Federal Reserve Chairman Jerome Powell, sat down with The Brookings Institute for a chat. His full remarks can be found here. Powell reitereated what Waller told aussies a few weeks back. “While October inflation data received so far showed a welcome surprise to the downside, these are a single month's data…”. One data point does not make a trend. The Fed is looking for “substantially more evidence to give comfort that inflation is actually declining.” Jay then broke down how the Fed is currently tracking inflation data and acknowledged the fact that the housing data is a lagging indicator. He also opined on the labor market. He specifically honed in on the labor force participation gap.

“But recent research by Fed economists finds that the participation gap is now mostly due to excess retirements—that is, retirements in excess of what would have been expected from population aging alone. These excess retirements might now account for more than 2 million of the 3‑1/2 million shortfall in the labor force.”

The stock market took off on Powell’s comments because at the very end of his speech he took a dovish turn…

“Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.”

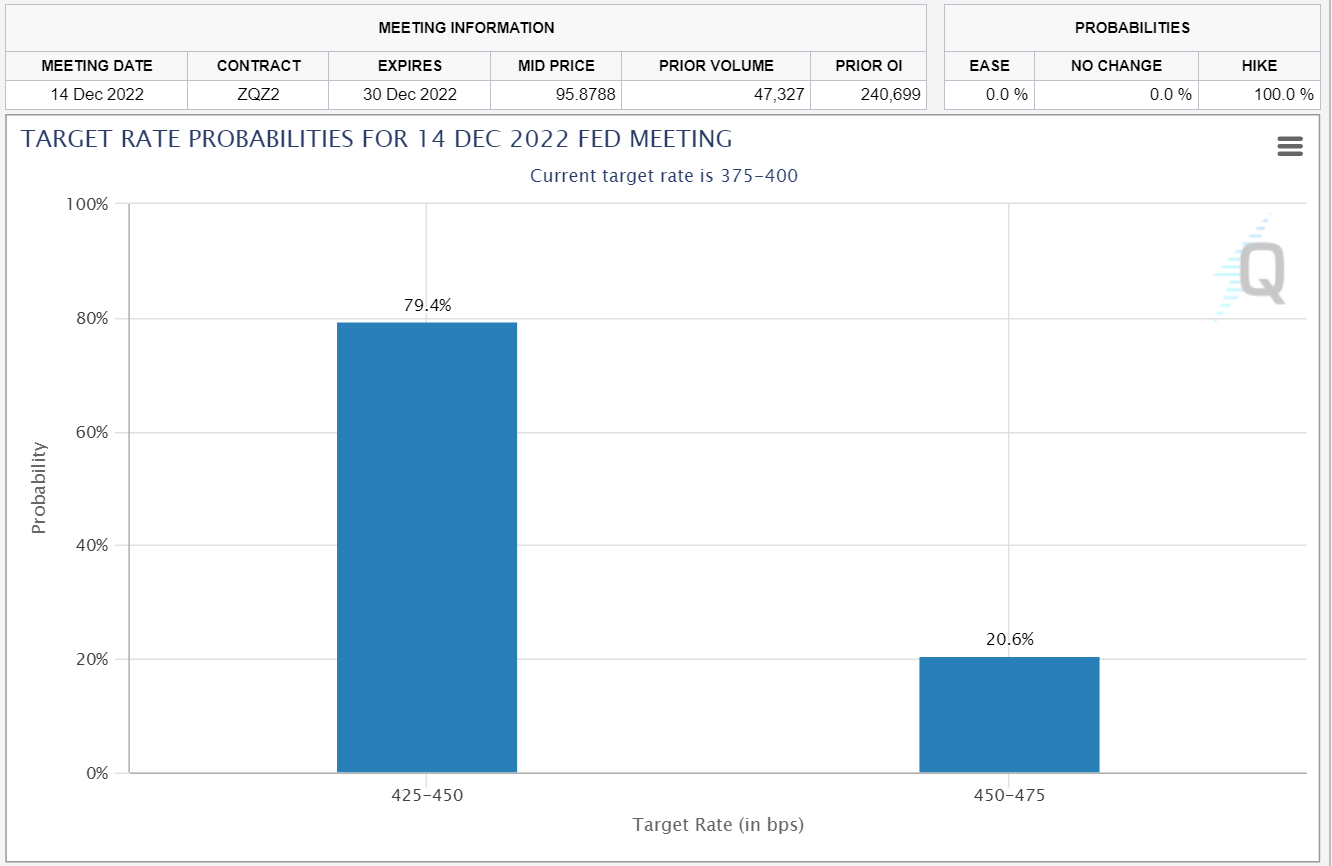

CME’s FedWatch tool has overwhelming odds for a 50bp increase in the rate.

What I think was missed is that Powell, Waller, and Williams have all said now that they expect interest rates to stay higher for longer.

“Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy.”

Bold is mine.

It looks like the Fed is setting up the big pause. They want interest rates to be kept at a reasonable rate and they are signalling that they want to keep them there for as long as they can. I applaud this idea. With interest rates at 0, the time value of money is nothing. This is the great danger that fuels reckless speculation. It causes the boom that ensures we’ll have a bust. Also, savers get demolished with 0% interest rates.

Earlier this week the Case-Shiller Home Price Index showed that the steep inflation in housing was quickly coming down.

We’ve now seen a very steep decline. Keep in mind that this index is on a 2-month delay. The whipsaw action we’re seeing is directly related to the money that flooded the market in 2020 and now has been frozen in place. Without loose monetary or fiscal policy, no new funds are flowing into the marketplace. This makes any rally (like today’s!) exceptionally difficult to continue.

In the labor market, we had both the ADP Employment report and the JOLTs data released. The ADP report showed a much lower increase in employment than what was expected but it appears that employment is simply moving back towards its longer term trend-line.

This was re-affirmed by the JOLTs report which continues to show an excessive amount of job openings.

The gap between openings and unemployed keeps staying stubbornly high putting pressure on employers to continue to increase wages. We have 4.275 million more job openings than unemployed workers. That means there is over 1.7 job openings for every unemployed worker. This is down slightly from last month. The pre-covid average was around 1.2.

With the labor market tight and the Fed continuing on the warpath against inflation, unprofitable companies will feel the pinch. Those companies that need to rollover their debt are going to be doing it at much higher interest rates. This could turn companies that are moderately profitable into unprofitable. There is going to be a shakeout and anyone holding these “growth” stocks is in for a real shock.

Appreciate the insight on what the market is likely overlooking. I saw the Dow close at almost 34,600 and thought, "WTH?". The gas tank of money supply growth necessary to sustain price levels has been draining (negative when annualized) for months now, and I keep wondering when the next downturn will arrive. Days like yesterday are another opportunity to short on the cheap. Papa needs a brand new Put!