total uranium consumption is reduced to 54.46k metric tons annually.

Here is an updated chart of uranium production with a new green line for this projected consumption.

Nothing of significance has changed here. The sell-off in uranium miners is unwarranted. None of these graphs or charts take into account new power plant development. Future consumption will increase by much more than the reduction of Germany’s consumption. In addition, the physical trusts that have invaded the market are buying up supply. The Sprott Trust alone has swallowed up roughly 15x the annual uranium consumption of Germany.

I’m adding CCJ options to my portfolio. I’ve targeted the June 2022 expiration which gives me a long lead time before they expire. The future is too bright for the uranium. This is merely a bump in the road.